The Bank of England, by eight votes to one, decided to raise the repo rate from 0.1% to 0.25% at its last meeting in 2021, which pretty much surprised financial markets. Before the December meeting of the MPC, the chances of an increase in borrowing costs fell to one to three, although in early November the derivatives market was confident of such an outcome. Bank of England Governor Andrew Bailey and his colleagues surprised, and twice in their last two meetings. The pound took off, but the music did not play too long for "bulls" on GBPUSD.

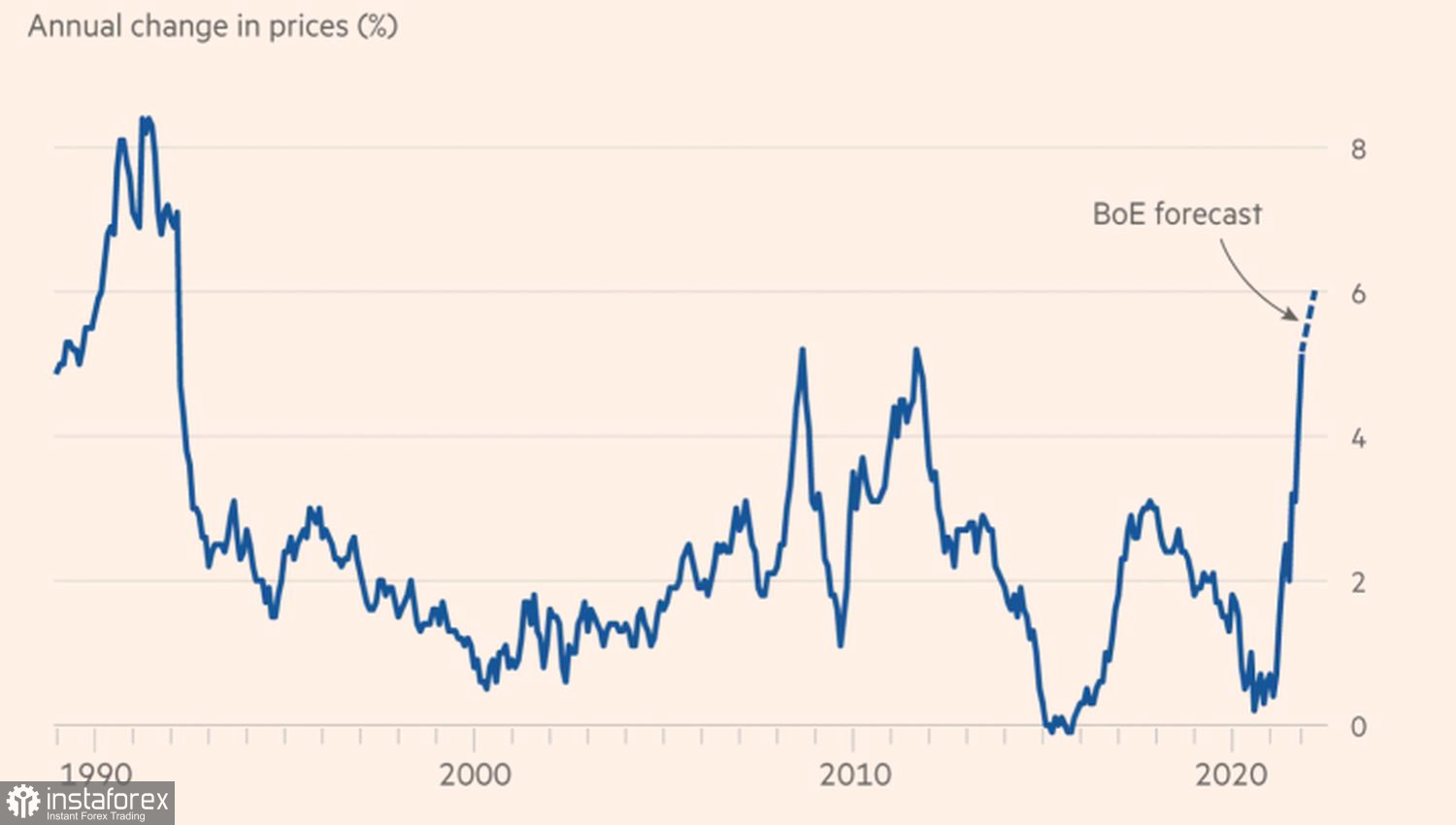

If there was no Omicron at the beginning of November, and inflation was growing by leaps and bounds, then at the middle of December, the new COVID-19 strain brings a fair amount of uncertainty not only to financial markets but also to the activities of central banks. BoE believes that the risks of consumer price acceleration to 6% outweigh the danger of a significant slowdown in the British economy due to the pandemic. It made the decision to act and deserves praise for it.

Dynamics of actual and projected inflation in Britain

By itself, raising the repo rate by 15 bps to 0.25% is unlikely to slow down GDP or curb inflation. The main thing is that the Bank of England will show its intention to continue the cycle of monetary restriction, which in theory should put pressure on inflationary expectations growing by leaps and bounds. The derivatives market is forecasting a further 50 bps increase in borrowing costs in February, followed by a base rate hike to 1% by the end of 2022. Essentially, investors expect BoE to follow the same trajectory as the Fed. Even slightly faster, as CME derivatives signal the first federal funds rate hike only by June. Why, then, the "bulls" on GBPUSD could not hold on to the levels they won above 1.33 for some time?

The British government, led by Boris Johnson, is taking the new COVID-19 strain more seriously than the White House, led by Joe Biden. It introduces restrictions that will certainly affect the economic growth of the UK. The first sign of a slowdown in GDP was the statistics on business activity. The composite purchasing managers index in December fell from 57.6 to 53.2, falling short of the forecast of 56.4. Issues on Northern Ireland under Brexit have not yet been resolved, and poor communications from the Bank of England raise doubts that the February repo hike is a settled issue.

The U.S. dollar draws strength from the hawkish comments of FOMC officials. Christopher Waller believes that only a serious negative from Omicron could force members of the Open Market Committee not to discuss the issue of raising the federal funds rate at the March meeting. If the monetary restriction occurs in the spring, and not in the summer, as the futures market expects, the U.S. currency has a good chance of winning new fans on Forex.

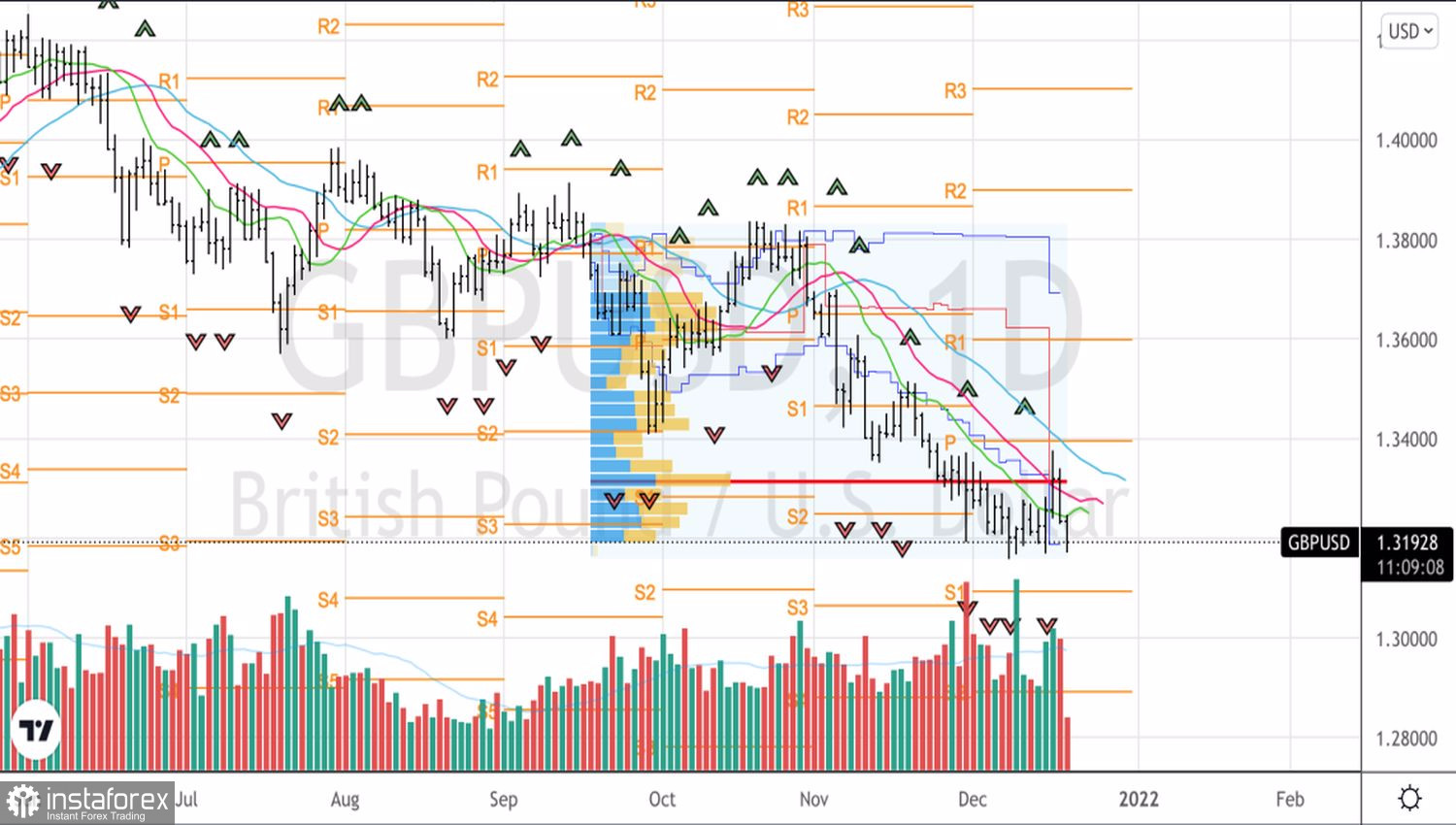

Technically, there is no reason to doubt the strength of the GBPUSD downward trend. A break of support at 1.317 or a rebound from dynamic resistance in the form of moving averages should be used to sell the pound against the U.S. dollar in the direction of 1.31 and 1.29.

GBPUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română