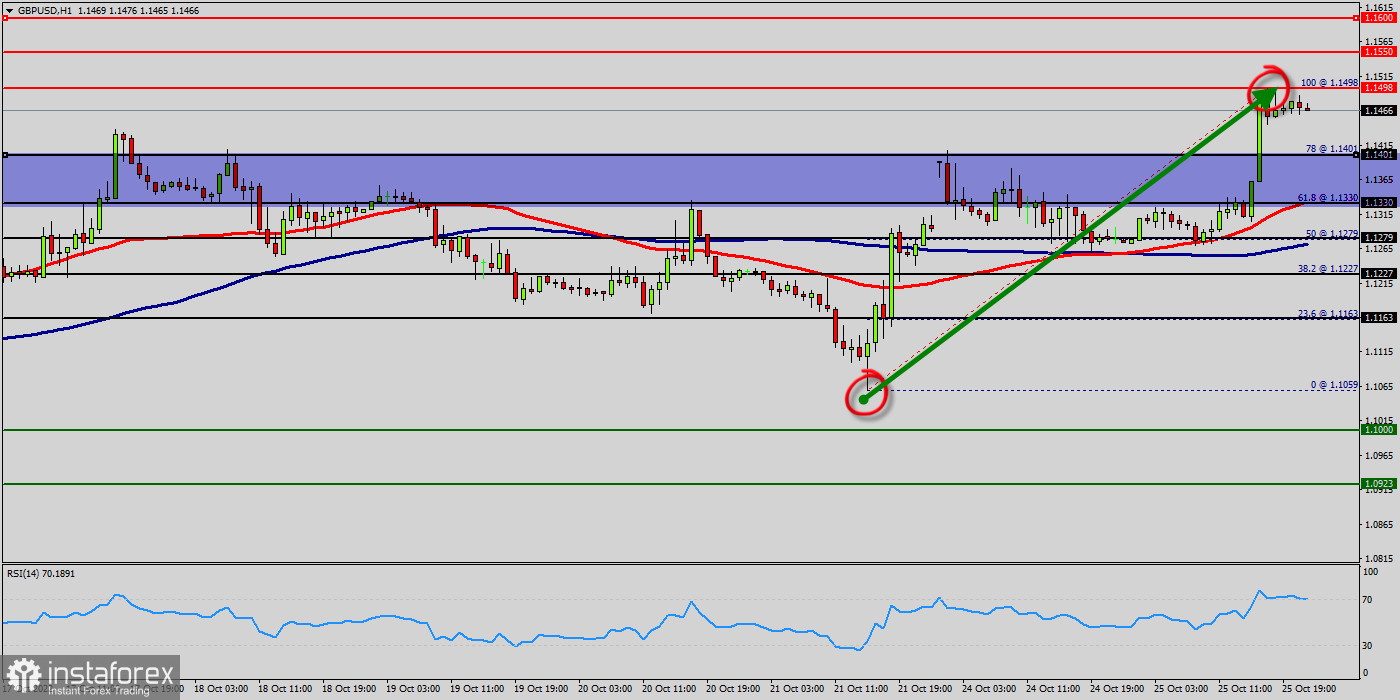

The bullish trend is currently very strong for GBP/USD. As long as the price remains above the support at the level of 1.1401, it could try to take advantage of the bullish rally.

The first bullish objective is located at 1.1498. Crossing it would then enable buyers to target 1.1498. Be careful, given the powerful bearish rally underway, excesses could lead to a short-term rebound. If this is the case, remember that trading against the trend may be riskier.

It would seem more convenient to wait for a signal indicating reversal of the trend. Bitcoin has closed above the pivot point (1.1330) could assure that

GBP/USD will move higher towards cooling new highs. The bulls must break through 1.1498 in order to resume the uptrend.

The GBP/USD pair is inside in upward channel. Closing above the major support (1.1330) could assure that GBP/USD will move higher towards cooling new highs. The GBP/USD pair is continuing rising by market cap at a range between 1.1330 and 1.1550.

The GBP/USD pair is trading at 1.1468 after it reached 1.1550 earlier. The GBP/USD pair has been set above the strong support at the price of 1.1330, which coincides with the 61.8% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend.

In the very short term, the general bullish sentiment is not called into question, despite technical indicators being neutral (RSI). The market is likely to show signs of a bullish trend around the spot of 1.1466.

Buy orders are recommended above the area of 1.1401 with the first target at the price of 1.1498; and continue towards 1.1550 in order to test the last bullish wave. The bullish momentum would be revived by a break in this resistance.

Buyers would then use the next resistance located at 1.1550 as an objective. The GBP/USD pair closed last week above the 1.1401 level, starting today with bullish bias in attempt to move away from this level, which encourages us to propose the bullish bias in the upcoming sessions, targeting visiting 1.1498 as a first positive station.

Further recovery should motivate the pair to challenge recent highs around 1.1550 to allow for extra gains to, initially, the interim hurdle at the 50-day EMA at 1.1550. The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 50 EMA is headed to the upside Bias will be back on the upside for retesting 1.1550 high.

On the other hand, if the GBP/USD pair fails to break through the resistance price of 1.1498 today, the market will decline further to 1.1330 (return to the last bearish wave).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română