The US dollar ends the year on a positive note – speculative demand for it is growing. It is assumed that the demand for the US dollar will exceed the demand for other currencies, which is noted in most analytical scenarios.

Daniel Wilson, vice president of the Federal Reserve Bank of San Francisco, published a forecast on the dynamics of the main parameters of the US economy, which largely explains the position of the Fed as a whole. Wilson expects sharp GDP growth in the 4th quarter, followed by a slowdown to 1.7%. This will happen already in 2022.

The labor market has not yet recovered about 5 million pre-pandemic jobs, but a decrease in unemployment to 3.8% can be expected by mid-2022.

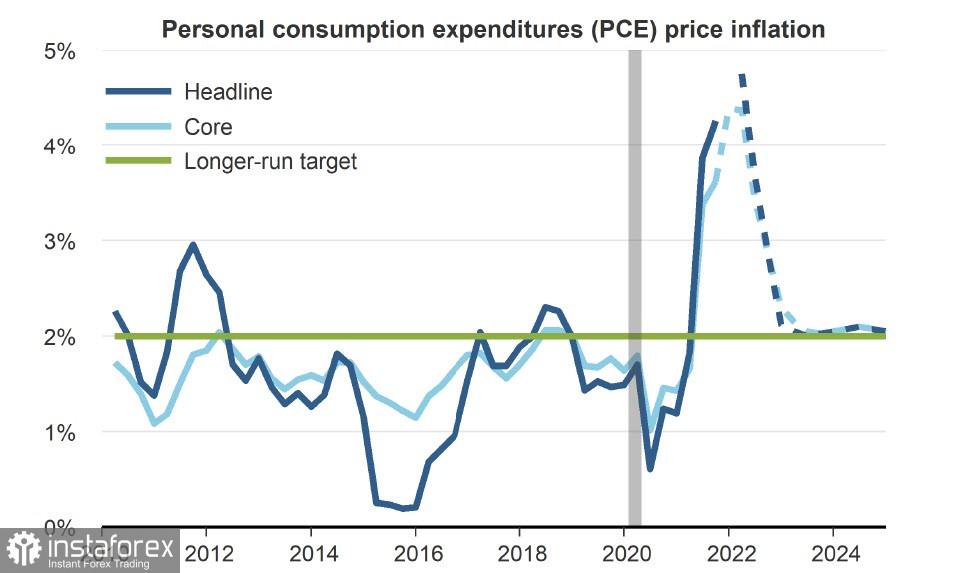

As for inflation, Wilson expects it to intensely fall in mid-2022.

This forecast is typical for the majority of Fed members, who are guided by the fact that inflation, even if it has ceased to be temporary, will still be brought under control fairly quickly.

But if so, there is no need for more than three rate increases. By the end of 2022, all the goals will be achieved – inflation will return to the targeted levels, unemployment to 3.8%, and GDP growth will remain stable. Too close a prospect of achieving the stated goals may serve as a basis for slowing the strengthening of the US dollar.

The CFTC report on the celebration of Christmas will be published tonight.

EUR/USD

The key factor that can pull the euro up is the easing of global inflationary pressures. For a long time, inflation by the central banks headed by the Fed was called temporary, but in the last month, they were forced to admit that inflation is serious and will happen for a long time. At the same time, in global forecasts, it is customary to insist that inflation will go down sharply in 2022/23 and then stabilize near the values targeted by central banks.

Such scenarios seem to be overly optimistic, primarily due to the unfolding gas crisis. If it is not stopped in the next month or two, it can give Eurozone's inflation a new and noticeably strong impulse to the growth of everything and everyone.

As production slows down, the negative impact on the euro will intensify. It should be noted that the threat of rising production costs will force the eurozone financial authorities to look for ways to limit the growth of the euro, which suggests that the ECB will lag behind the Fed in the pace of normalization of monetary policy, and this lag will only increase.

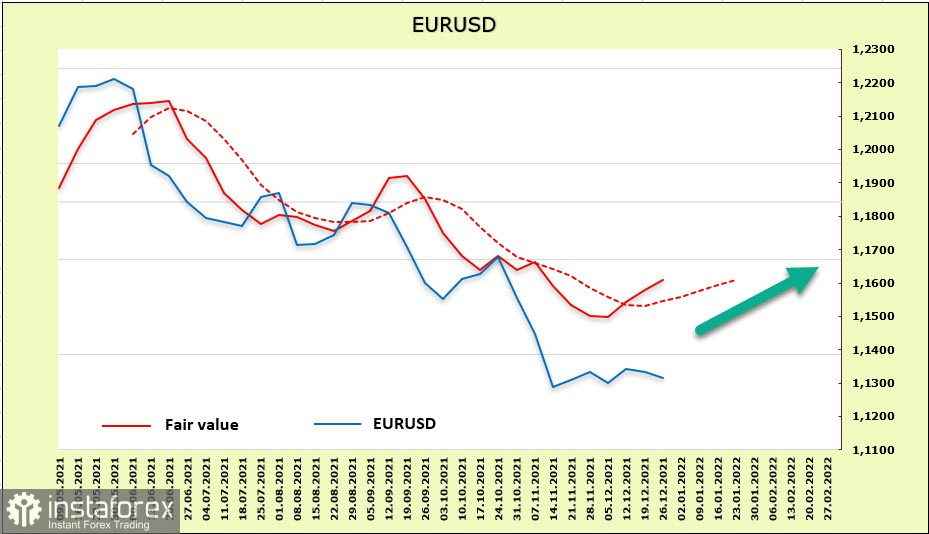

At the moment, the euro continues to consolidate, remaining within the limits of the bearish channel. The estimated price has gone above the long-term average, which gives a chance for the development of a short-term correction.

The limit of the upward correction lies in the area of 1.1450/70, where the upper border of the channel is previously passed. It can be assumed that any upside attempts will ultimately be used to increase bearish pressure. In the long term, the euro is targeting a breakdown of 1.1178 and a further decline to 1.10.

GBP/USD

The Bank of England surprised the markets in December by raising the bank rate by 0.15% to 0.25%. According to the BoE, it is necessary to maintain the principle of "moderate tightening". The markets regard a rate increase by about 0.78% in 2022, which is even slightly more than that of the Fed, that is, the Bank of England can implement higher rates of monetary policy normalization than the Fed. This factor will pull the pound up.

One of the disadvantages is a large current account deficit. If gas prices continue to rise, this may lead to pressure on the pound compared to the euro (in the eurozone, the current account is in surplus).

But the favor of strengthening the pound's position is the decline in the probability of introducing new restrictive measures in connection with the onset of the Omicron strain, which was already mentioned a week earlier. The weakening of this threat allowed the pound to relieve excessive bearish pressure.

The estimated price is near the long-term average, and the GBP/USD spot rate is also nearby, so there is no clearly expressed direction.

The pound is still trading in a bearish channel, around the middle of the channel. A likely consolidation above the resistance zone of 1.3350/3400 will slightly increase the chances of continued growth. The main target is 1.3570/80.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română