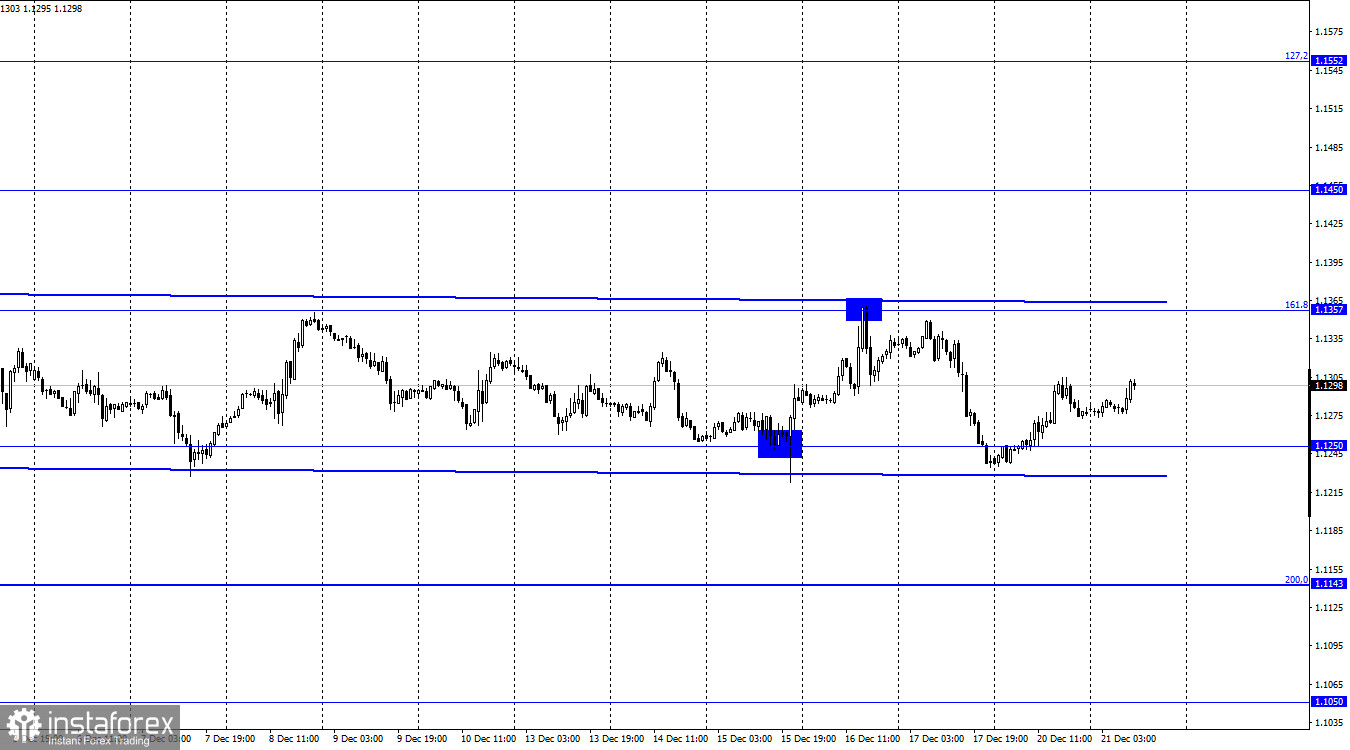

EUR/USD – 1H.

EUR/USD continued to trade within a certain range on Monday. Therefore, I decided to run a sideways corridor, which is the best reflection of what is going on in the market right now. The pair has been between 1.1227 and 1.1363 for three weeks now. So, although this corridor is not too narrow, it is still a sideways corridor. Therefore, I believe that the mood of the traders is neutral. According to COT reports, the number of Shorts has been increasing in recent months and the number of Longs has been decreasing. However, this is a trend, not a sentiment. The traders' mood is rather neutral now, because the number of Short and Long contracts is almost the same, and the pair is moving in a sideways corridor, as you can see. Therefore, despite its positioning near the yearly lows, it is too early to expect the European currency to continue falling. Notably, the Fed and ECB meetings have not had much impact on the chart picture. This week and next week there will be almost no information background, so it is hard to imagine what could pull the pair out of the sideways corridor.

EUR/USD continued to trade within a certain range on Monday. Therefore, I decided to run a sideways corridor, which is the best reflection of what is going on in the market right now. The pair has been between 1.1227 and 1.1363 for three weeks now. So, although this corridor is not too narrow, it is still a sideways corridor. Therefore, I believe that the mood of the traders is neutral. According to COT reports, the number of Shorts has been increasing in recent months and the number of Longs has been decreasing. However, this is a trend, not a sentiment. The traders' mood is rather neutral now, because the number of Short and Long contracts is almost the same, and the pair is moving in a sideways corridor, as you can see. Therefore, despite its positioning near the yearly lows, it is too early to expect the European currency to continue falling. Notably, the Fed and ECB meetings have not had much impact on the chart picture. This week and next week there will be almost no information background, so it is hard to imagine what could pull the pair out of the sideways corridor.

One of the most important issues right now is the Omicron strain and its rapid spread. However, despite the growing number of cases, doctors and scientists point out that the strain itself is far less dangerous to humans than delta strain. It causes complications less often and leads to the death of the patient rarely. Some even believe that humanity as a whole would be better off with the omicron strain and acquire collective immunity. However, for the Euro currency and the US dollar, as we can see, the new wave of disease does not play much of a role either. Even the fact that several European countries have already imposed a strict quarantine and several more are contemplating a lockdown, the euro currency does not continue to fall against the dollar. In the US there is no intention of imposing a quarantine. Therefore, I conclude that a lockdown in the EU is not sufficient for a further fall of the euro. At the same time, the economic situation could worsen due to a new epidemic wave, which could lead to a new fall in the Euro. However, there is now a sideways corridor and a close below it would indicate a renewed fall in the pair.

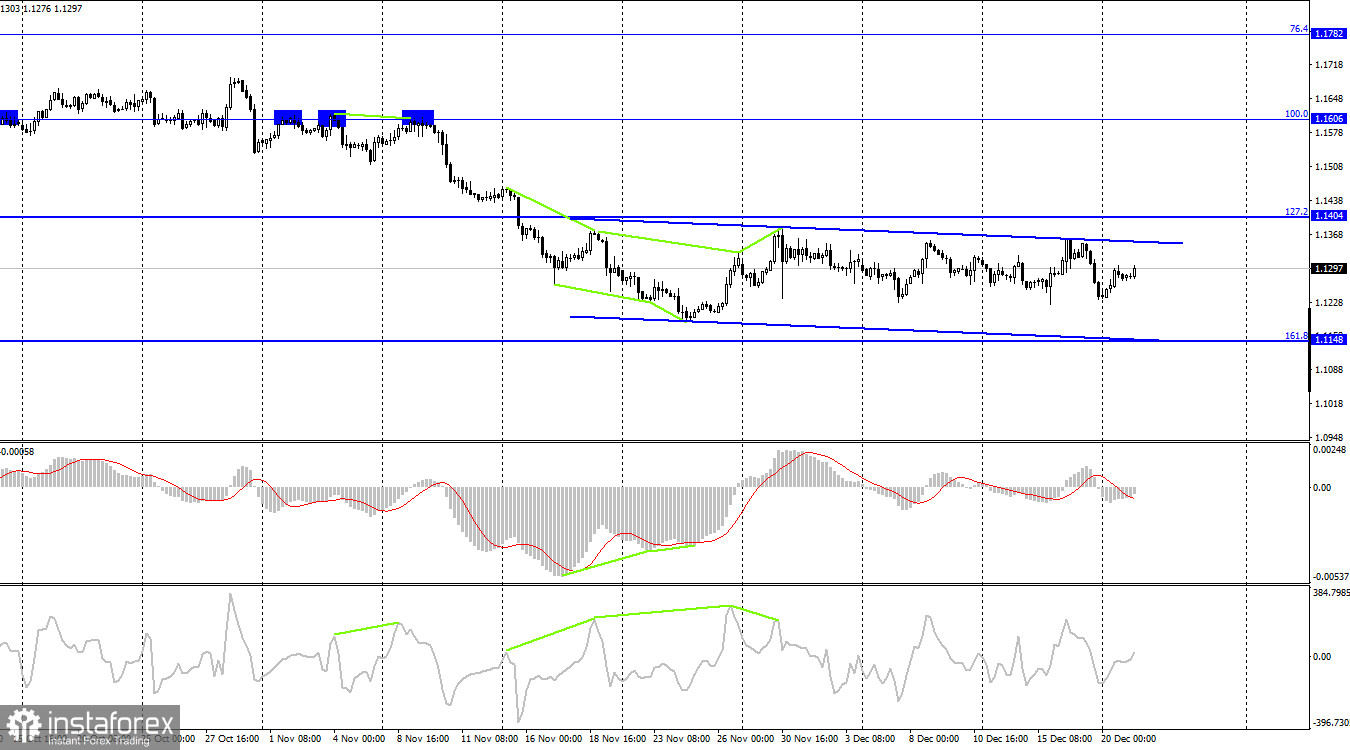

EUR/USD – 4H

According to the 4H chart, EUR/USD reversed downwards, moving towards the retracement level of 161.8% (1.1148). The pair is currently trading in the 1.1148-1.1404 range, without testing either level. To be exact, it remains inside an almost sideways corridor, which is now also present on this chart. Thus, the situations on both charts are very similar. There are no emerging divergences at this point.

According to the 4H chart, EUR/USD reversed downwards, moving towards the retracement level of 161.8% (1.1148). The pair is currently trading in the 1.1148-1.1404 range, without testing either level. To be exact, it remains inside an almost sideways corridor, which is now also present on this chart. Thus, the situations on both charts are very similar. There are no emerging divergences at this point.

News calendar for US and EU:

On December 21, there will be no important economic events in the EU and the US. The information backdrop will have no impact on traders' mood today.

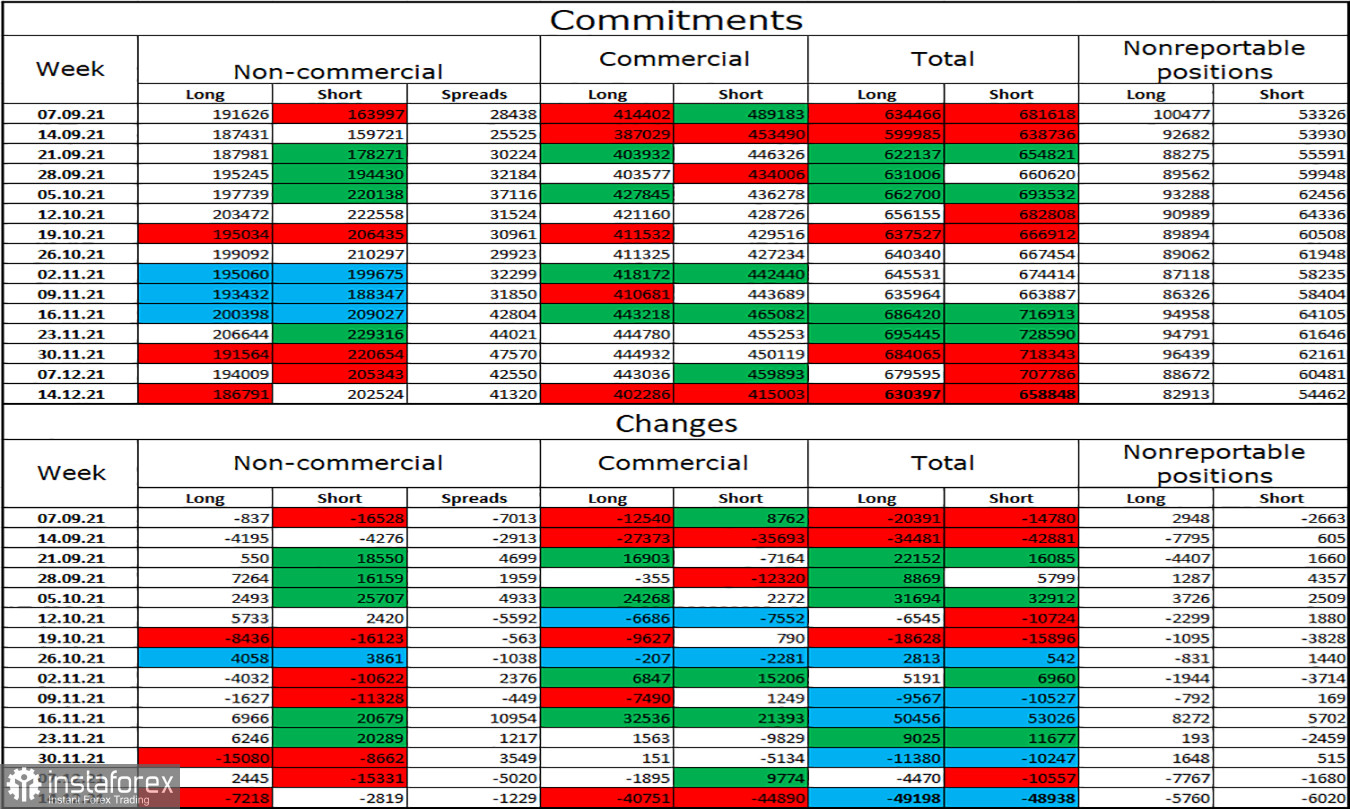

COT (Commitments of Traders) report:

A new COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became more bearish. Speculators got rid of both longs and shorts. In total, 7218 long contracts on the euro currency and 2819 short contracts were closed. Thus, the total number of long contracts in the hands of speculators decreased to 186 thousand, and the total number of short contracts - to 202 thousand. The "bearish" mood among the most important category of traders remains. The most interesting changes were observed among traders of the "Commercial" category, who closed 40-45 thousand contracts of both types. In total, during the reporting week, about 100 thousand contracts on the euro currency were closed.

EUR/USD outlook and tips for traders:

The pair's sales should have been closed around the level of 1.1250. New sales will be possible after closing at 1.1230 with a target of 1.1143. I recommend buying the euro currency when rebounding from the level of 1.1250 with a target of 1.1357. They should now be kept open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română