To open long positions on GBP/USD, you need:

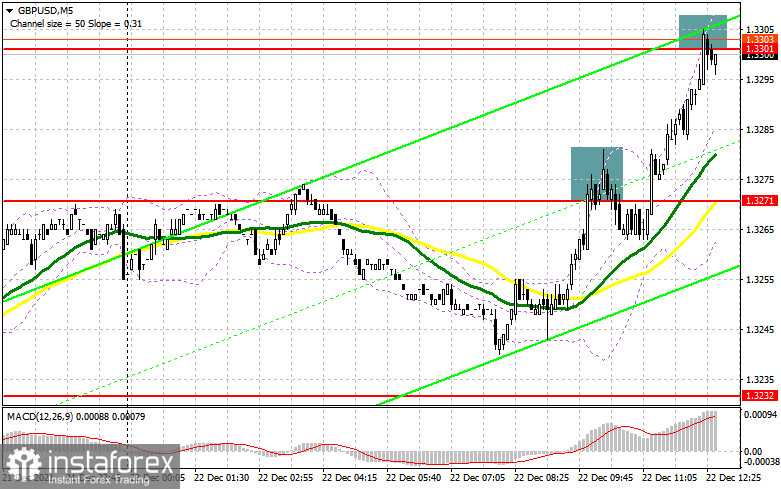

In my morning forecast, I paid attention to the level of 1.3271 and recommended making decisions on entering the market. Let's take a look at the 5-minute chart and figure out the entry point. An unsuccessful breakthrough and a return to the level of 1.3271, as well as weaker-than-expected data on the UK GDP growth rate in the 3rd quarter - it seemed that it could be better for an educated signal to sell the pound. But, as it happens, the market decided to move in its direction. As a result, it was necessary to fix losses. After the repeated breakout of 1.3271, the pair began to actively gain positions. I did not wait for the 1.3271 reverse tests, so I was forced to skip the entry point. And what were the entry points for the euro this morning?

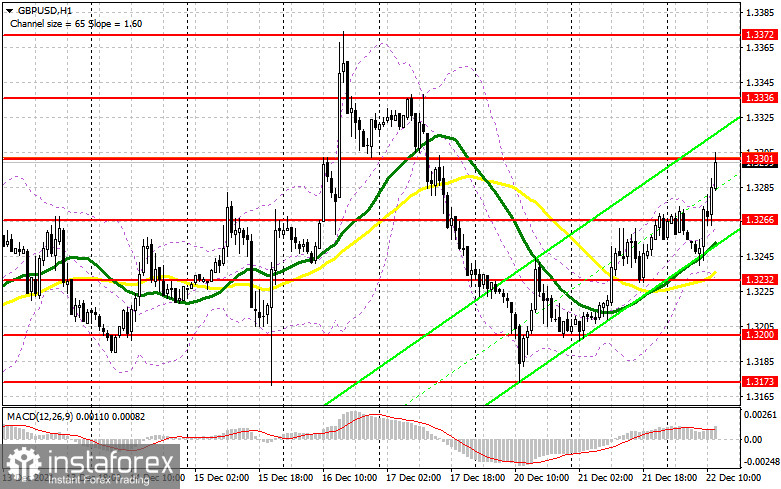

Now the whole focus is shifted to the 1.3301 level and the behavior of the pound there. The release of US GDP data is scheduled for the US session, which may please traders, which will lead to the strengthening of the US dollar against the pound. For this reason, only protection and a reverse test of the 1.3301 level will lead to the formation of a signal to open long positions in the continuation of the bull market with the prospect of a return to 1.3336. Weak data on US GDP will only increase the appetite for risks, so in the event of a breakthrough and a reverse test of 1.3336, you can continue to buy the pound to update the maximum of 1.3372, where I recommend fixing the profits. In the scenario of a decline in the pound during the American session and the absence of bull activity at 1.3301, it is better to postpone long positions until the next support update at 1.3266. It is also possible to open long positions in GBP/USD immediately for a rebound at a minimum of 1.3232, or even lower - from 1.3200, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

The bears once again failed to cope with the task assigned to them, and now it is necessary to return the resistance of 1.3301 under control. Only a decline below this level and a reverse test from the bottom up will lead to a signal to open short positions against the observed bull market, and strong data on the US consumer confidence indicator, which is expected to grow, can strengthen demand for the dollar, which will push the pair to the next low – 1.3266. A breakout and a reverse test of this level from the bottom up will give an additional entry point for the sale of the pound with a promising correction of the pair to 1.3232 and 1.3200, where I recommend fixing the profits. In the case of GBP/USD growth during the American session, bears need to defend the resistance of 1.3336. Only the formation of a false breakdown there will give an excellent signal to open short positions. In the case of weak fundamental statistics for the United States and the lack of sellers' activity there, I recommend postponing sales to a larger resistance of 1.3372, where you can sell GBP/USD immediately, counting on the pair's rebound down by 20-25 points within a day.

The COT reports (Commitment of Traders) for December 14 recorded a reduction in both short and long positions. Considering that long positions were reduced by almost half, this led to serious changes in the negative delta. However, it is worth noting that these data do not take into account the results of the meeting of the Federal Reserve System and the Bank of England. But if you look at the big picture in general, the prospects for the British pound look rather sad. After the Bank of England's decision to raise interest rates, the pair shot up, but the very next day it underwent a hard sell-off, which unsettled market participants hoping for the end of the bearish trend. The US dollar is likely to continue to be in demand amid uncertainty with the new strain of coronavirus Omicron, which is spreading at a fairly rapid pace, scaring market participants from active actions: no one wants to buy an overbought dollar, but the cheap pound is also not a very attractive tool yet. Until the situation with the next wave of coronavirus returns to normal, it will be quite problematic to talk about the growth of the pound. However, high inflation remains the main reason why the Bank of England will continue to raise interest rates next year, which will support the British pound. The COT report for December 14 indicated that long non-commercial positions fell from the level of 48,950 to the level of 29,497, while short non-commercial positions fell from the level of 87,227 to the level of 80,245. This led to an increase in the negative non-commercial net position from 38,277 to -50,748. The weekly closing price sank from 1.3262 to 1.3213.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates the further building of an upward trend.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline in the pair, the average border of the indicator around 1.3266 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română