For the third week in a row, bitcoin has been consolidating within a wide range. At the same time, the asset cannot show a confident recovery amid a big number of sell positions and fears among traders. In addition, it is quite possible that the crypto asset has not hit its local low. In the worst-case scenario, this means that the asset may slump to $42K.

Reasons for BTC fluctuation

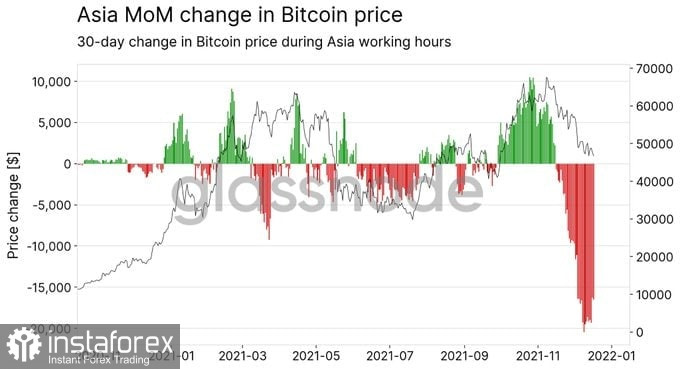

First of all, investors in bitcoin do not have a single opinion about the asset's future. Thus, in Europe and North America, traders are sure that bitcoin will reach new highs, whereas Asian market players foresee a bearish trend. According to Glassnode, Asian markets are exerting downward pressure on bitcoin, thus preventing it from gaining in value. Asian traders are selling off the asset, thus creating the largest sell-off in 2021. Such an approach of Asian investors is supporting the local downtrend.

BTC may retest local low at $42K

In addition, the pressure from the Asian region may push the price towards the low of $41K. This is proved by the price drop from the resistance level, which points to strong bearish sentiment. Meanwhile, the number of bitcoin coins in the market goes on climbing, thus increasing pressure on the asset. That is why the price may slide to $45K. Technical indicators on the daily chart are also showing a downward dynamic. Thus, the MACD indicator is moving sideways below the zero line, whereas the stochastic indicator and the RSI indicator may decline below the bullish zone.

Local low not formed yet

However, the main reason for concerns is the absence of fundamental factors that may prove that the level of $42.7K is acting as a local low. According to bitcoin analyst, Peter Brandt, the formation of a local low was accompanied by a slump in trade volume. The current decline does not meet this rule. That is why BTC may tumble below $40K. At the same time, the accumulation process has already begun. Thus, it is highly possible that the local low will be formed. In this case, the asset may break the low and slide to $36K-$40K.

Current situation

At the moment, the coin is still trading sideways. Judging by the recent decline from the upper limit, the price may move towards the lower limit where there is an important support level at $45.7K. If the price breaks the mentioned level, it may enter the channel of $42K-$45K. After that, it may either decrease or rebound above $46K. According to the second scenario, the price is likely to remain in the current range and then, leave it with a decrease to $36K-$40K.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română