Breaking news from the world of cryptocurrencies:

The blockchain gaming project Ertha Metaverse, powered by Binance Smart Chain, has raised $ 5.4 million in funding. The startup has also conducted IDOs on Seedify, GameFi, and RedKite. The tokenomics of the project enables players to earn money by owning and trading virtual land plots. They are sold as NFTs called HEX. The startup announced more than 7,500 completed plots. According to the forecast of Grayscale Investment specialists, the annual revenue of the Web 3.0 metaverse sector may reach $1 trillion in the near future.

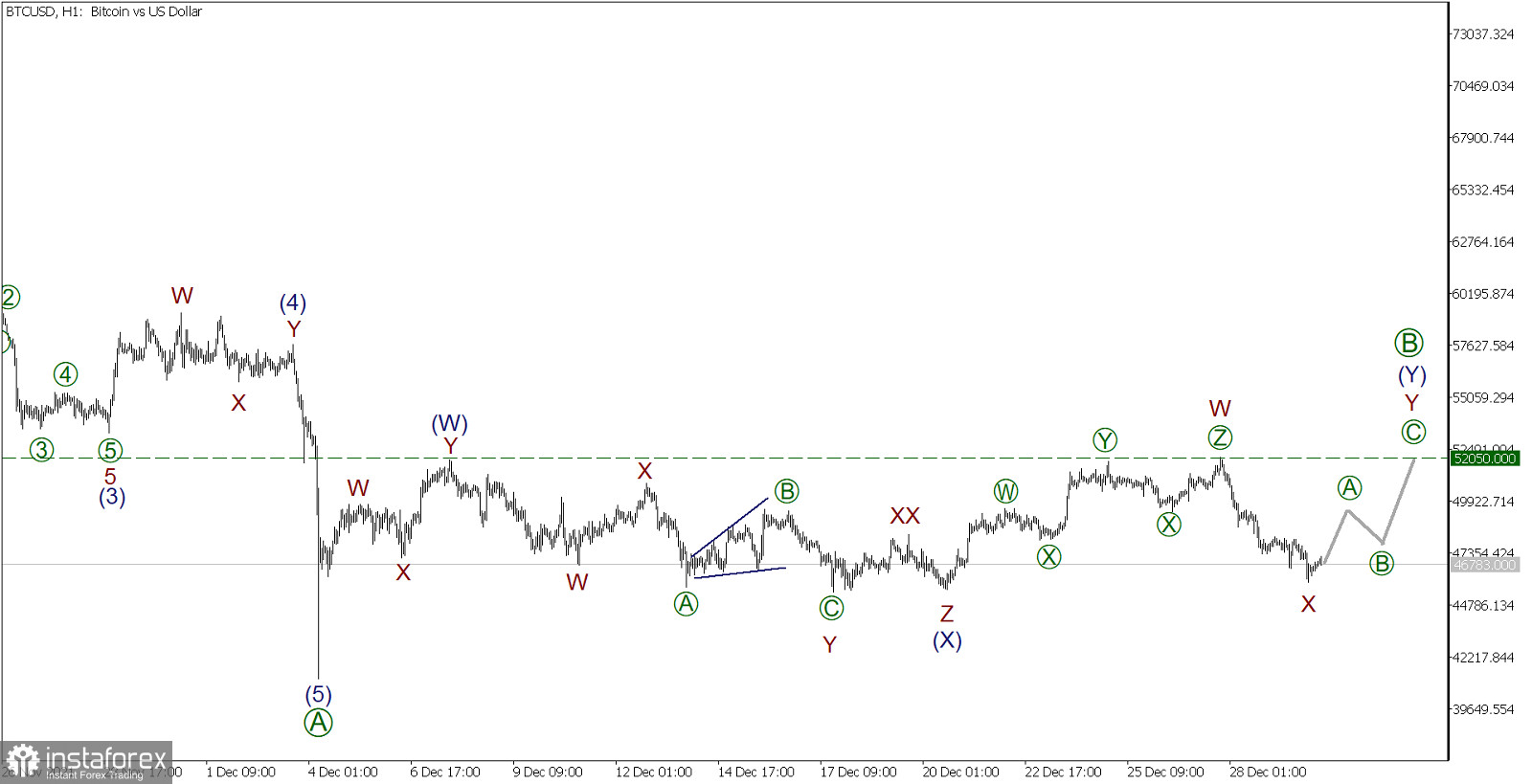

Now, let's continue to consider Bitcoin from the viewpoint of the Elliott theory on the hourly timeframe.

BTC/USD, H1 timeframe:

The formation of a correctional wave [B] of the BTC/USD pair can be seen as in previous trading days. This correction is similar to a double-triple (W)-(X)-(Y).

The first two sub-waves (W) and (X) have been fully completed as part of this correctional figure. It takes the form of a double and triple zigzag. We are now witnessing the formation of the last active wave (Y), which can take the form of a double triple W-X-Y of a smaller wave level.

It is assumed that the first active sub-wave W, which took a triple zigzag form, was completed in the area of 52050.00. After that, the price fell in wave X, which apparently came to an end. In this case, the final sub-wave Y is expected to develop in the near future. It is very possible that it will be a simple zigzag [A]-[B]-[C], as shown in the chart.

It is assumed that the entire wave Y will end at the level of 52050.00, which was marked by the first active wave W.

Therefore, one can consider opening buy deals at this time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română