Breaking news from the world of cryptocurrencies:

Valkyrie Investments has launched a managed exchange-traded fund (ETF) based on stocks of companies that directly or indirectly invest, transact, or hold Bitcoin as a reserve asset. The Valkyrie Balance Sheet Opportunities ETF has received the VBB ticker on the Nasdaq. VBB does not offer direct investment in Bitcoin. At the end of December 16, the volume of assets under the management of the fund amounted to $635,549.

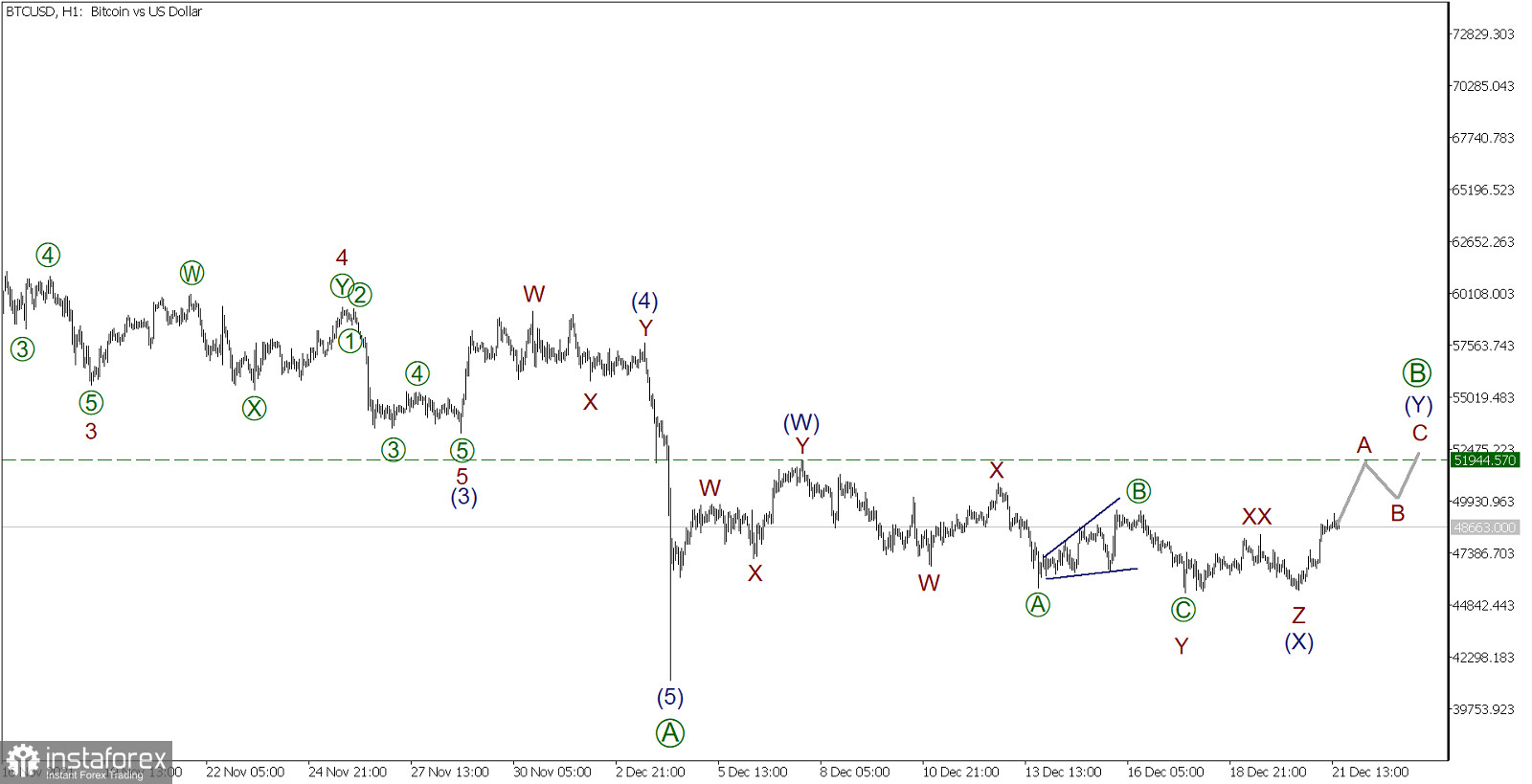

BTCUSD, H1:

For the BTCUSD cryptocurrency, we see the formation of a downward simple zigzag [A]-[B]-[C]. After the completion of the downward movement within the impulse wave [A], the market reversed and began to build a corrective wave [B].

Most likely, the corrective wave [B] has a horizontal structure and takes the form of a double three (W)-(X)-(Y). As part of the horizontal pattern, two parts look fully completed – the subwaves (W) and (X), double and triple zigzag.

Currently, we see an increase in the rate within the initial part of the final active wave (Y), which may take the form of a simple zigzag A-B-C, as shown in the chart. The first impulse wave A is likely to end near the level of 51,944.57, marked by wave (W).

In the current situation, it is possible to consider opening buy deals in order to take profit at a specified level.

Trading recommendations: buy from the current level, take profit 51,944.57.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română