Good day, dear traders!

In yesterday's trading, the GBP/USD pair showed quite an impressive gain.

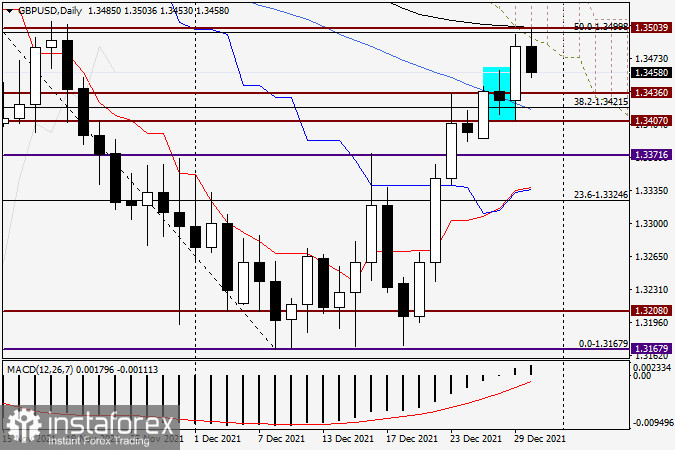

Daily

Yesterday's impressive rally could even be considered a rally. In the absence of important macroeconomic indicators and drivers for the price movement, this is typical of the British pound. The volatility of the pound is well known to those who have been in the market for some time. I recommend newcomers to take advantage of this feature of the British currency. So, after the circled candlestick from the day before yesterday, which could be considered as a reversal candlestick, at first the market seemed to start winning back this pattern. However, this did not last long. In the second half of the day, the situation on the currency market changed, and the US dollar fell. This factor was used by the bulls on the pound. They reversed the quotation up from 1.3407. As a result, the pair finished yesterday's session with a decent increase, closing the trading at 1.3485.

As expected earlier, the market focus is likely to be on the historic psychological and technical level of 1.3500. It is likely that the further direction of the GBP/USD will depend on the bulls' chances to overcome this level. In today's trading, the pair had already risen to 1.3503. However, it faced strong seller resistance there and reversed to the south. Right now, GBP/USD is trading near 1.3455. It is not quite clear yet whether this is a rebound or a reversal downwards. For a rebound, the current downtrend is strong enough. On the other hand, the thin pre-holiday market and increased volatility of the British currency should not be ignored. At the same time, the resistance offered by the black 89 exponential moving average and the lower boundary of the daily Ichimoku cloud should not be unnoticed. All in all, the situation for trade decisions is quite difficult.

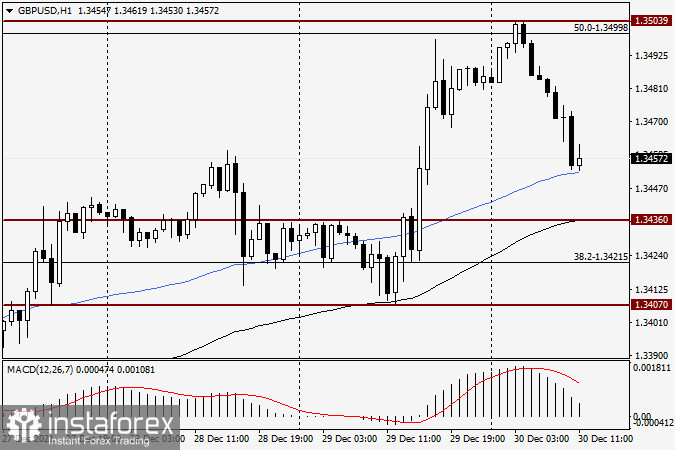

H1

Yesterday's recommendation to look for selling out of the strong 1.3500 resistance zone on the GBP/USD pair was reasonable. As you can see on the hourly chart, the pair failed to pass such an important and significant mark as 1.3500 at the first attempt. And there is nothing surprising about that. As for trading recommendations, I suggest buying the pair after its decline to the support area near 1.3436, where the black 89 exponential moving average passes. However, if the pair descends to this point, it is advisable to see confirmation candlestick signals and only after that open buy trades. I recommend trying to sell in case reversal patterns of candlestick analysis appear slightly below 1.3500. This factor will once again signal the inability of the Pound bulls to pass this crucial level, which could result in the pair turning southwards. Tomorrow we will try to sum up the results of the year on the given trading instrument.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română