The market actually froze in place. Last week, the intraday volatility of EUR/USD was still measured by several dozen points, whereas today, this range has narrowed to 10-20 points. The time has come for those who are taking profits in between short price waves.

In general, the EUR/USD pair has been trading within the price range since the end of November, alternately pushing off from its borders. The range is gradually narrowing, but the principle remains the same: traders cannot decide on the vector of price movement, so they fix profits when they approach the "ceiling" or at the lower border of the level. Initially, the borders were indicated by the range of 1.1200-1.1360 but then it narrowed to 1.1260-1.1340. Recently, the pair began to attract buyers earlier as soon as the price falls below the level of 1.1300.

During Monday's Asian session, the bears tried to approach the bottom of 1.13 again, amid a narrow market and an empty economic calendar. The tone of trading is set by general fundamental factors, which determine the level of market interest in anti-risk or vice versa, risky assets. The US dollar, as a protective instrument, depends on traders' "degree of nervousness". At the start of the new trading week, the US dollar index recovered, having risen in a few hours from 96.035 to 96.165 points. This is quite modest growth, but it is quite noticeable in the current conditions.

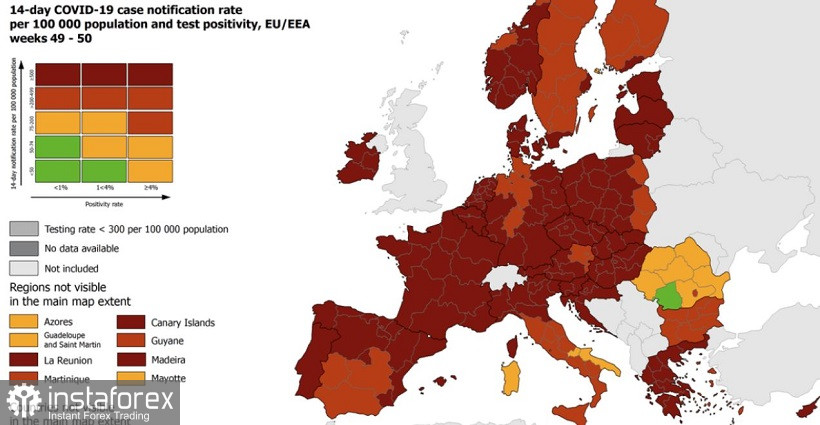

Given the completely empty economic calendar and closed trading floors (in particular, in Britain, Canada, New Zealand, and Australia), medical reports come to the fore again. Omicron continues to spread across the planet, slowly displacing Delta. The new strain of coronavirus has already become dominant in many countries of the world, including in the United States, where more than 70% of new cases were accounted for by it. However, the most disturbing news comes from Europe. Here, increasing cases of coronavirus are recorded, the scale of which is not comparable to the anti-records of 2020.

For example, on Saturday, the daily increase in coronavirus cases in France crossed the 100 thousand mark for the first time during the entire pandemic period. Record growth figures are reported for the third day in a row. Today, President Emmanuel Macron and key members of his government will discuss new security measures via videoconference. According to preliminary data, Paris will not yet introduce a new lockdown in the country, focusing on the vaccination campaign. On Friday, representatives of the French government recommended that adult residents of the country receive a revaccination three months after the initial vaccination. According to rumors, the government will make a medical vaccination pass valid only if people have received a third dose of the vaccine.

The Italians also announced new records of COVID-19. For the first time since the beginning of the pandemic, the number of new cases of coronavirus per day exceeded 50,000 (the population of Italy - 58 million, France - almost 70 million). Rome has already responded to the current situation by increasing quarantine restrictions. In particular, they are now required to wear masks in the open air. In addition, the Italian government has decided to close Italy's nightclubs and dance halls. Open-air parties are also prohibited at least until January 31st.

The toughest measures were taken in the Netherlands – a full lockdown has been in effect there since December 19. Germany will ban people from gathering in companies of more than 10 people from tomorrow and will close nightclubs. In Portugal, bars and nightclubs were closed, and residents were obliged to work remotely at least until January 9.

The United States is also seeing a sharp increase in COVID-19 cases. The country's chief virologist, Anthony Fauci, has warned that Christmas travel will increase the spread of the new variant of the virus even among the fully vaccinated.

The situation is smoothed out by the fact that Omicron is much easier to carry than Delta: infected people are less likely to need hospitalization. Scientists have also found that the new strain is less deadly compared to its predecessor. In other words, most people, when infected with Omicron, will have symptoms that are comparable to a common cold. This is good news. The bad news is that there remains a minority – in absolute numbers, their number may be quite enough to overload the healthcare system of many European countries and the United States. With Omicron, two times fewer people actually get to hospitals, but at the same time, it infects twice as many people. Therefore, many EU countries risk facing a medical collapse. American experts also fear that the burden on the US healthcare system is too high.

Nevertheless, the authorities of the EU countries and the USA are reacting differently to the situation with the spread of COVID-19. European countries are gradually tightening quarantine restrictions (not only for the unvaccinated), whereas the United States is focusing on strengthening the vaccination campaign. In the United States, adults 18 years of age and older can receive a booster dose of Moderna, Pfizer, or Johnson & Johnson. At the same time, US President Joe Biden rejected the possibility of introducing a new lockdown in the country last week.

This information alignment will not allow the euro to go beyond the above price range. Therefore, when approaching the range of 1.1340-1.1350, short positions can be considered to the base of the 13th mark (the support level is located at 1.1300 - this is the average line of the Bollinger Bands indicator on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română