Analysis of trades and tips on trading the euro

The first test of 1.1265 occurred at a time when the MACD indicator was far enough from the zero mark. It limited the upward movement of the pair. Besides, there was a strong bearish bias the day before. For this reason, I decided not to open ling positions on the euro. In the afternoon, there was another test of 1.1265. At that moment, the MACD indicator was just starting to move up from the zero mark, which was a confirmation of the correct entry point into the market. As a result, the pair rose by about 30 pips. No other signals were formed.

The euro managed to spread wings amid positive data on the euro area's current account balance and the monthly report of the Bundesbank. It recouped some of Friday's losses. The euro/dollar pair is hovering in the sideways channel again. It is likely to trade in this channel throughout this week. Before making decisions, it is better to stick to the second scenario and trade in opposite directions. The US dollar also advanced following better-than-expected data on the index of leading indicators. An economic index that measures US business cycles rose in November, suggesting the economy continued to grow this year. The Leading Economic Index increased by 1.1% to 119.9 in November compared to the previous month.

Today, in the morning, the economic calendar contains a batch of economic reports. The euro may add gains provided that figures exceed economists' forecasts which are not optimistic. It is necessary to pay attention to the Gfk German Consumer Climate Index for January 2022, as well as to the Consumer Economic Sentiment Indicator in the eurozone for December. Analysts expect a drop in all readings. In the afternoon, the US will release a report on the current account of the balance of payments. However, this data is unlikely to affect the greenback as this report has no impact on Forex. Market participants are now worried about the spread of the Omicron strain. According to the latest data, about 70% of new cases of coronavirus in the US are accounted for by a new strain. It may adversely affect the economy.

Entry points to open long positions

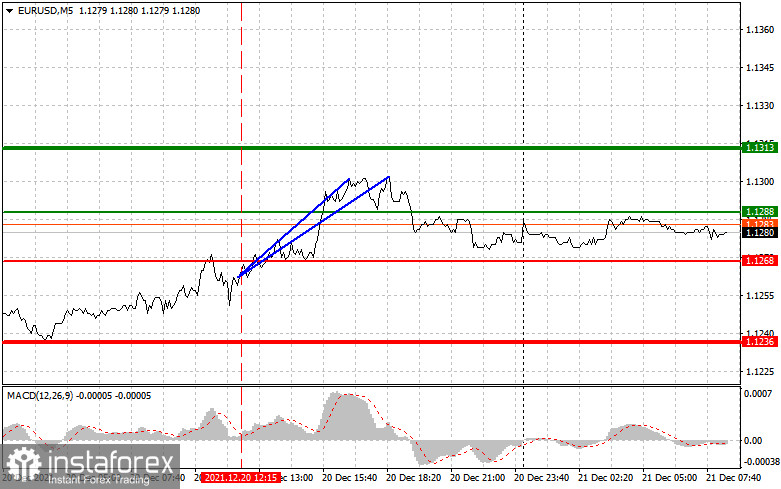

Scenario №1: today, it is recommended to open long positions on the euro when the price reaches 1.1288 (the green line on the chart) with the target level of 1.1313. When the price approaches 1.13, I recommend locking in profits and opening short positions on the euro immediately in the opposite direction, counting on a downward movement of 10-15 pips. The euro is likely to grow amid strong data in the eurozone. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just begun to rise from it.

Scenario №2: it is also possible to buy the euro today if the price reaches 1.1268. At this moment, the MACD indicator should be in the oversold area. It will limit the downward movement of the pair. It may also trigger an upward reversal. The price may rise to the levels of 1.1288 and 1.1313.

Entry points to open short positions

Scenario №1: it is recommended to open short positions on the euro after it approaches 1.1268 (the red line on the chart). The target level will be 1.1236. I recommend locking in profits at this level. Open long positions immediately in the opposite direction, counting on an upward movement of 10-15 pips in the opposite direction. Weak data on the eurozone economy will put pressure on the euro. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just begun to decline from it.

Scenario №2: it is also possible to sell the euro today if the price reaches 1.1288. At this moment, the MACD indicator should be in the overbought area. It will limit the upward movement of the pair. It may also trigger a downward reversal. The pair may drop to 1.1268 and 1.1236.

Description of the chart:

The thin green line shows the entry point to open long positions.

The thick green line is the estimated price where you can place a Take profit order or lock in profits by yourself as the price is unlikely to rise above this level.

The thin red line shows the entry point to open short positions.

The thick red line is the estimated price where you can place a Take profit order or lock in profits by yourself as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions on entering the market. Before the release of important fundamental reports, it is best to stay away from the market. The market is quite volatile and you may incur losses. If you decide to trade during the news release, then always place stop-loss orders to minimize losses. Without placing stop-loss orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous decisions based on the current market situation is initially a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română