On Monday, the gold market failed to find any upside traction, with some economists set to revise their 2022 outlook downwards.

Goldman Sachs cut their US GDP growth projections for the first quarter of 2022 to 2% from 3%, chief economist Jan Hatzius wrote.

Analysts noted that the US economy could face pressure next year, as the Fed winds down support from its monetary and fiscal policies.

Last week, the Federal Reserve announced it would accelerate QE tapering, fully winding down monthly asset purchases by March 2022. The Fed also hinted at 3 interest rate increases next year.

Amid political perturbations in the US, the world's economy faces growing uncertainty as European countries enact new restrictions to limit the spread of COVID-19.

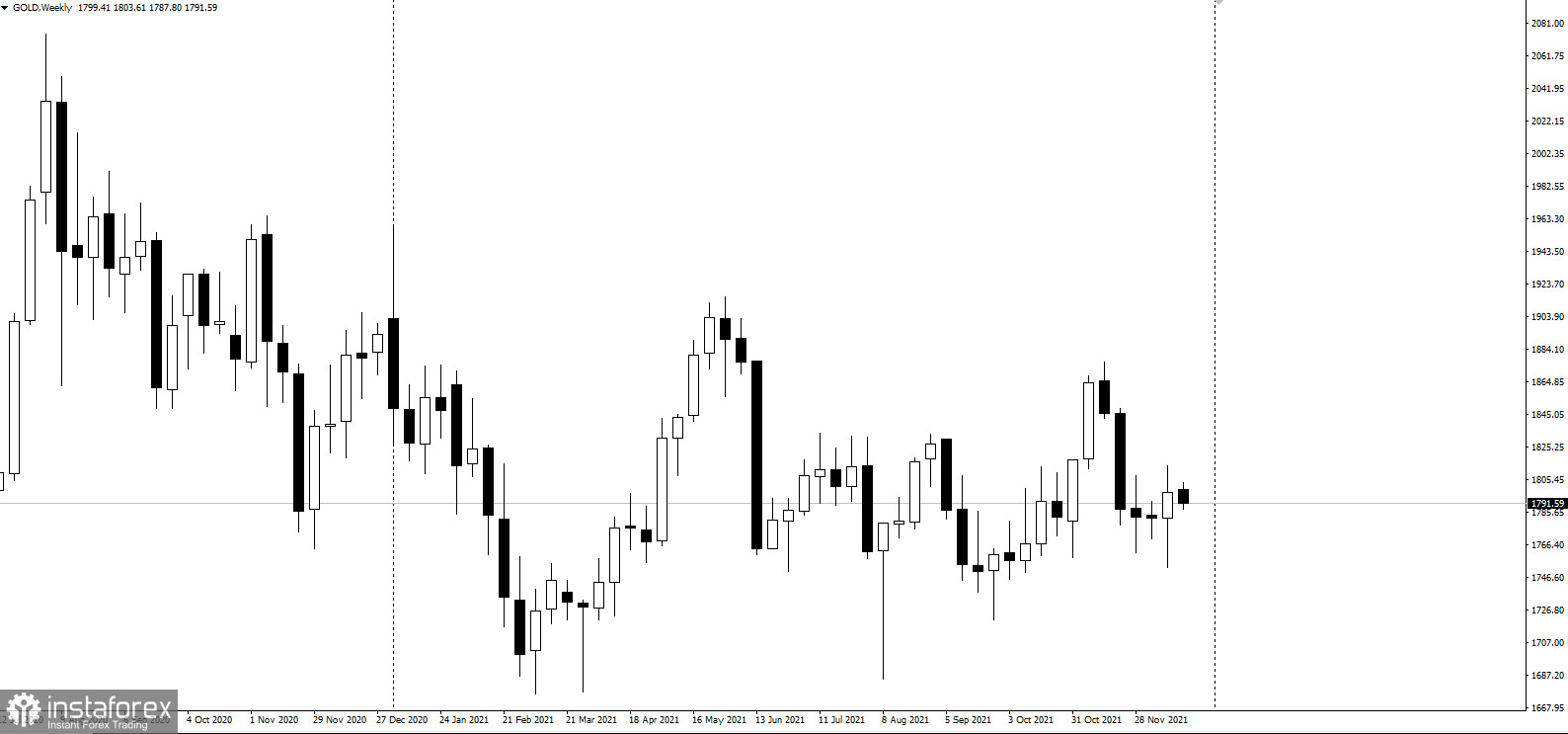

Investor sentiment soured in the run-up to the winter holidays, with gold struggling to attract any follow-through buying after surpassing $1800 per ounce on Friday. Many market analysts saw the upward move as short-term short covering.

However, gold could continue to fight on, as it remains the most reliable hedge against inflation, Swissquote's senior analyst Ipek Ozkardeskaya commented.

Rising interest rates would raise opportunity costs for gold investors, but uncertainty caused by Omicron could lead to a more dovish regulator policy, giving support to gold.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română