Hi dear colleagues!

According to the European Medicines Agency, the effect of available vaccines has diminished with the emergence of the Omicron strain. As this strain has several dozen mutations, existing vaccines are far from being able to cope with it, i.e. neutralize it. However, the development of new vaccines against the Omicron strain still needs to be confirmed as it is little-known. However, just a couple of days ago, a fifth vaccine against COVID-19 by a US pharmaceutical company Novavax, called Nuvaxovid, was approved in the European Union. The European Union leaders believe that the current availability of treatments and existing vaccines is more optimistic than it was 1-1.5 years ago. However, there is still a long way to go before there is good news on this important issue, as Omicron is showing active spread in several countries in Europe as well as in the United States. There is a demand for drugs that can produce antibodies in both the adult and adolescent populations aged 12 years and above. This is still a serious problem in many countries. This situation also has a significant impact on the introduction of additional restrictive measures, which can undoubtedly affect the economic situation of individual countries and the world as a whole.

As for yesterday's US GDP and also the consumer confidence index, both of these important indicators are better than forecast. Today market participants' attention will be focused on macroeconomic statistics from the United States. Today a big block of US data will be released. I recommend paying attention to durable goods orders, personal income, and expenditures of Americans, as well as initial claims for unemployment benefits.

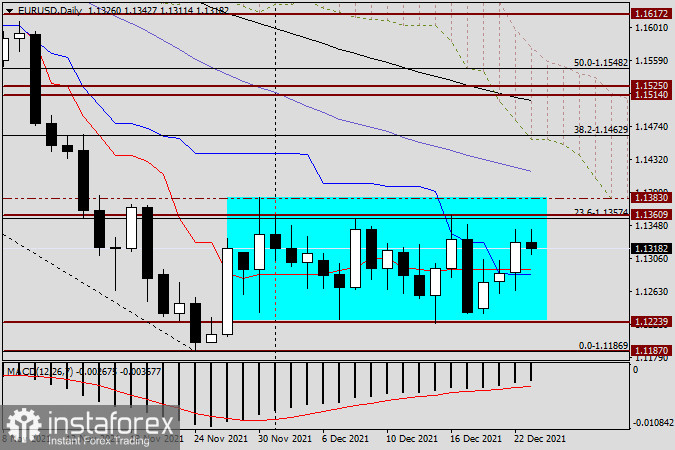

Daily

As expected, the EUR/USD pair rose during yesterday's trading and ended Wednesday's session at 1.1326, which is above the important technical level of 1.1300. Today, in case the rally continues, the pair could once again test sellers' key resistance at 1.1383. In case the pair closes above this level today, bullish sentiment could strengthen and the price will continue to rise. If it fails to do so, EUR/USD may fall to 1.1292, where the red Tenkan line is. The blue Kijun line of the Ichimoku indicator is just below. At the moment there are no major changes, and EUR/USD continues to trade in the range outlined earlier. This is clearly visible on the daily price chart.

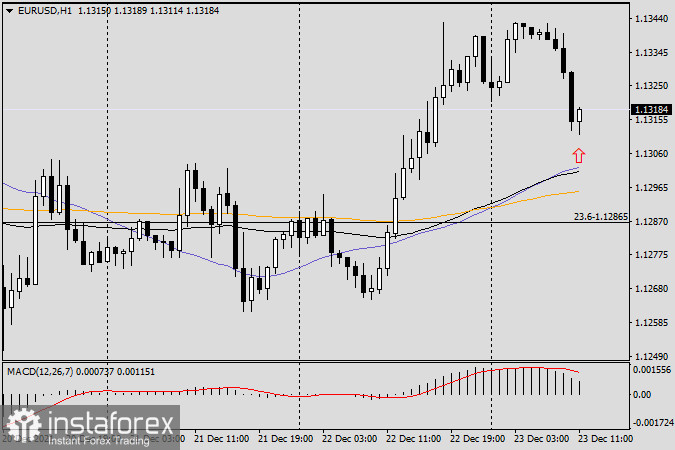

H1

As for the trading recommendations, there is a pullback on the hourly timeframe, which could well be considered as a correction. With all three moving averages around 1.1305-1.1295, a pullback in the highlighted area may be used to open a sell trade, especially if there are Japanese candlestick patterns to support that. Selling near 1.1355, 1.1365 and 1.1385 is also possible with the same signals. Let me remind you that since there is no clear directional trend for the EUR/USD pair, we have to consider and take into account both positioning options with small targets of 30-40 points.

Good luck in trading!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română