The USD/CAD pair has been showing increased volatility recently against the background of the general weakness of the market. On Monday, it updated its 13-month price high, reaching the level of 1.2963. However, the bears took the lead the next day, after which the Canadian dollar almost fell 150 points down. Such movements look atypical for the period of pre-Christmas bliss. Yet, there are reasons for everything.

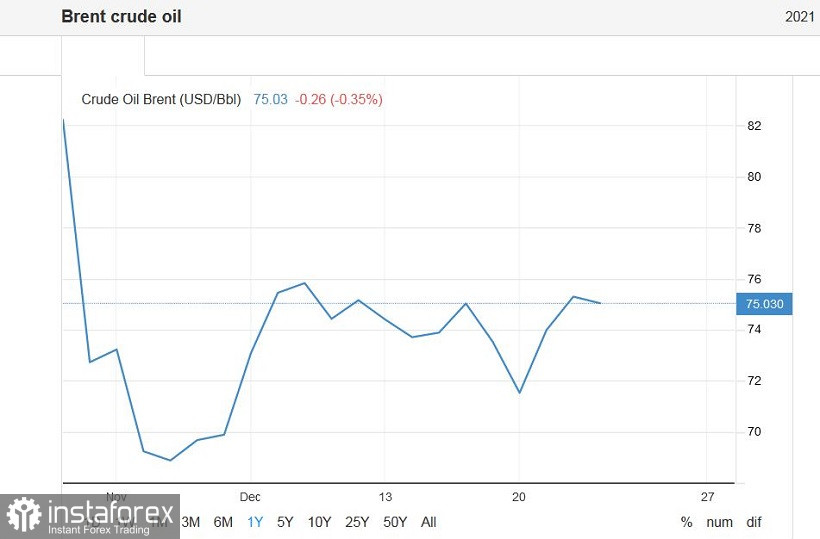

Oil is the primary driver for strengthening the Canadian currency. The value of the so-called "black gold" is growing again: if a barrel of Brent crude was trading at around $ 66 at the beginning of December, then today, its price has risen to $ 75. The Canadian dollar is taking advantage of the situation, especially amid the general risk appetite and the weakening of the US currency. However, it is too early to talk about a trend reversal. The USD/CAD bears have a certain "power reserve" (the closest support level is located at 1.2770), but the current price movement should still be treated exclusively as a correction.

Let's take a look at the weekly chart of USD/CAD: the pair have been in the upward trend since the end of October. For the last two months, the price has been gradually but consistently growing. During this period, the pair moved more than 600 points, despite the impressive downward pullbacks. The starting point of the growth was the speech of Fed Chairman Jerome Powell, during which he announced that the regulator would begin a gradual normalization of monetary policy. At that time, the Bank of Canada had already managed to curtail the stimulus program, thereby surpassing its southern neighbor. However, future prospects looked vague: on the one hand, the representatives of the Canadian regulator voiced hawkish rhetoric, but on the other hand, they avoided specifics.

The final point was the Bank of Canada's December meeting, following which the Central Bank took a wait-and-see attitude and voiced vague formulations regarding the prospects for monetary policy. The head of the regulator, Tiff Macklem, emphasized the existing risks while overshadowing the successes of the national economy. In particular, he said that large-scale flooding in British Columbia (Canada region) and a new strain of the coronavirus Omicron could put pressure on the country's economic recovery process, exacerbating supply chain disruptions and reducing demand for some services. In its accompanying statement, the Canadian regulator noted that the drawdown of the economy will be leveled "approximately in the second or third quarters of 2022."

In general, the tone of the Bank of Canada's rhetoric in December was less hawkish compared to October. The head of the regulator said last autumn that the Central Bank could raise the rate earlier than previously expected. Given the fact that the Bank has prematurely curtailed the stimulus program, traders then assumed that the Central Bank would decide on this step in the first half of next year, thereby outstripping the Fed. But following the results of the December meeting, traders revised their position. According to many experts, the Bank of Canada will decide on the first rate hike only in the second half of the year (and not in April, as previously assumed) 2022, following the US Fed. Such conclusions helped USD/CAD buyers to discover new price levels. On Monday, traders updated the annual high of 1.2963, while the main upward target is slightly higher – at 1.3050 (the lower limit of the Kumo cloud on the monthly chart).

However, the pre-holiday period made its own adjustments, not allowing USD/CAD bulls to consolidate their success. Oil's price is growing due to published data on a significant reduction in oil reserves in the United States. US reserves decreased by 4 million 720 thousand barrels last week when experts expected a more modest reduction (2.5 million barrels). It should also be noted that stocks of raw materials in the States have been declining for the fourth week in a row.

In addition, the oil market reacted to another event. It became known that production in Libya was suspended at four oil fields due to internal conflicts, including the country's largest Sharara field. According to preliminary estimates, the country is losing (and the market, accordingly, is not receiving) more than 300 thousand barrels per day.

This news background has supported the Canadian dollar, but this support will be temporary.

Technically, the pair on the daily chart is located between the middle and upper lines of the Bollinger Bands indicator, as well as above all the lines of the Ichimoku indicator. All this indicates the priority of upward movement. In view of the strengthening of the oil market, the Canadian dollar may rise to the support level of 1.2770 (the average line of the Bollinger Bands indicator coinciding with the Kijun-sen line on the D1 timeframe). The next support level is located much lower, namely at 1.2640 (the lower line of the Bollinger Bands). Therefore, if the downward impulse begins to fade around the 1.2770 mark, it is advisable to consider the option of opening long positions with the first target of 1.2950 (upper line of the Bollinger Bands on the same timeframe).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română