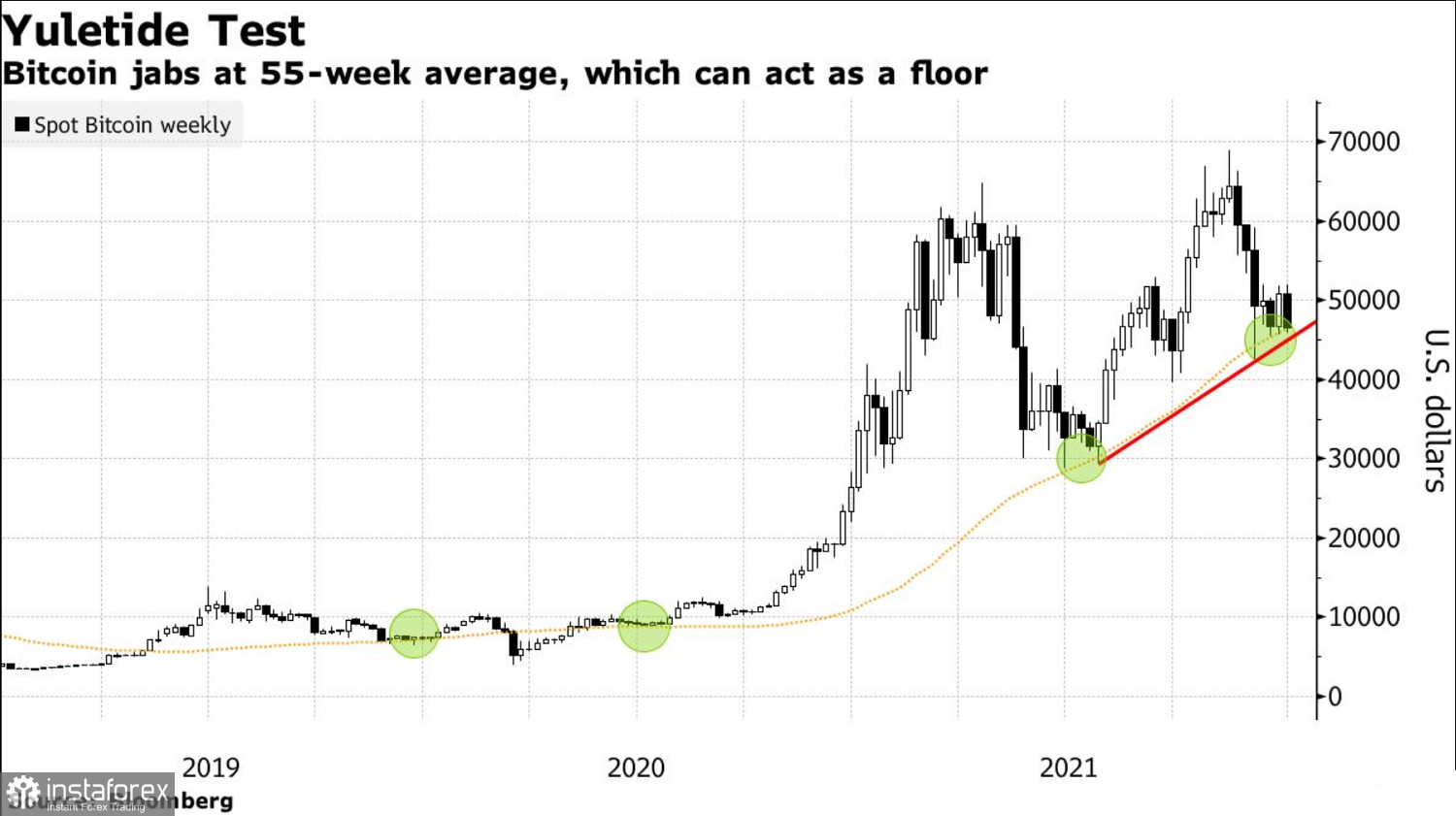

Bitcoin dipped by more than 15% this month amid a broader decline in the crypto sector. The fall has pushed the token near the 55 MA that actually held after the sudden crash this December. Technical research suggests that a decisive break below the average would result in a drop to $ 40,00.

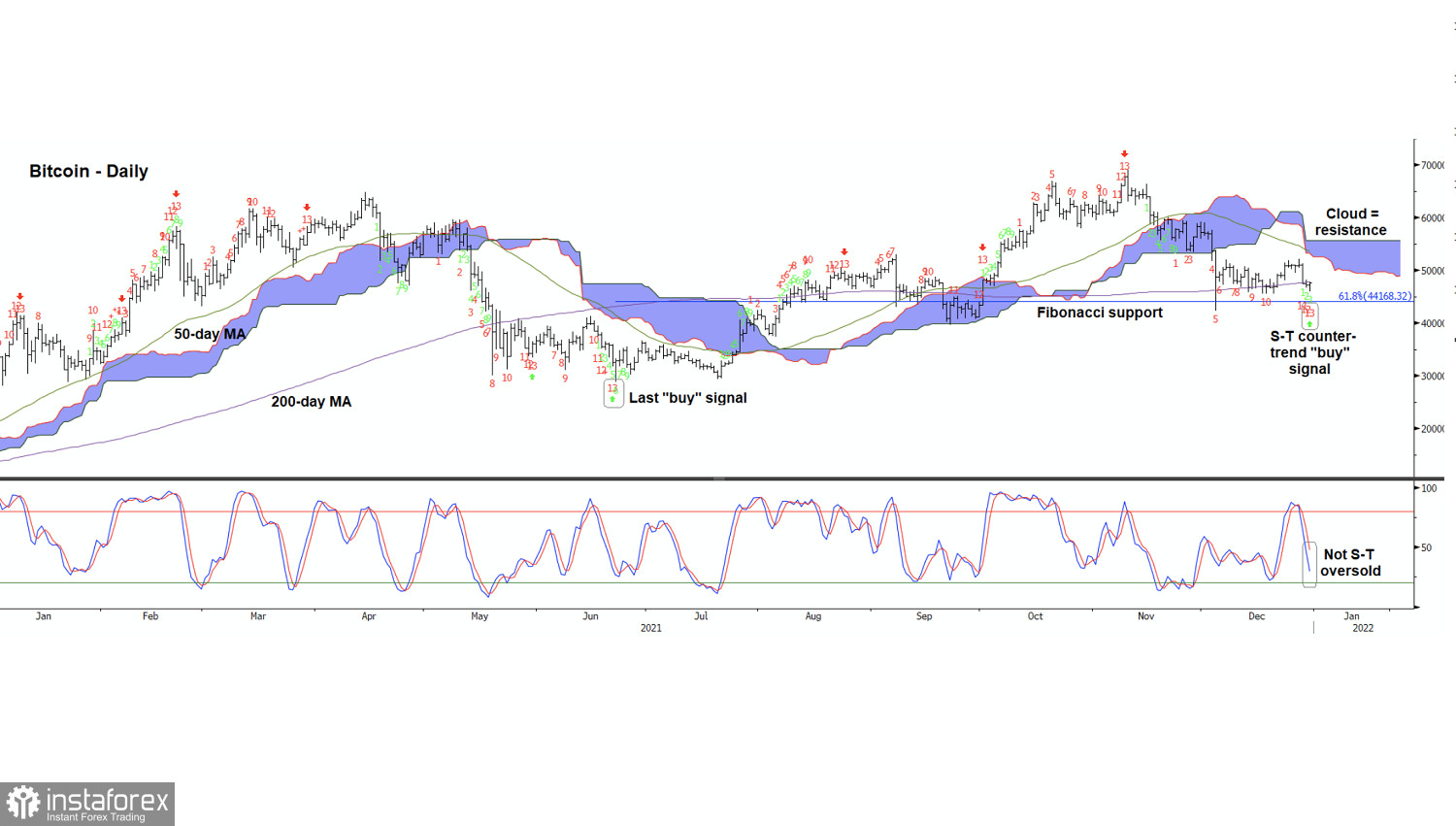

Founder and managing partner of Fairlead Strategies, Katie Stockton, said Bitcoin is showing a new short-term buy signal, which suggests a two-week bounce. But that is a bit "unconvincing" because to other indicators, conditions do not appear to be oversold.

Bitcoin is an emblem of volatility, and the main question facing 2022 is whether all of its fluctuations will eventually lead to a lower, rather than higher, level when the wave of pandemic-era stimulus recedes.

Bitcoin is an emblem of volatility, and the main question facing 2022 is whether all of its fluctuations will eventually lead to a lower, rather than higher, level when the wave of pandemic-era stimulus recedes.

Quadency CEO and founder Rosh Singh believes retail investors may have been distracted by the massive rallies in some alternative coins.

"That puts some pressure on Bitcoin as well," Singh said. "A lot of people in crypto are pretty optimistic about the next year and think we should see a rally with the way that things have been going," he added.

Bitcoin continuing to rally is something we often hear, so crypto proponents remain undeterred, pointing to trends such as increased interest in the sector from financial institutions.

"There has been a significant increase in the massive adoption of cryptocurrency and blockchain this year, thanks to a significant influx of institutional investment that has rekindled confidence in the sector," Analyst Walid Kudmani said. "This could ultimately lead to significant price gains and increased volatility as retail investors attempt to catch up."

BitBull Capital CEO Joe Di Pasquale agrees that prices may recover soon and 2022 is likely to be a positive year for Bitcoin. He said: "We can expect relief in the new year and a possible recovery. If we saw a bear market like 2018 - $ 100,000 is definitely on the charts, but timeframes can vary, especially when changes in macroeconomic policies and rules start to emerge this year. "

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română