The GBP/USD pair rallied in the last hours as the DXY plunged. DXY's deeper drop should force the greenback to lose significant ground versus its rivals. It was trading at 1.1412 at the time of writing and it seems determined to resume its growth.

Today, the UK CBI Industrial Order Expectations came in at -4 points versus -13 points expected. On the other hand, the US HPI and S&P/CS Composite-20 HPI came in worse than expected.

The US CB Consumer Confidence is expected at 105.9 in October versus 108.0 in September. A deeper drop could weaken the USD and could push GBP/USD toward new highs.

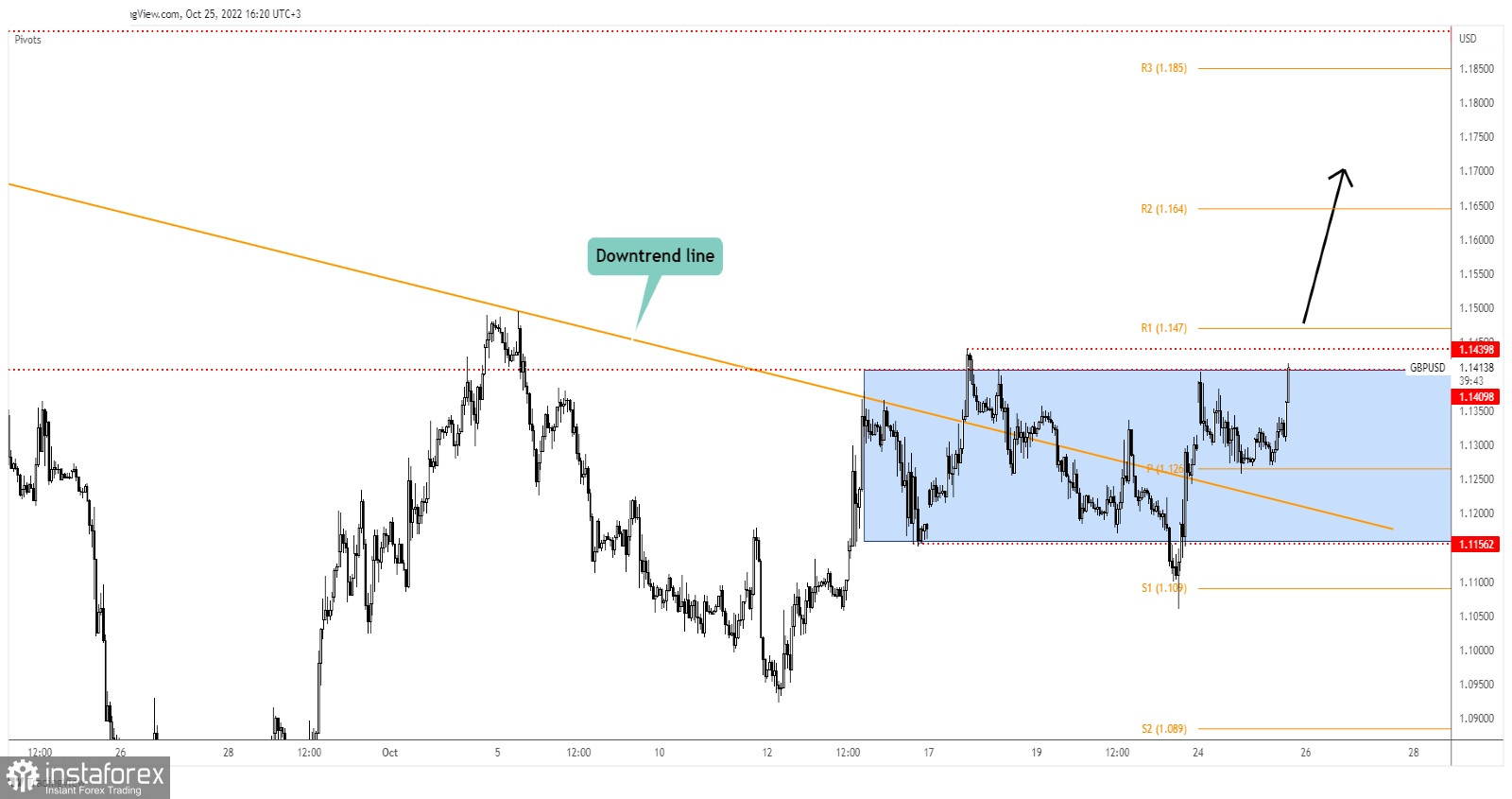

GBP/USD Range Breakout!

As you can see on the H1 chart, the rate came back and stabilized above the downtrend line and above the weekly pivot point of 1.1260 after registering only a false breakdown below the 1.1156 range's support.

Now, it is challenging 1.1409 and the 1.1439 static resistance. The R1 (1.1470) stands as an upside obstacle as well. It remains to see how the price reacts after the US data. A false breakout through the immediate resistance levels could invalidate the upside scenario.

GBP/USD Prediction!

A valid breakout through 1.1439 and above R1 (1.1470) activates further growth. This is seen as a long opportunity. The first upside obstacles and the target is represented by the R2 (1.1640).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română