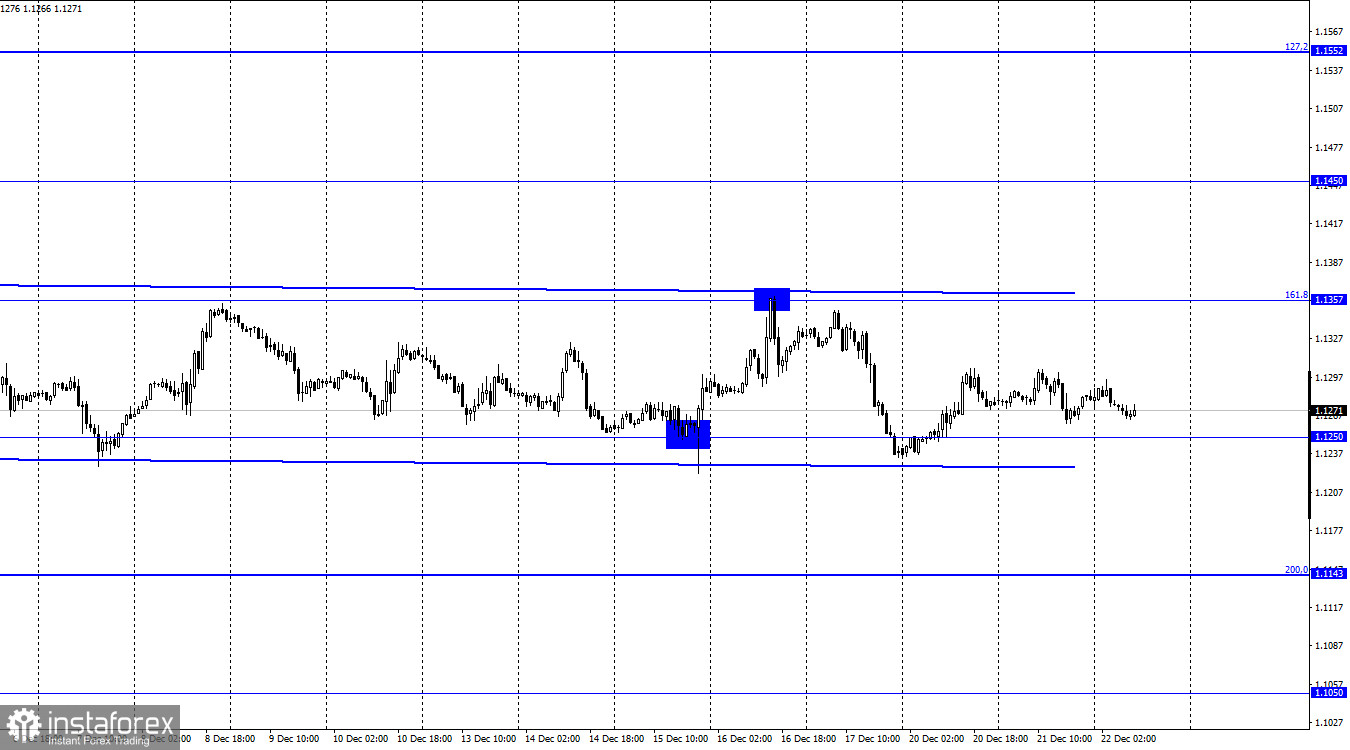

EUR/USD on 1H

On Tuesday, EUR/USD is still trading within the sideways channel which I mentioned in my previous reviews and which is clearly seen on the chart. So, the current price movement is weak, and is there is no clear trend. This is exactly what I expected at the end of the year. There is absolutely no information background at the moment. This week, only a few reports can move the market but the movement is likely to stay within 20-30 pips. So, the quote is very unlikely to exit the sideways channel and consolidate beyond its boundaries. At the end of each year, trading activity usually slows down, and this December is no exception. In the current situation, you should decide for yourself whether you want to trade the pair in this narrow range and look for signals inside it. I would pay attention to the signals formed near the boundaries of the channel although there can hardly be found now. The latest signal was generated on December 16, the next day after the Fed announced the results of its meeting. Since then, the pair has not approached the channel boundaries.

As I see it, there is no sense in analyzing fundamental factors or the price chart that is absolutely straightforward. Only the Omicron news can somehow affect traders' sentiment. Every day, the increasing number of new reports confirms that the situation around coronavirus is getting worse in different countries worldwide. Yet, they do not cause great concern among traders since Omicron does is considered less severe but more contagious than other strains. However, its rapid spread may still impact the economy of any country. The situation around the pandemic is almost similar in both the EU and the US. Analysts expect the economy to slow in the fourth quarter of 2021 and the first quarter of 2022. It is difficult to predict the reaction of the central banks at the beginning of next year. Currently, neither the euro nor the US dollar experience pressure from Omicron.

EUR/USD on 4H

On the 4-hour chart, the pair performed a new downside reversal as USD advanced and started a new round of decline towards the correctional level of 161.8% - 1.1148. But overall, the pair is still stuck between the levels of 1.1148 and 1.1404 which is a sideways channel that can be found on the 4-hour chart. Thus, the picture is very similar on both charts. None of the indicators display any upcoming divergences.

Economic calendar in US and EU:

US – GDP data for Q3 (13-30 UTC).

US – Consumer Confidence Index (15-00 UTC).

On December 22, no economic reports are expected in the European Union. Meanwhile, important data on GDP growth for the third quarter will be published in the US together with a less significant report on consumer confidence. Therefore, the news background is not strong on Wednesday.

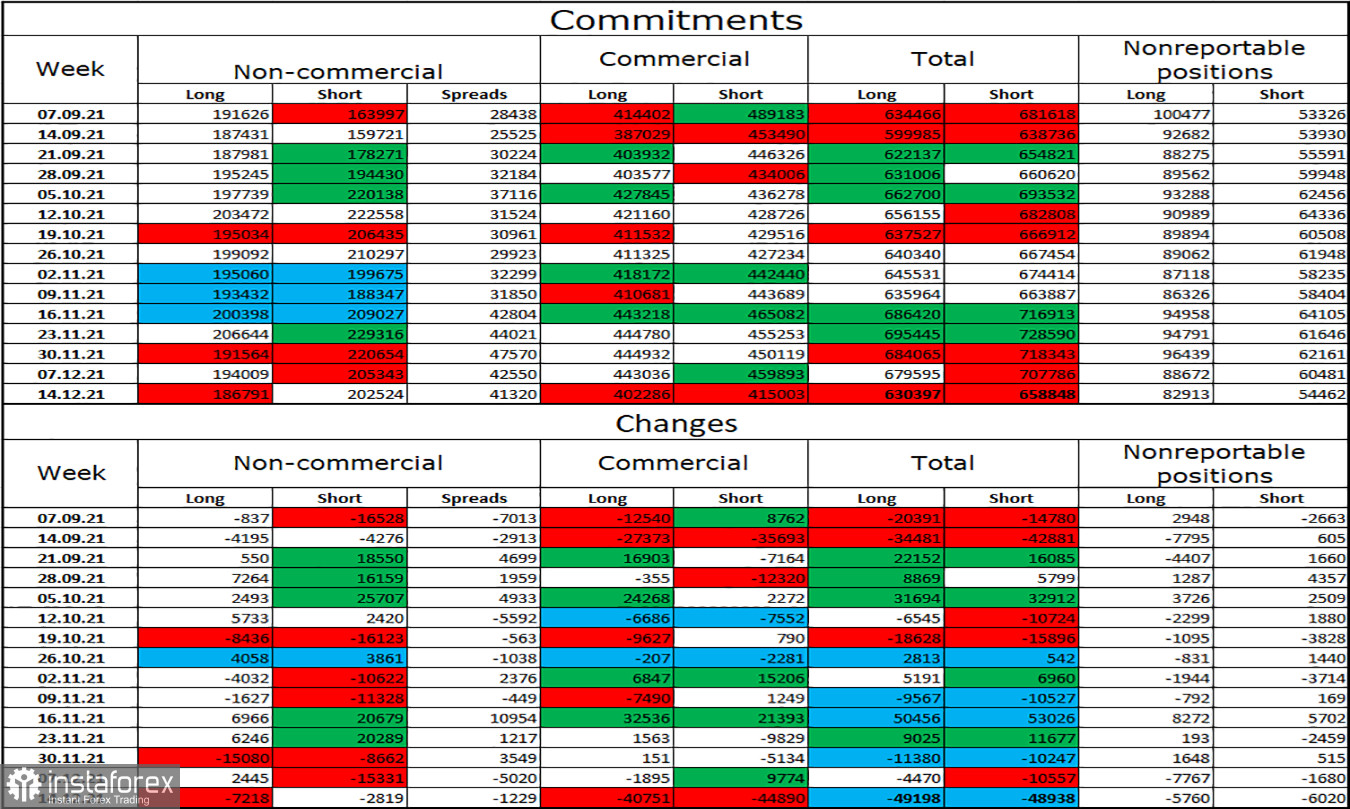

COT (Commitments of Traders) report

The latest COT report showed that the Non-commercial group of traders became more bearish on the pair during the reporting week. Traders were getting rid of both long and short positions. In total, 7218 long contracts and 2819 short contracts were closed on the euro. Thus, the total number of long positions decreased to 186,000 while the number of short contracts dropped to 202,000. The major category of traders remains moderately bearish. At the same time, traders of the commercial group closed 40-45,000 contracts of both types. In total, about 100,000 contracts on the euro currency were closed during the reporting week.

EUR/USD outlook and trading tips

Short positions on the pair should have been closed around the level of 1.1250. You can consider new sell positions when the price settles below the level of 1.1227 with the target at 1.1143. I recommend buying the euro on a rebound from the level of 1.1250 with the target at 1.1357. At the moment, long positions should stay open.

Definitions

Non-commercial traders are large market players, including banks, hedge funds, investment funds, private, and large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, and companies that buy currency to ensure current activities or export-import operations rather than to obtain quick profit.

The non-reportable category of traders refers to small speculators who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română