Euro parity still in play ahead of decisive US inflation data, for that common currency came within whisker of 0.9965 ($1.0000) this week. Right now, the EUR/USD pair is still moving around the price of 0.9965 - 1.0000. The currency pair EUR/USD is trading below the resistance levels of 1.0000, 1.0050 and 1.0100.

The euro to US dollar (EUR/USD) rate has fallen about 1.25% year-to-date to trade around 0.9965. The decline is comparable to losses last seen for seven years, when the European Central Bank unleashed its massive stimulus programme.

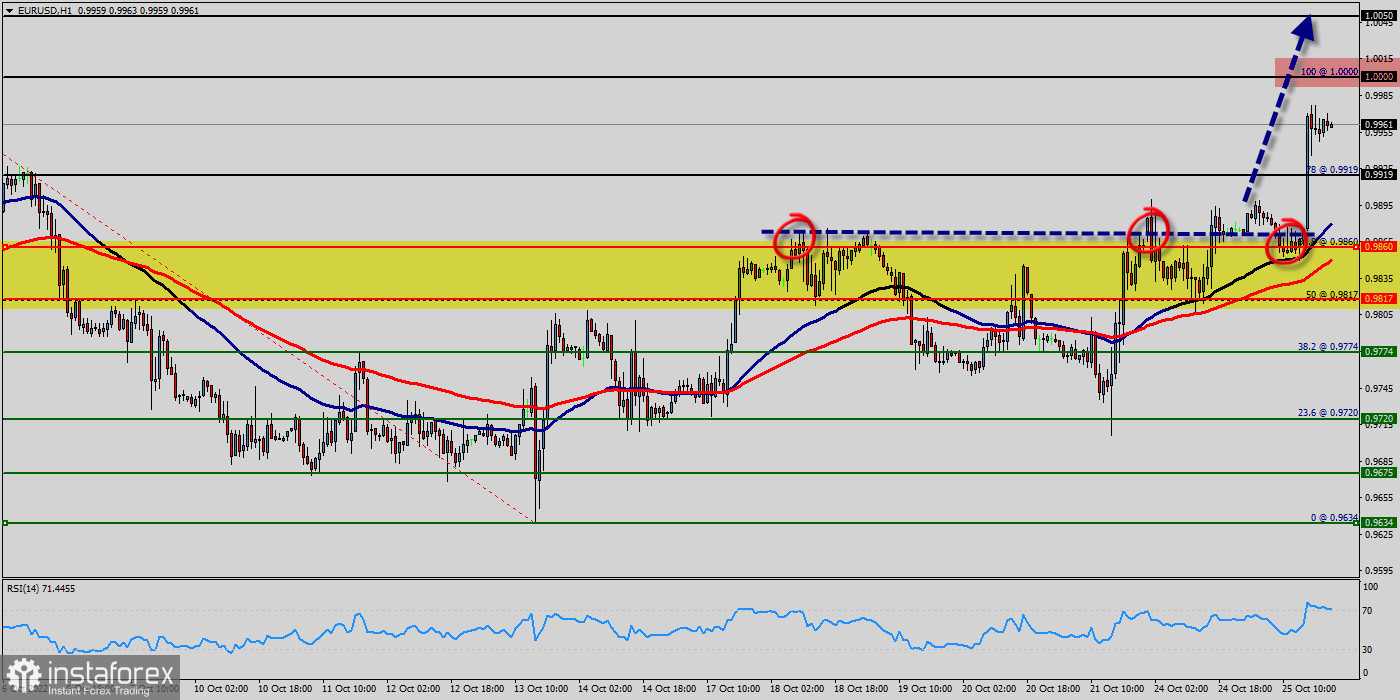

The EUR/USD pair continues to move upwards from the level of 0.9860, which represents the double bottom in the hourly chart.

Yesterday, the pair rose from the level of 0.9860 to the bottom around 0.9965. Today, the first resistance level is seen at 1.0000 followed by 1.0050, while daily support is seen at the levels of 0.9919 and 0.9860.

According to the previous events, the EUR/USD pair is still trading between the levels of 0.9919 and 1 USD. Hence, we expect a range of 81pips in coming hours (1.0000 - 0.9919).

The first resistance stands at the price of 1 USD, therefore if the EUR/USD pair fails to break through the resistance level of 1.0000, the market will rise further to 1.0050.

This would suggest a bearish market because the RSI indicator is still in a negative area and does not show any trend-reversal signs. The pair is expected to climb higher towards at least 1.0050 in order to test the second resistance (1.0050).

The US Dollar and the Euro are two of the most prominent and well-known currencies in the world. The Euro versus US Dollar (EUR/USD) currency pair has the largest global trading volume, meaning it is the world's most-traded currency pair.

Whether you find the instrument easy or difficult to trade on, it's not a pair that many traders neglect, due to its daily volatility and price movement. Thus, the market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

Today, resistance is seen at the levels of 1.0000, 1.0050 and 1.0100. So, we expect the price to set above the strong support at the levels of1.0000, 1.0050 and 1.0100; because the price is in a bullish channel now.

The RSI starts signaling an upward trend. Consequently, the market is likely to show signs of a bullish trend. Thus, it will be good to buy above the level of 0.9919 with the first target at 1 USD and further to 1.0050 in order to test the daily resistance.

If the GBP/USD pair is able to break out the daily resistance at 1.0050 , the market will rise further to 1.0100 to approach resistance 3 in coming hours or days.

However, the price spot of 1 USD and 1.0050 remains a significant resistance zone. Therefore, the trend is still bullish as long as the level of 0.9860 is not breached.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română