The AUD/USD pair resumed its growth as the USD was punished by the DXY's drop. The bias is bullish in the short term, so further growth is favored. It was trading at 0.6503 at the time of writing and it seems determined to approach and reach new highs.

Fundamentally, the Aussie received a helping hand from the Australian economic data today. The CPI rose by 1.8% versus the 1.6% expected, while Trimmed CPI surged by 1.8% exceeding the 1.5% growth expected.

On the other hand, the USD is bearish after the CB Consumer Confidence, Flash Services PMI, and Flash Manufacturing PMI came in worse than expected in the last two days. Tomorrow, the ECB and the US Advance GDP publication could really shake the markets, that's why you need to be careful.

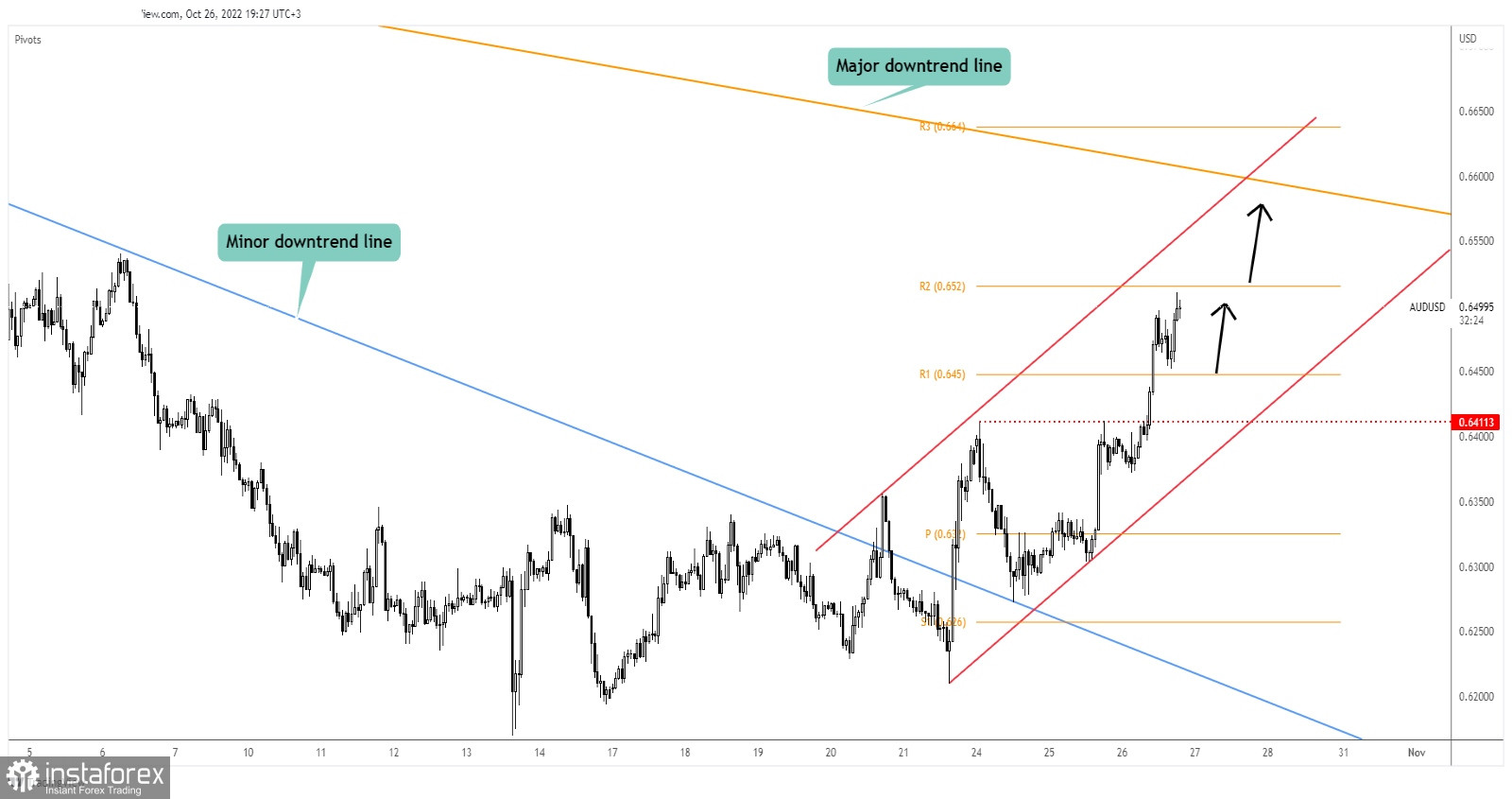

AUD/USD Up Channel!

AUD/USD jumped higher within an up-channel pattern. Staying near 0.6411 signaled an imminent breakout and a bullish continuation. It has ignored also the R1 (0.6450) and is almost to reach the R2 (0.6520) static resistance.

As long as it stays above the R1 (0.6450) and above the uptrend line, the bias is bullish as the rate could approach and reach new highs.

AUD/USD Forecast!

A valid breakout above the R2 (0.6520), jumping, and stabilizing above it activates further growth at least towards the channel's upside line. This scenario could bring new long opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română