The invention of the anti-coronavirus drug Mir-19 was announced, while there is a Christmas rally in the stock markets, and the Western world is hysterical, fighting the Omicron strain. The indicated drug is a medicine and not a vaccine, which will treat patients in the early stages of the disease.

This is really strong news because the use of the drug in the early stages of the disease with subsequent recovery will lead to the final victory over COVID-19 and end the pandemic, which has been going on for almost two years.

How will this news affect the state of the global economy in general and financial markets in particular in 2022?

We believe that this is a very important event that will actually save not only the lives of individual people but also return entire countries to normal life. Naturally, against this background, one can expect an increase in business and production activity in the world. Investors' interest in the shares of companies will rise, which will receive broad support amid the economic recovery. Moreover, it will be possible to expect the start of a boom in economic activity with the stimulation of demand for commodity assets, which will lead to an increase in prices. The supply chains of goods to Western countries with post-industrial economies will gradually begin to recover, which is likely to lead to overstocking of the market and to a gradual decrease in inflationary pressure. This will happen as long as the world's largest emission centers exist in the United States and the eurozone, which will support the entire global financial system by printing currency.

It is possible that a noticeable change in the state of US inflation could even lead to a smoother process of raising interest rates, which will hold back the strengthening of the US dollar in the future. In fact, we can talk about some process of continuing the relaxed course of monetary policy to stimulate the recovery of the American economy. Most likely, the same will be carried out by other world central banks.

Why is it "unprofitable" for the Fed to actively raise interest rates?

This is due to the fact that rising rates contribute to a drop in investor interest in US government bonds, which actually reduces the financing of the US economy and the country as a whole. It is worth noting that America cannot exist without constant external support, since the US dollar remains its main commodity in the world. There are no buyers of Treasuries, there is no US dollar supported by this, which means that the money supply is growing and with it, inflation. There is one more important point. The sale of Treasuries leads to an increase in their profitability, which means an increase in the cost of servicing the debt on interest. The local financial system will not survive. It will not be able to service the national debt, which will lead to the financial collapse of the United States. And since the US dollar is still at the center of the global financial system, we should expect the beginning of a new, extensive and deep global crisis.

However, this probability of a negative scenario is still hypothetical, but who knows how events will go?

To sum it up, it can be noted that 2022 is likely to be a turning point. Coronavirus will be defeated, and the world economy will begin to actively recover – this will lead to an increase in global stock markets, and world central banks will try not to rush to tighten monetary policies. In this situation, the US dollar is unlikely to appreciably rise, since other world central banks will show their strength by gradually raising interest rates, which will raise the rates of their national currencies.

Crude oil and other commodity prices are also likely to remain at least at current levels. Meanwhile, the cryptocurrency world is about to suffer a serious blow. We expect increased pressure from state regulations, which will lead to an outflow of speculative capital from cryptocurrencies to stock markets. In general, the new year should be the year of restoration and normalization of the life of people and countries.

Day forecast:

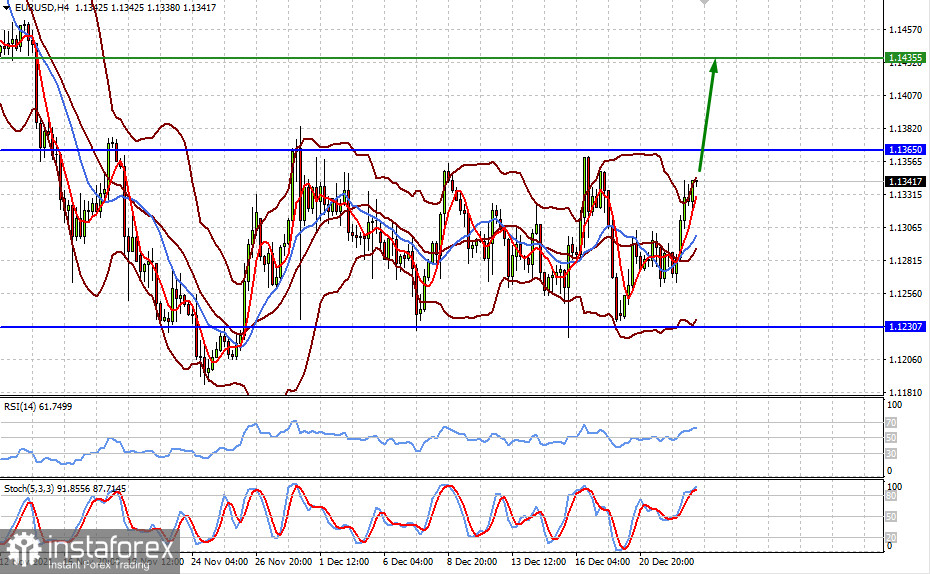

The EUR/USD pair is gaining support on a wave of demand for risky assets, which has led to a Christmas rally in stock markets. If such sentiments persist, the pair will rise to the level of 1.1365 and then to 1.1435.

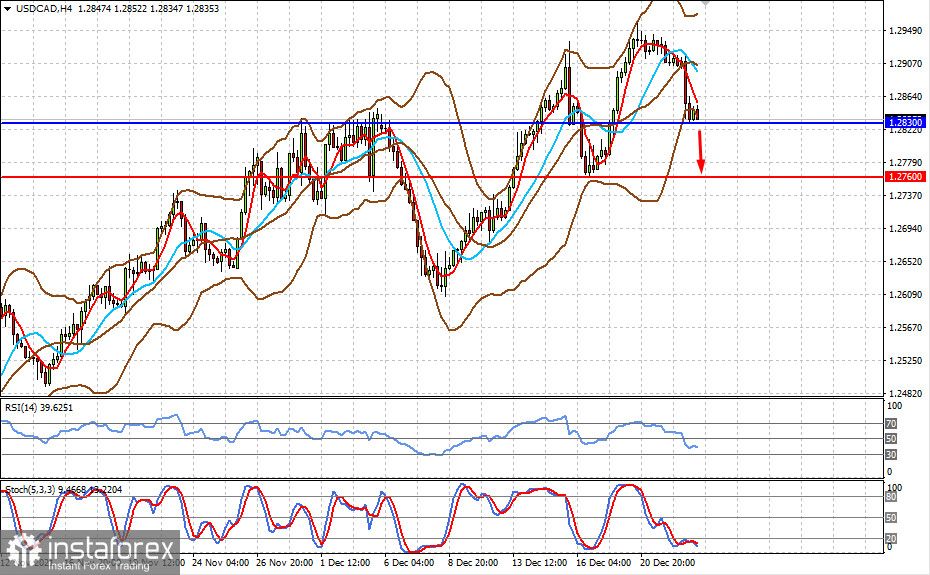

The USD/CAD pair lies at the level of 1.2830. Its breakdown amid the recovery in oil prices may lead to its decline to 1.2760.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română