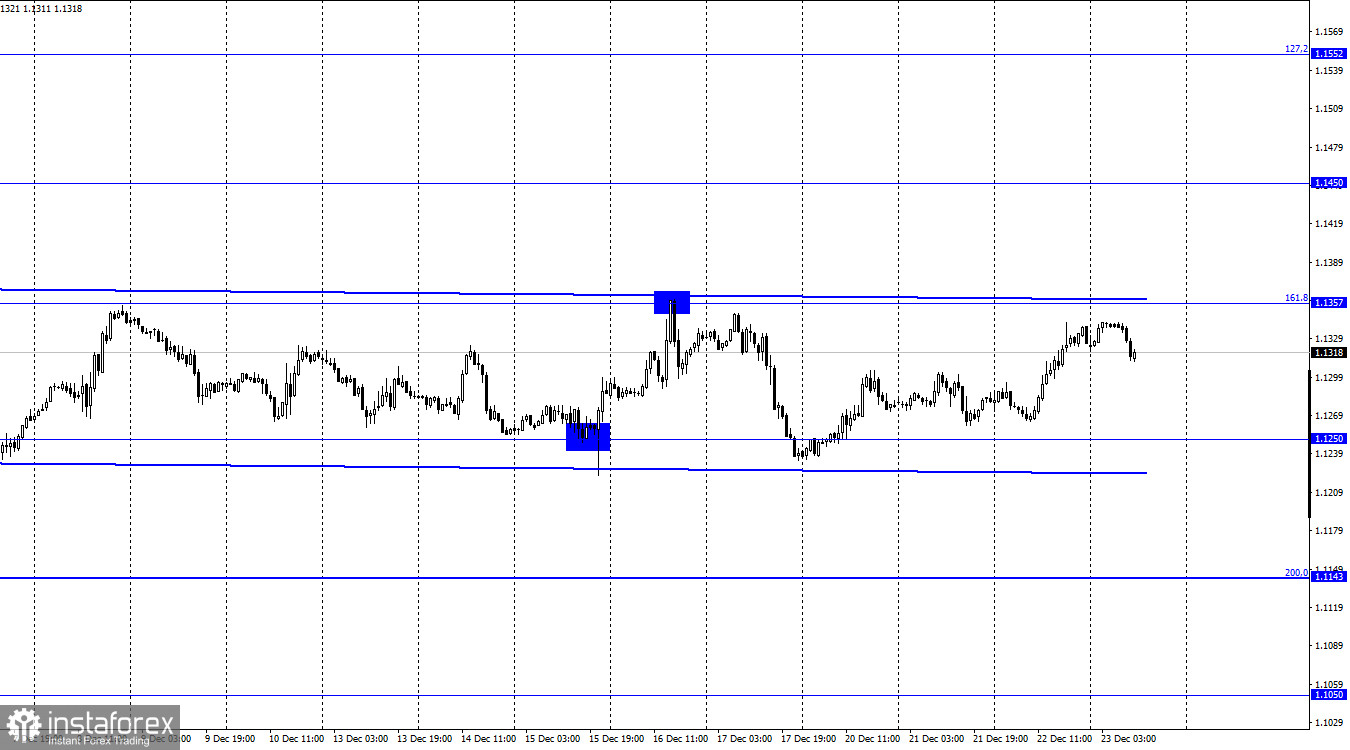

EUR/USD – 1H.

On Wednesday, the EUR/USD pair continued to trade inside the side corridor, which I mentioned in recent reviews and which is present on the chart. Thus, the movement of the pair may not be weak, but at the same time, it is lateral. This means that traders are no longer considering opening new positions this year. I would like to draw your attention to the fact that the euro currency has been inside this corridor for almost a month. Therefore, it's not even about the holidays, during which activity in the market often falls. The fact is that the euro/dollar pair is now at a crossroads. On the one hand, bull traders do not have the strength to start growth. On the other hand, bear traders have been actively selling in the last few months and also want to rest. Thus, the information background is not even too important now. Yesterday, however, a report on GDP in the third quarter was released in America. This was the final report, and it showed an increase in GDP compared to the second quarter by 2.3%, which is slightly higher than in the previous estimate.

However, all day yesterday, the quotes of the euro showed growth. Thus, no one paid attention to this report. What can we say about the consumer confidence indicator? Even the results of the Fed and ECB meetings last week failed to bring the pair out of the side corridor, although a lot of important information was announced at these events. Thus, I once again conclude that it's not even about the upcoming Christmas and New Year. The fact is that traders do not know what to do with the pair now. Today, I do not expect traders to react to American reports. The topic of omicron, which gained momentum at the end of the year, also does not interest traders too much, since this strain does not threaten the economy too much yet. Only a few countries around the world have introduced lockdown, the rest are going to cope with vaccination, revaccination, and other methods. This is the case, in particular, in the United States, where Joe Biden is not going to impose strict restrictions, despite the new update of anti-records of morbidity among the population.

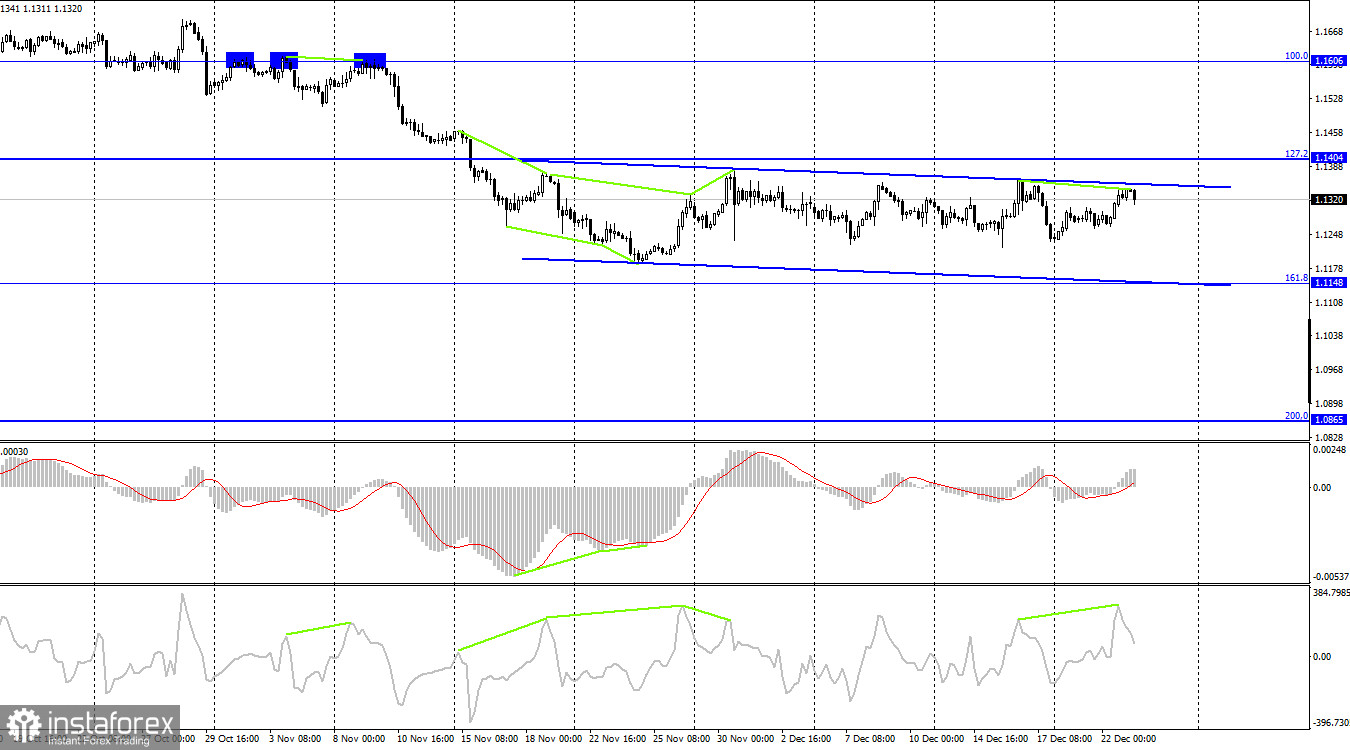

EUR/USD – 4H

On the 4-hour chart, the pair performed an increase to the upper boundary of the descending corridor, which may just as well be called a sideways one. The bearish divergence formed by the CCI indicator allows us to expect a reversal in favor of the US currency and a slight drop in the direction of the corrective level of 161.8% (1.1148). The situation on the hourly chart is almost identical. Closing the pair's rate above the corridor will allow us to expect further growth of the euro currency.

News calendar for the USA and the European Union:

US - change in the volume of orders for long-term goods (13:30 UTC).

US - change in the level of expenditures and incomes of the population (13:30 UTC).

US - number of initial and repeated applications for unemployment benefits (13:30 UTC).

US - consumer sentiment index from the University of Michigan (15:00 UTC).

On December 23, the calendar of economic events contains only American records. However, all of them are not the most important for traders. I believe that the information background today will have a weak impact on the mood of traders.

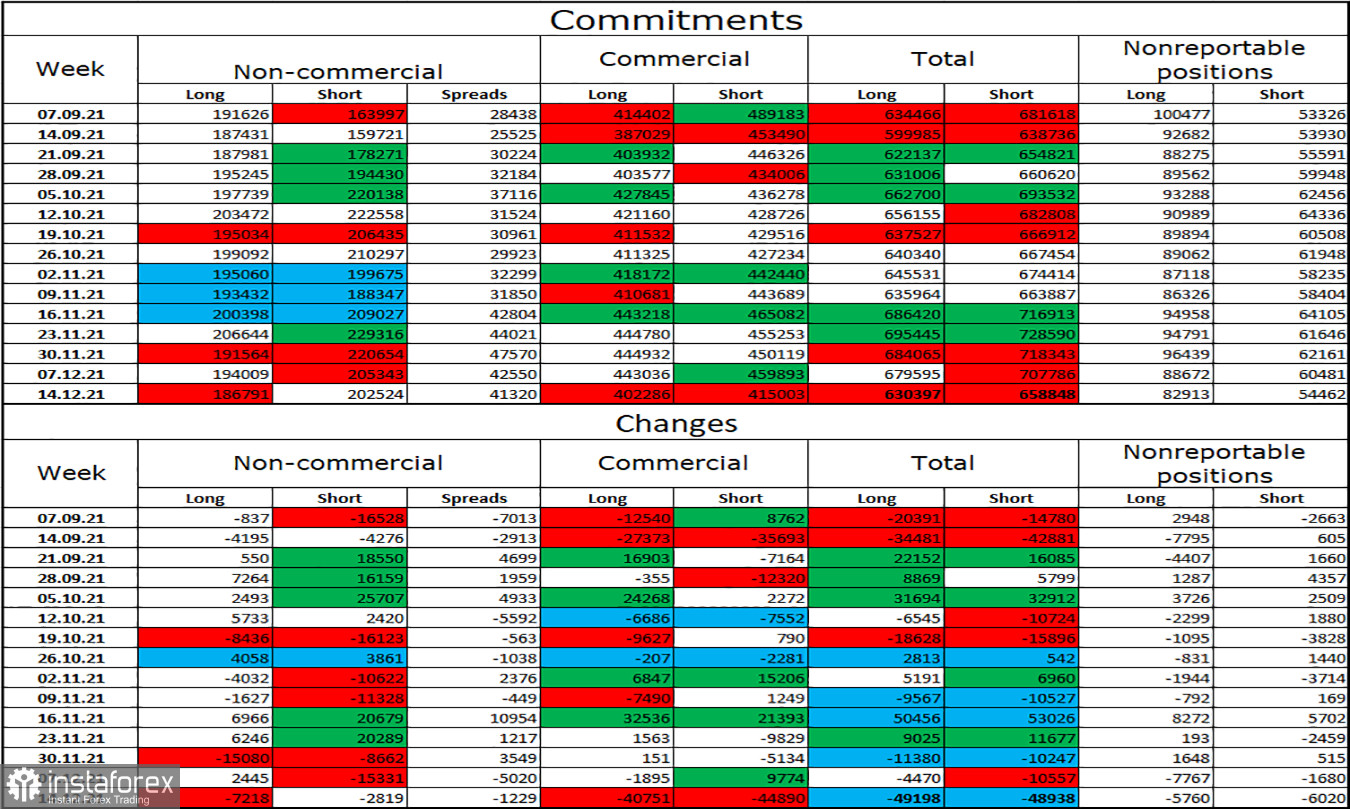

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became more "bearish". Speculators got rid of both longs and shorts. In total, 7218 long contracts on the euro currency and 2819 short contracts were closed. Thus, the total number of long contracts in the hands of speculators decreased to 186 thousand, and the total number of short contracts - to 202 thousand. The "moderately bearish" mood among the most important category of traders remains. The most interesting changes were observed among traders of the "Commercial" category, who closed 40-45 thousand contracts of both types. In total, during the reporting week, about 100 thousand contracts on the euro currency were closed.

EUR/USD forecast and recommendations to traders:

Sales will be possible in case of a rebound from the level of 1.1357 on the hourly chart with a target of 1.1250. I recommended buying the euro currency when rebounding from the level of 1.1250 with a target of 1.1357. I recommend new purchases if the pair closes above the side corridor on the hourly chart with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română