OPEC has resolved several important issues over the past two years.

At the start of the pandemic, two member countries had disagreements over how to handle the crisis. Fortunately, they reconciled and the group teamed up on the largest production cut in OPEC history in response to reduced demand.

Overall, 2020 has become a year of unprecedented events.

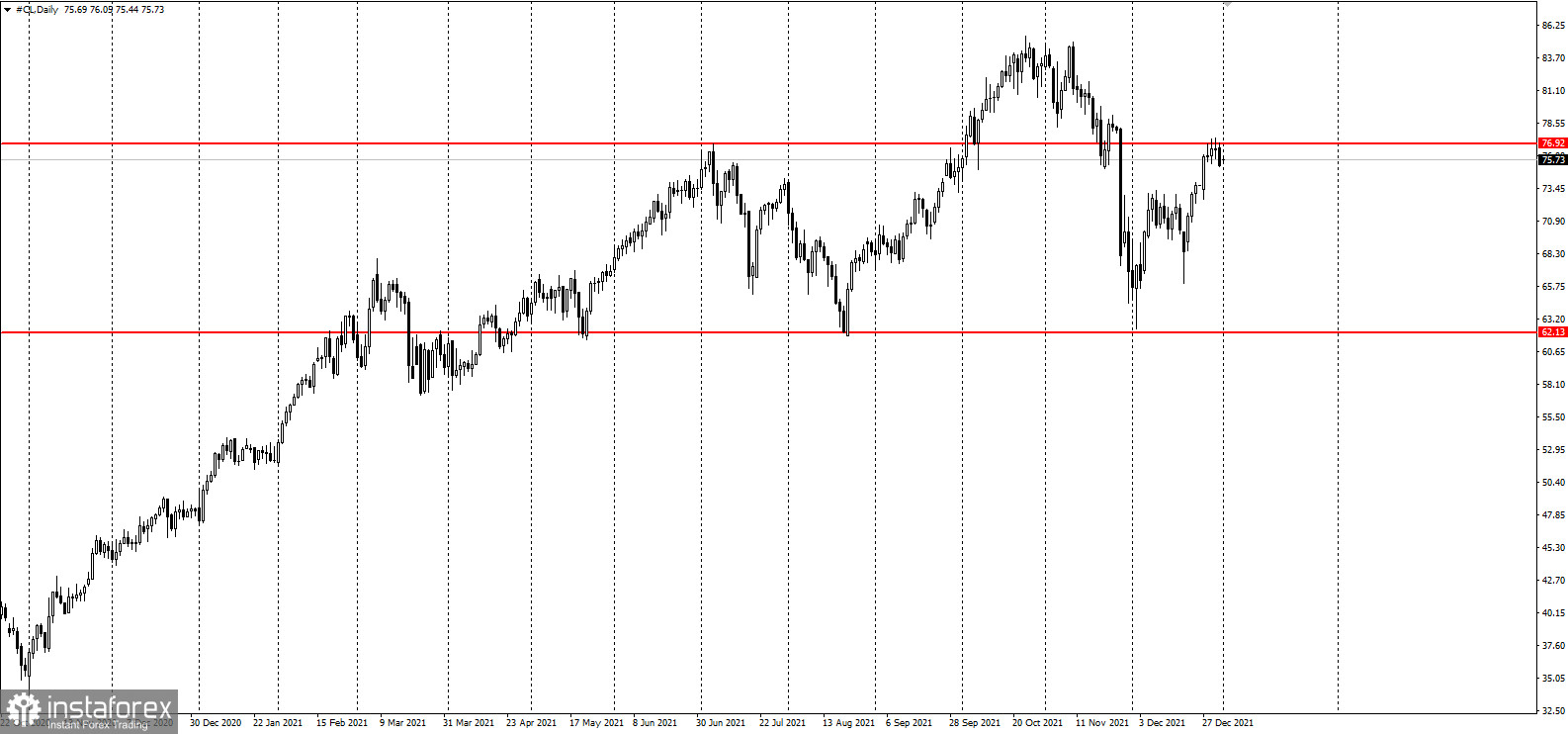

But 2021 wasn't that different as prices began to rebound. That is tempting to most oil-dependent countries in the Gulf and Africa. Surprisingly, those countries remained strong and decided to increase monthly oil production by 400,000 b/d instead.

The plan is still in place until OPEC reconsiders it this January. Some analysts warned of an impending oil surplus, but analysts in OPEC said they do not see it.

Economists believe the first problem this year will be oversupply, but that will not be serious because it will pass once omicron cases decrease. Actually, even if the outbreak persists, the governments of many countries will not impose another lockdown.

A much bigger problem is declining reserves because the world's oil production capacity is shrinking. Untapped oil reservoirs tend to dwindle resources, and this is one of the main reasons why so many oil producers were reluctant to start plugging wells when complete isolation of countries killed demand.

According to a Reuters report, total production is approaching 10.9 million barrels per day. Most of the reserve capacity will be located in OPEC or in the Middle East, but this spare power requires maintenance, and maintenance requires an investment.Investing in oil production is becoming more and more difficult these days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română