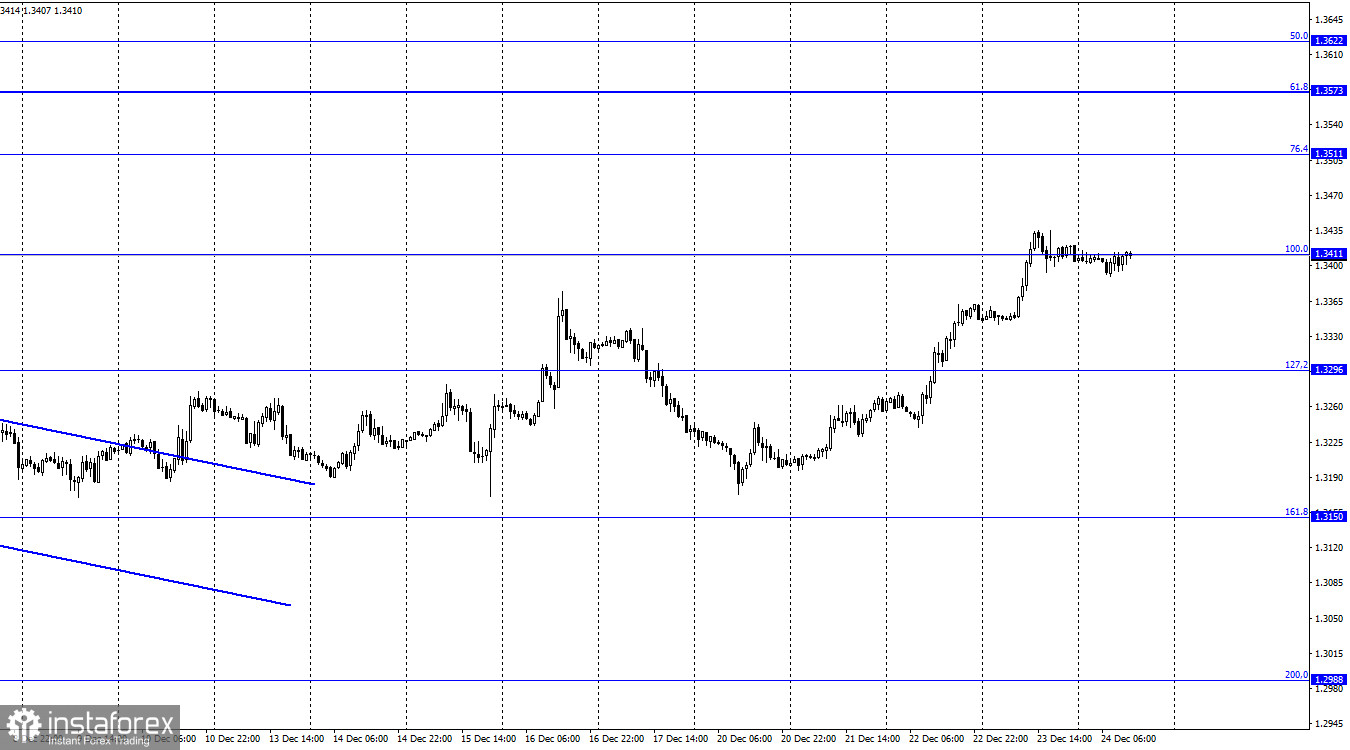

GBP/USD, H1

On the hourly chart, the GBP/USD pair continued its growth on Thursday and at the end of the day was near the correction level of 100.0% - 1.3411. There was no rebound from this level, but there was no consolidation above it either. Thus, on Friday, when most financial institutions and banks are closed, and most traders have already left the market and are preparing for Christmas, no one expects a strong movement from the pound-dollar pair.

There is no information background today, and it will be absent throughout the next week. Thus, the British pound made the final leap at the end of the year upwards, but this leap could be caused by graphical factors. In other words, we saw a pretty strong correction. After all, if you go to the higher timeframes, the downward trend is clearly visible there. And all the growth in recent days is really just a correction.

I do not think that any reasons for the growth of the pound should be sought now. It could rise in price due to the fact that there will be no lockdown in the U.K. But it will not yet be in the United States and in many countries of the European Union. The pound could not get traders' support based on this factor. But the pound sterling is burdened with political and geopolitical problems.

In the past two weeks, attention was somehow more focused on the meetings of the Fed and the Bank of England, but negotiations with the European Union and France faded into the background. However, they have not ended with anything, but only put on pause, since the Christmas and New Year weeks are not the best time for new negotiations. Perhaps the pound rose even in the absence of a negative information background. But in recent weeks, nothing has changed so much so that it suddenly starts to rise in tandem with the U.S. dollar. Thus, I believe that the growth will not be sustained.

GBP/USD, H4

On the 4-hour chart, the pair consolidated above 1.3274, the 61.8% retracement level. Thus, the growth process can be continued in the direction of 1.3457, the 50.0% Fibo level. A rebound of quotes from the level of 50.0% will work in favor of the U.S. currency and the beginning of the fall, and consolidation above this level will increase the chances of continued growth in the direction of 1.3642, the 38.2% retracement level. However, all these movements may occur as early as next week. None of the indicators show any maturing divergences.

U.S. and U.K. News Calendar:

Both the U.K. and U.S. Economic Calendars are blank on Friday. The information background today will not have any impact on the mood of the traders who remain on the market.

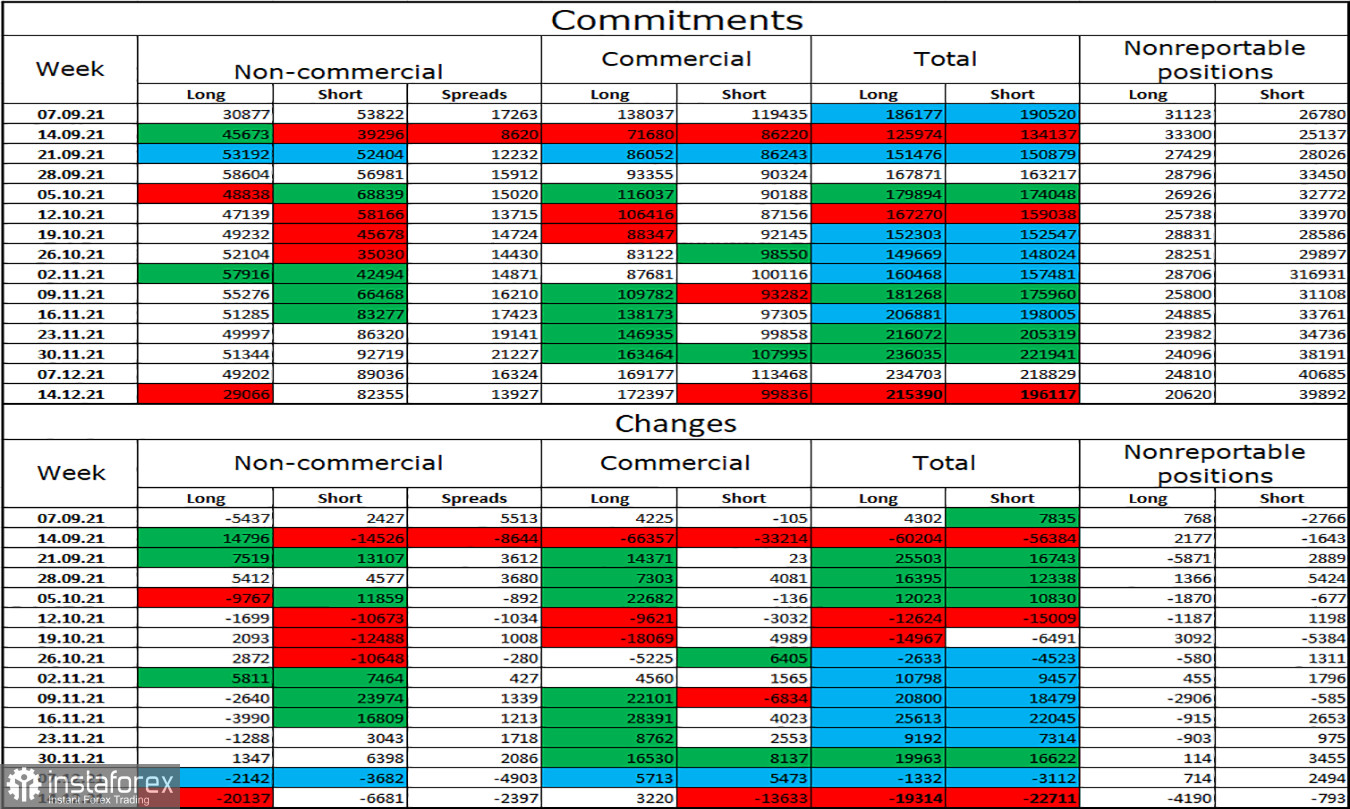

COT Report (Commitments of traders):

The latest COT report from December 14 in the U.K. showed that the mood of major players has changed dramatically. To be more precise, it became much more "bearish," since the "Non-commercial" category closed 20,000 Long contracts at once. The trend of strengthening the "bearish" mood has been observed for two months.

In the reporting week, speculators also closed 6,681 Short contracts. The total number of Short contracts in the "Non-commercial" category of traders is now more than twice as high as the number of Long contracts: 82,000 versus 29,000. Thus, at the end of the next week and the next COT report, I cannot conclude that the situation for the British pound has improved a little. It can still continue the process of falling.

Forecast for GBP/USD and recommendations for traders:

I recommended buying the British pound in case of a rebound on the hourly chart from the level of 1.3171 with targets at 1.3296 and 1.3411. Closing did not take place above the level of 1.3411, so you can exit from purchases. I do not recommend opening sales yet - the British pound has grown too strong in recent days, and today the pair is unlikely to show at least some movement.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations.

"Nonreportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română