Gold's price has surged after falling in October and November and a three-week consolidation period in December. So, it received slight support, which has caused a wave of hopes in the market for a possible further upward movement.

After the price of the "yellow" metal reached $ 2050 per ounce in August 2020 amid the acute phase of the coronavirus pandemic and significant stimulus measures in America, which weakened the US dollar, prices were now declining at the end of the year under the influence of some recovery in the demand for risky assets and growing hopes that the pandemic would end soon. However, the following waves of COVID-19 and lockdowns supported the price again, which began to consolidate in a fairly narrow range after a decline in the summer of 2021.

This is against the background of strong US inflation and rising fears that the Fed would decide to start the process of raising interest rates in an effort to curb this unpleasant phenomenon. Now, a period of uncertainty started, which led to the sideways dynamics of prices.

Currently, investors are trying to understand how the expected start of interest rate hikes in the US will affect the gold's dynamics. But everything seems to be not so simple here.

What should be expected from the dynamics of gold prices in January 2022?

The primary factor affecting the dynamics of gold prices remains the expectation of the Fed's rate increase next year. This raises a question. Is the price of gold not falling, since the American regulator has planned three requests for interest rates this year? Yes, this is true. He announced such plans at the end of the December meeting, but what is important is the absence of a specific date when will these increases occur. While voicing the bank's position on this issue, J. Powell did not provide any specifics but made it clear that the Central Bank would act on the basis of the situation. This means that if inflation continues to rise after the new year, the first increase in the rate may take place as early as next spring.

At the same time, if inflationary pressure stabilizes or even corrects downwards in the wake of the COVID-19 pandemic, which will stimulate the recovery of supply chains, then rates are likely to start rising by the middle of the year. Practically, the Fed allows further discussion on the issue of raising rates, which gave rise to an uncertainty factor. That is why there are no strong movements of the US dollar in the currency market, and the price of gold is consolidating in the range.

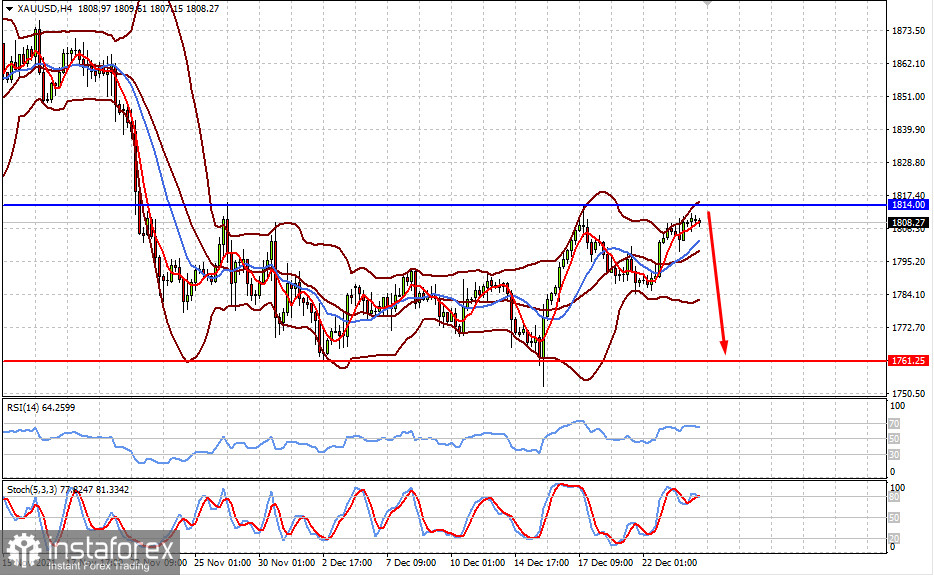

Assessing the prospects for the beginning of next year for gold prices, we believe that the sideways dynamics of gold prices will likely persist until the publication of new US inflation data. An important signal for a prospective growth in gold prices or their decline will be the dynamics of the dollar exchange rate in the currency market. If the dollar on the ICE index consolidates "sideways", then gold's quotes will likely remain in the range as well.

Forecast for the day:

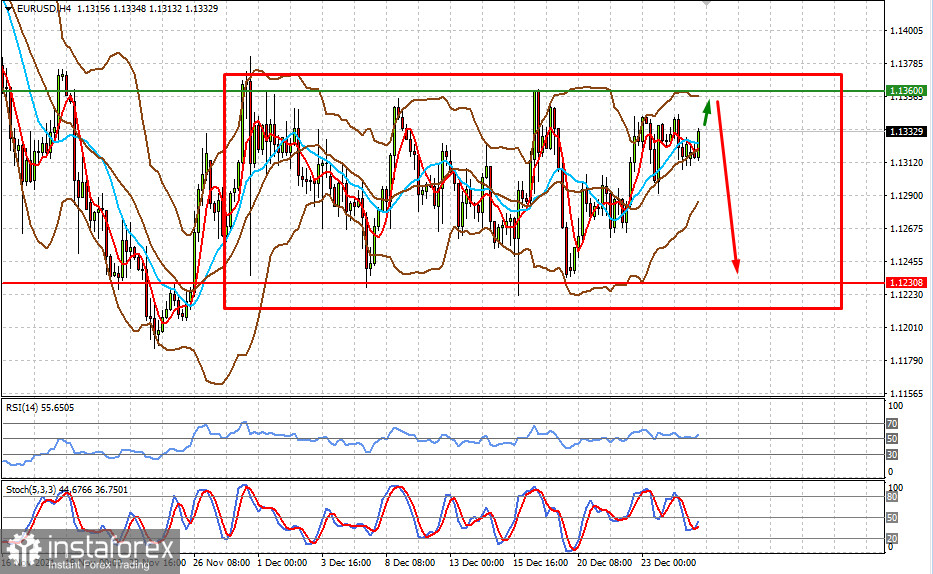

The EUR/USD pair is likely to remain in the range of 1.1230-1.1360 until this year ends.

The price of spot gold is also likely to trade in the range of 1761.25-1814.00 until the new year if it does not rise above its upper border.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română