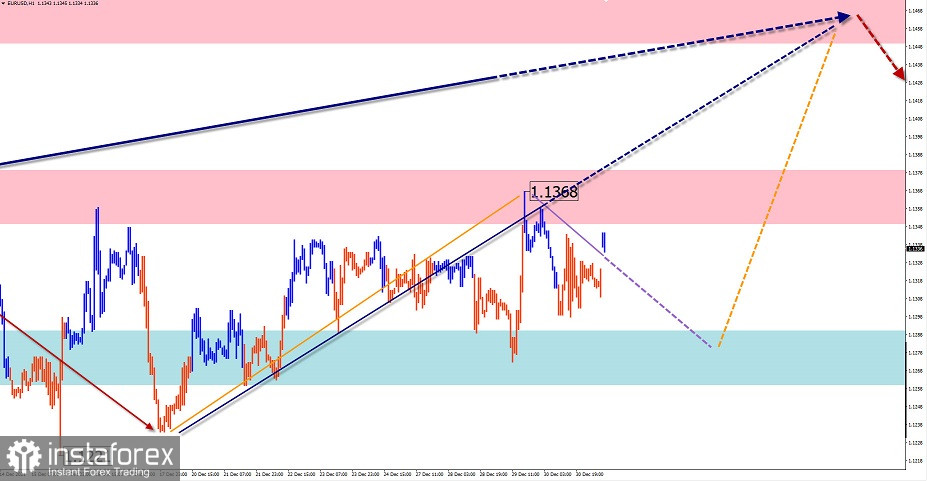

EUR/USD

Analysis:

On the chart of the European currency, the downtrend has been further dominating since the beginning of 2021. The price has approached the upper boundary of the powerful potential reversal zone of the weekly scale. The price has started a correction, forming a stretched plane since mid-November. The incomplete section dates back to December 18.

Outlook:

The euro price is expected to move in the corridor between its closest zones in the coming days. After the pressure on the support zone a trend reversal and the start of price growth is more likely. In case of a breakout of the nearest resistance, the rise will continue to the next settlement zone.

Potential reversal zones

Resistance:

- 1.1450/1.1480

- 1.1350/1.1380

Support:

- 1.1290/1.1260

Recommendations:

Today, selling in the euro market can lead to losses and is not recommended. It is advisable to focus on searching signals of your trading systems to buy the instrument

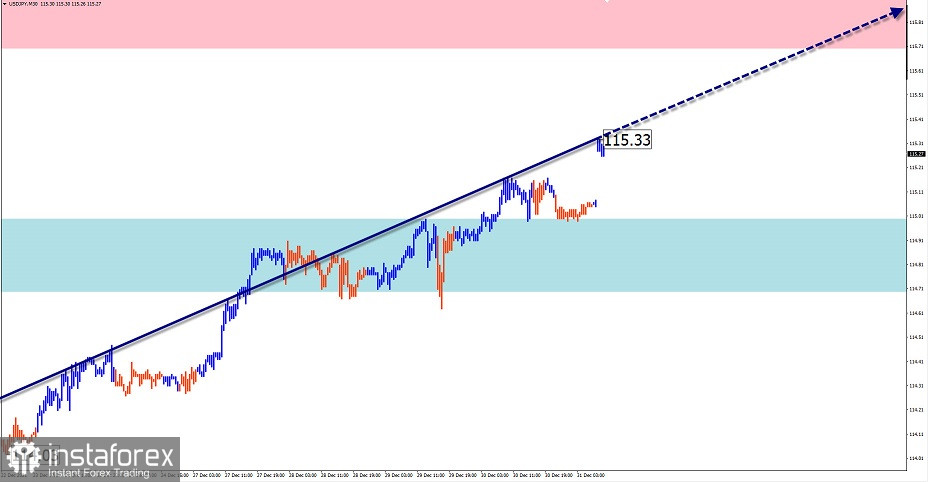

USD/JPY

Analysis:

The Japan's yen has been losing ground to the US dollar since the beginning of 2021. The dollar's uptrend was interrupted by a potential reversal zone of the large TF two months ago. The incomplete bullish section from November 30 approached the upper boundary of the resistance zone.

Outlook:

A further growth of the price movement is expected in the next trading sessions. Short-term attempts of price reduction, no further than to the calculated support, are possible. Resistance zone coincides with a strong level of large scale potential reversal.

Potential reversal zones.

Resistance:

- 115.70/116.00

Support:

- 115.00/114.70

Recommendations:

On the chart of the Japanese yen, short-term purchases with a small lot are possible. It is advisable to consider the limited potential of the forthcoming rise in trades. There are no conditions for selling the pair today.

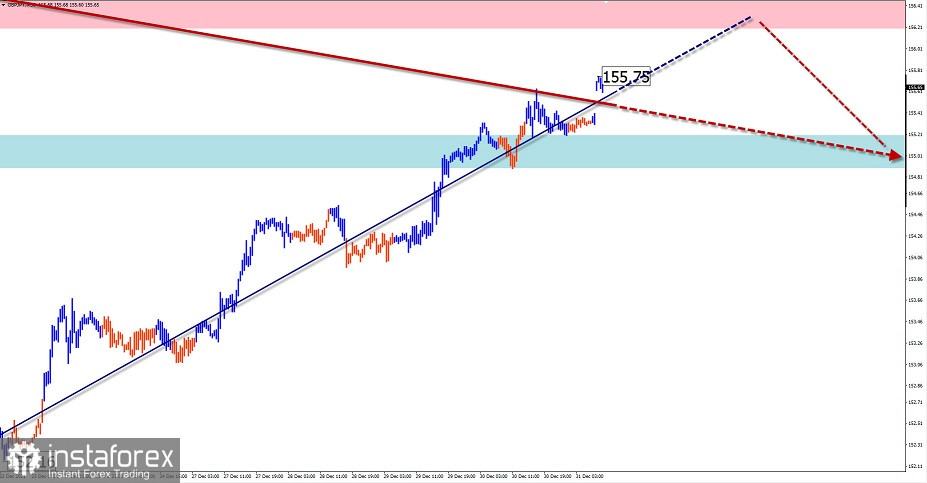

GBP/JPY

Analysis:

On the chart of the GBP/JPY cross pair, the descending correctional wave has been further forming since October 20. The price was rebounding upwards, forming the middle part of the wave (B) over the past month. This trend has entered its final phase.

Outlook:

In the current day, a further upward trend is expected, with the price growth to the area of a potential reversal zone. There is calculated resistance on its lower border. Then, the formation of a reversal and the beginning of a reduction are highly possible.

Potential reversal zones

Resistance:

- 156.20/156.50

Support:

- 155.20/154.90

Recommendations:

There are no conditions for selling in the cross market today. At the ends of counter pullbacks short-term buying is possible in the small lot.

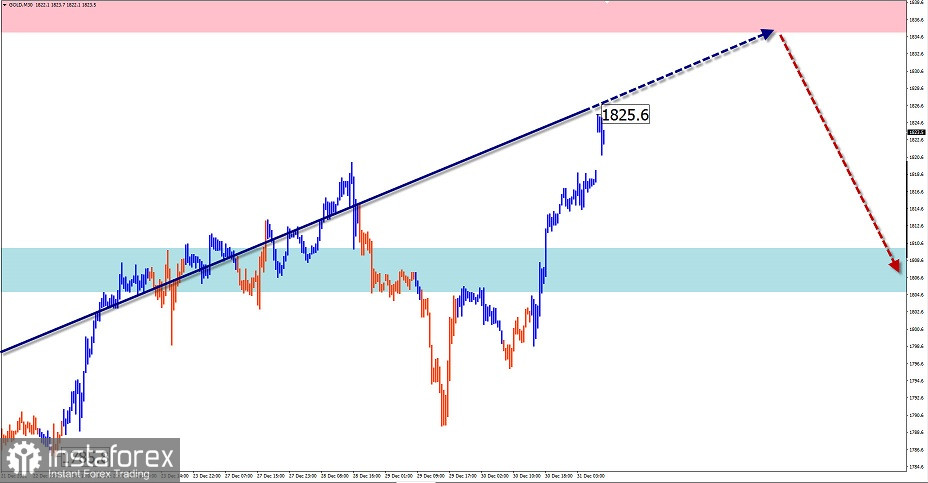

GOLD

Analysis:

On the gold chart, the direction of short-term trends since last March sets the algorithm of the ascending wave. The wave is developing in the form of a shifting plane. The unfinished section since the end of November is directed upward. There are several resistance levels of different TF in this area of the chart.

Outlook:

In the next 24 hours, the bullish sentiment is expected to end, the formation of a reversal and the pullback of the price down are most likely. With the change of the rate the volatility may increase and short-term piercing of the upper resistance level is also possible.

Potential reversal zones

Resistance:

- 1835.0/1840.0

Support:

- 1810.0/1805.0

Recommendations:

Trading in the upcoming flat is quite risky and can lead to deposit losses. It is recommended not to enter the gold market until the formation of more detectable signals.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română