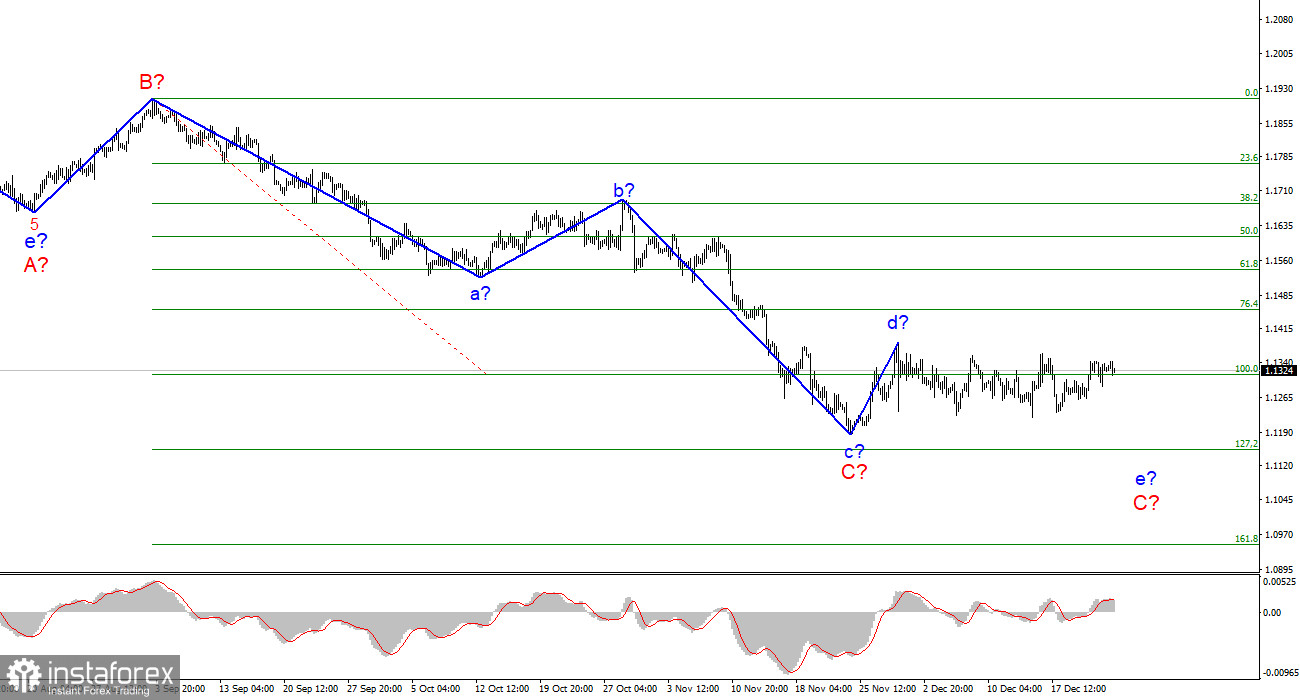

The wave marking of the 4-hour chart for the euro/dollar instrument continues to remain integral and does not require additions. The construction of a descending wave e-C is still questionable since the current wave takes a very extended, horizontal form. If the descending wave does not continue its construction, then wave C will have to be recognized as three-wave and completed, although I believe that it should still take a five-wave form. The wave that originates on November 30 cannot be attributed now either to wave C or to the first wave of a new upward trend segment if this is it since neither the peak of wave d-C nor the low of wave c-C have been broken over the past few weeks. In the current situation, we can only wait for the situation to develop. Given that the holidays are slowly beginning, the current wave may take on an even longer form. And now it makes no sense to understand its internal waves since this structure can turn out to be almost any length.

Christmas week continues.

There was no news background for the EUR/USD instrument on Friday and could not have been, since Christmas will be celebrated all over the world tomorrow, and the day before this holiday, many exchanges and commercial structures no longer work with banks. Thus, an amplitude equal to 15 base points on Friday should not confuse anyone. And as a result, the instrument ends in 2021 around its annual low. Since the current wave marking still allows us to assume the completion of the downward trend segment, in any case, all the hopes of the euro currency are transferred to the next year. It's hard for me to even imagine what could make the market suddenly start actively buying the euro currency this year. There will be almost no news and reports next week either. In the next year, at first, the hopes of the euro will consist only in wave marking, which we assume at least the construction of an upward wave D. However, the entire downward section of the trend can take the form A-B-C-D-E. That is, another downward wave can be built. And if the news background for the euro continues to remain so weak, then, most likely, this is exactly what will happen.

General conclusions.

Based on the analysis, I conclude that the construction of the descending wave C can be completed. However, the internal wave structure of this wave still allows the construction of another downward, internal wave. Thus, I advise selling the instrument with targets located around the 1.1152 mark, for each MACD signal "down", until there is a successful attempt to break the peak of wave d. New sales should not be opened on each signal. It is better to place a restrictive order above the peak of wave d once.

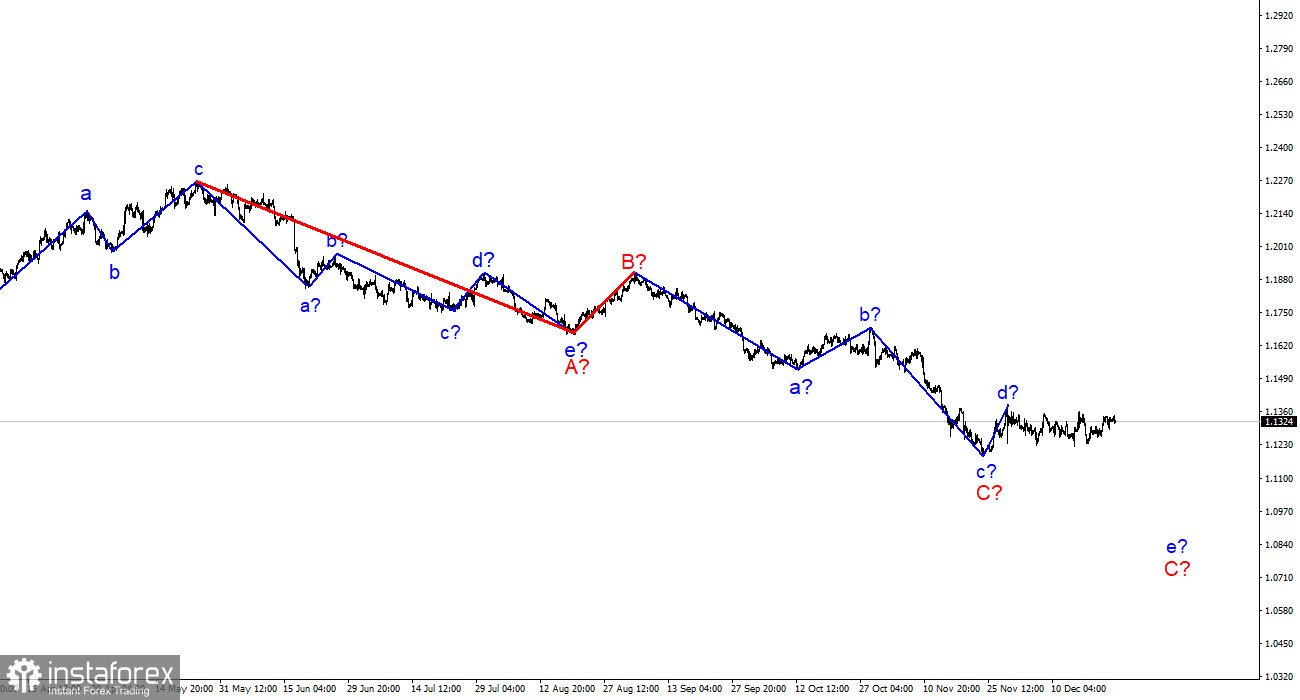

Senior schedule.

The wave marking of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave correction structure A-B-C. Thus, the decline may continue for several more weeks until wave C is fully completed (it should take a five-wave form in this case).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română