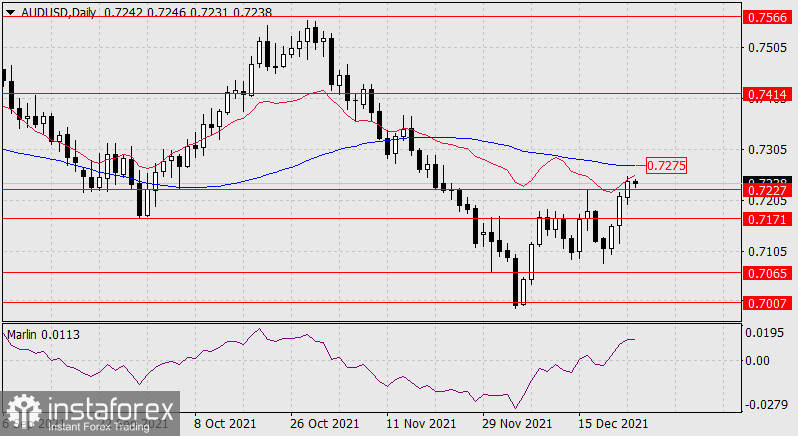

Yesterday the Australian dollar made a big effort and surpassed the target level of 0.7227 - the October 6 low and other extremes of not a very distant record. The price may try to work out the resistance of the MACD line at 0.7275, but this will require additional forces, which, even if you ignore the current thin market, are few even from the technical side - the price on the daily scale is still below the balance indicator line (red), which indicates the corrective nature of the growth of the entire movement from the level of 0.7007, and the Marlin Oscillator has outlined a downward reversal.

Marlin's downward reversal is more pronounced on the four-hour chart. Consolidating below the level of 0.7227 will be the first signal of the aussie's intention to complete this correction, and the move below 0.7171 will confirm this signal.

Growth is possible only after the price breaks above the daily MACD line, above 0.7275. In this case, the target will open at 0.7414 - the August 2020 high.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română