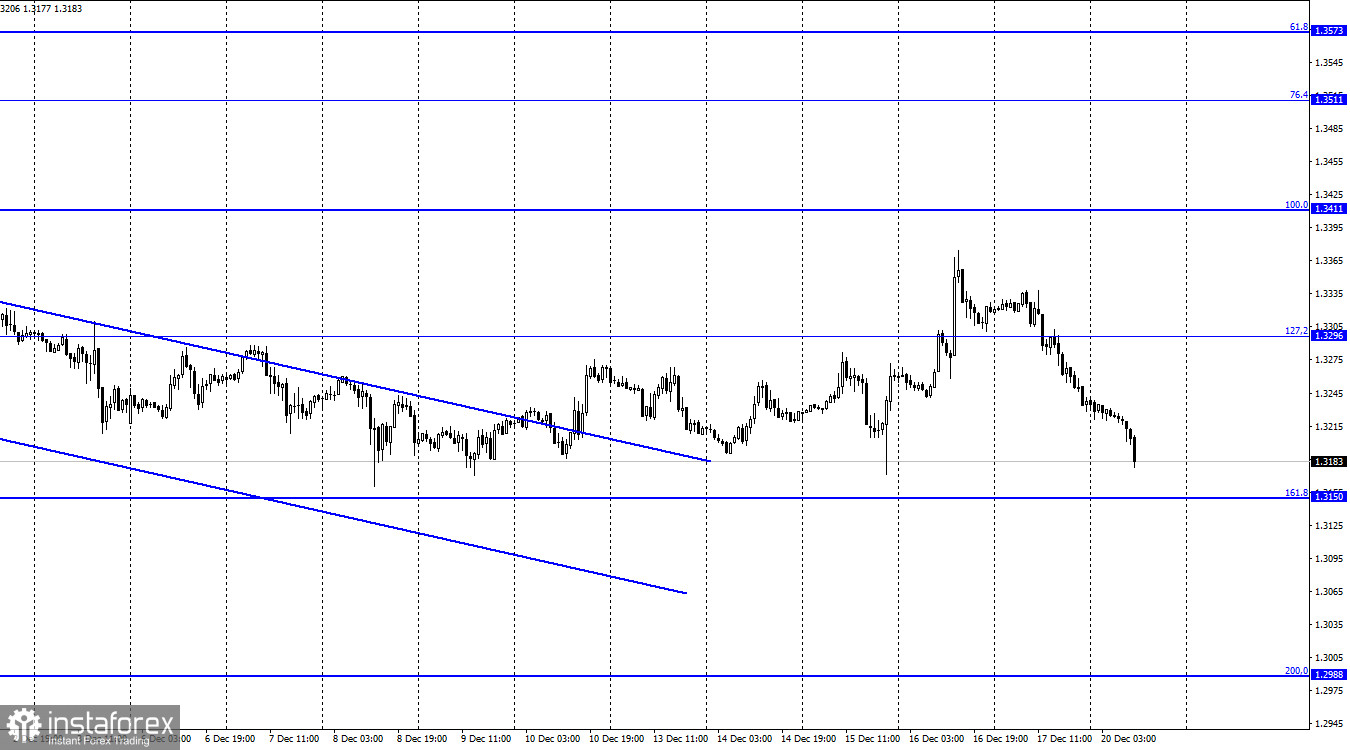

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the US currency on Friday and began the process of falling, which continues today in the direction of the corrective level of 161.8% (1.3150). The rebound of the pair's exchange rate from the Fibo level of 161.8% will allow us to count on a reversal in favor of the UK currency and some growth in the direction of the corrective level of 127.2% (1.3296). Fixing quotes below the level of 161.8% will increase the chances of a further fall in the direction of the next Fibo level of 200.0% (1.2988). The information background for the pound on Friday was quite weak. The only report of the day on retail trade turned out to be quite good, but traders frankly ignored it, since almost the whole day the pound did nothing but fall. Unfortunately, the "magic kick" from the Bank of England in the form of an interest rate increase was not enough for very long.

This means that there are now more significant factors that are pushing the pound down again. And one of these factors may be the omicron strain, which is now taking over the whole world. As doctors and epidemiologists have reported, this strain is not more deadly than the previous delta variant. However, it is much more contagious, which can cause a severe strain on the health care system in any country. It is this problem that the UK is currently experiencing. A state of emergency has already been declared in London, as omicron accounts for more than a third of all coronavirus cases and this strain is spreading very quickly. Nothing has been reported about the new restrictions yet, but it can be assumed that if the situation continues to develop in this direction, there will be restrictions. British doctors are already calling omicron the most dangerous of all. "We are facing the most serious threat since the beginning of the pandemic. I believe that the figures that we will see in the coming days will shock the imagination in comparison with the increase in the number of cases of infection with other strains," the United Kingdom Health Safety Agency said. Thus, we can expect a new slowdown in the economy.

GBP/USD – 4H.

On the 4-hour chart, the pair performed a reversal in favor of the US currency and anchored under the corrective level of 61.8% (1.3274). Thus, the process of falling quotes can now be continued in the direction of the next Fibo level of 76.4% (1.3044). Emerging divergences are not observed in any indicator today. All movement is more like movement inside a side corridor.

News calendar for the USA and the UK:

On Monday, the calendar of economic events in the UK and the US is empty. Thus, the influence of the information background on the mood of traders will be absent today.

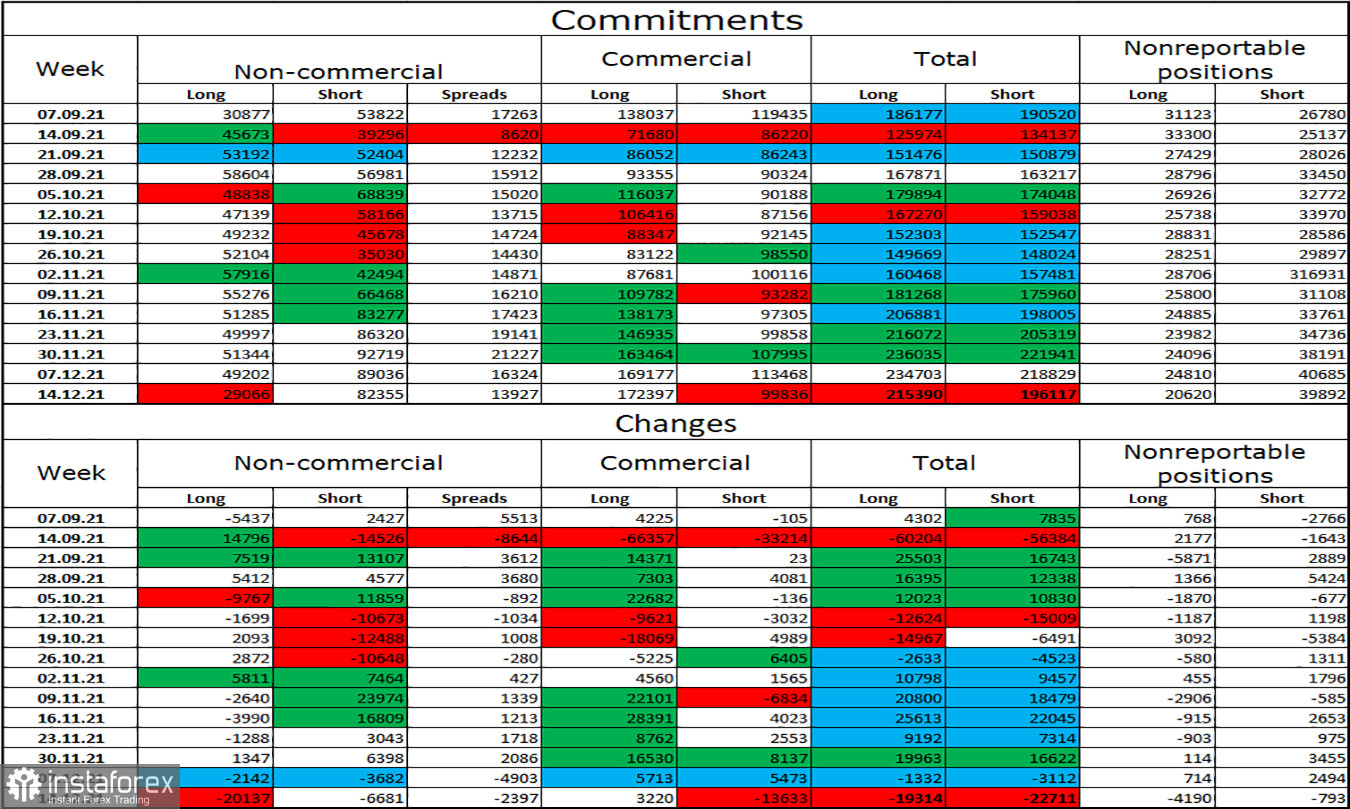

COT (Commitments of Traders) report:

The latest COT report from December 14 on the British showed that the mood of the major players has changed a lot. To be more precise, it has become much more "bearish", since the "Non-commercial" category immediately closed 20 thousand long contracts. The trend of strengthening the "bearish" mood has been observed for two months. In the reporting week, speculators also closed 6,681 short contracts. The total number of short contracts in the category of "Non-commercial" traders is now more than twice as high as the number of long contracts: 82 thousand versus 29 thousand. Thus, based on the results of the next week and the next COT report, I cannot conclude that the situation for the Briton has improved at least a little. It can continue the process of falling.

GBP/USD forecast and recommendations to traders:

I recommend buying the pound if there is a rebound on the hourly chart from the level of 1.3172 (previously the pair fought off it three times already) with a target of 1.3296. I recommend considering sales if there is a closure below the level of 1.3150 with a target of 1.2988.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română