- A decline to the level of $ 40,000 is not very fast, but Bitcoin continues to steadily lose positions

Bitcoin increased by $ 2,000 on Tuesday. But in general, its quotes have continued to decline moderately for the last few weeks. It was already mentioned earlier that further decline in the rate of the first cryptocurrency seems to be the most logical development of events now. There are too many factors that indicate Bitcoin's fall – there is too much negative news for the cryptocurrency segment. And although some analysts and investors believe that it's just a matter of time before it reaches the $ 100,000 mark, it should be noted that Bitcoin can not only grow, but also decline. After all, its past upward trends ended with a decline of 85-90%. Why not repeat the same scenario this time? But of course, we are not talking about a decline below $ 40,000. In the perspective of the next few months, hardly anyone believes that Bitcoin is capable of declining below the level of $ 30,000. A new strain of Omicron, which is taking over the whole world, may lead central banks to extend the effect of stimulus programs and postpone indefinitely raising interest rates. This will support the first cryptocurrency and others too. Therefore, it's definitely too early to abandon Bitcoin. First, it is necessary to understand what the consequences of the new wave of the epidemic will be.

- Jack Dorsey, the former CEO of Twitter, believes Bitcoin could replace the US dollar

Despite the fact that Bitcoin's future currently does not look too optimistic, former Twitter CEO Jack Dorsey expressed his opinion that Bitcoin is quite capable of replacing the US dollar. He talked about this on his own Twitter account. In addition, Michael Saylor, CEO of Microstrategy, a company that has become famous around the world for its huge investments in Bitcoin, stated earlier this month that this cryptocurrency remains the main weapon against inflation, as well as a global reserve asset. Saylor also does not believe that Bitcoin infringes on the fame of the US dollar, which he believes is the world's currency. "The world needs inflation hedging. If you have Bitcoin, then don't sell it," the president of the company said, which owns 121,000 BTC coins.

It can be seen that many celebrities continue to stick to their opinion that Bitcoin will only gain popularity and, accordingly, grow in price. However, an asset for hedging inflation will not be needed when inflation is down to acceptable levels. And when it drops to these values now, it may depend on the Omicron strain and its spread throughout the world.

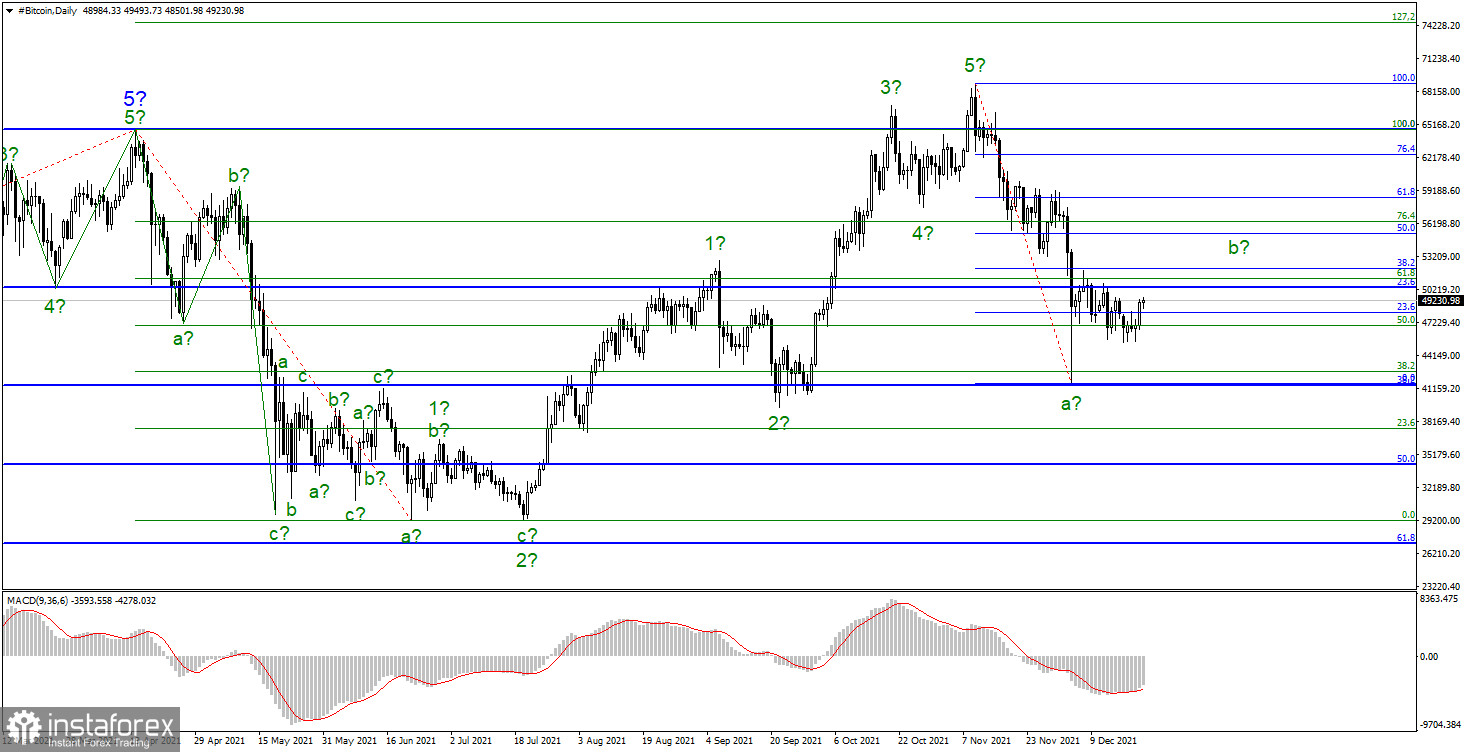

The upward section of the trend by its internal structure does not cause any doubts and seems complete. If this is really the case, then the formation of a descending set of waves has begun and continues at this time. So far, it cannot be concluded that even the first wave of a new downward trend has ended, since the decline continues almost every day. Thus, wave a can take on an even stronger and more extended form. It can be recalled that Bitcoin is very dependent on the news background and mood of the market. If the market decides to continue selling it, then nothing prevents the first wave from acquiring a more lengthy form. Since the attempt to break through the 23.6% Fibonacci level was unsuccessful, the decline may continue with targets located around $ 42,731 and $ 41,394, which corresponds to 38.2% and 38.2% Fibonacci. There is also an option with an increase within wave b to $ 55,295, from which a decline is expected.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română