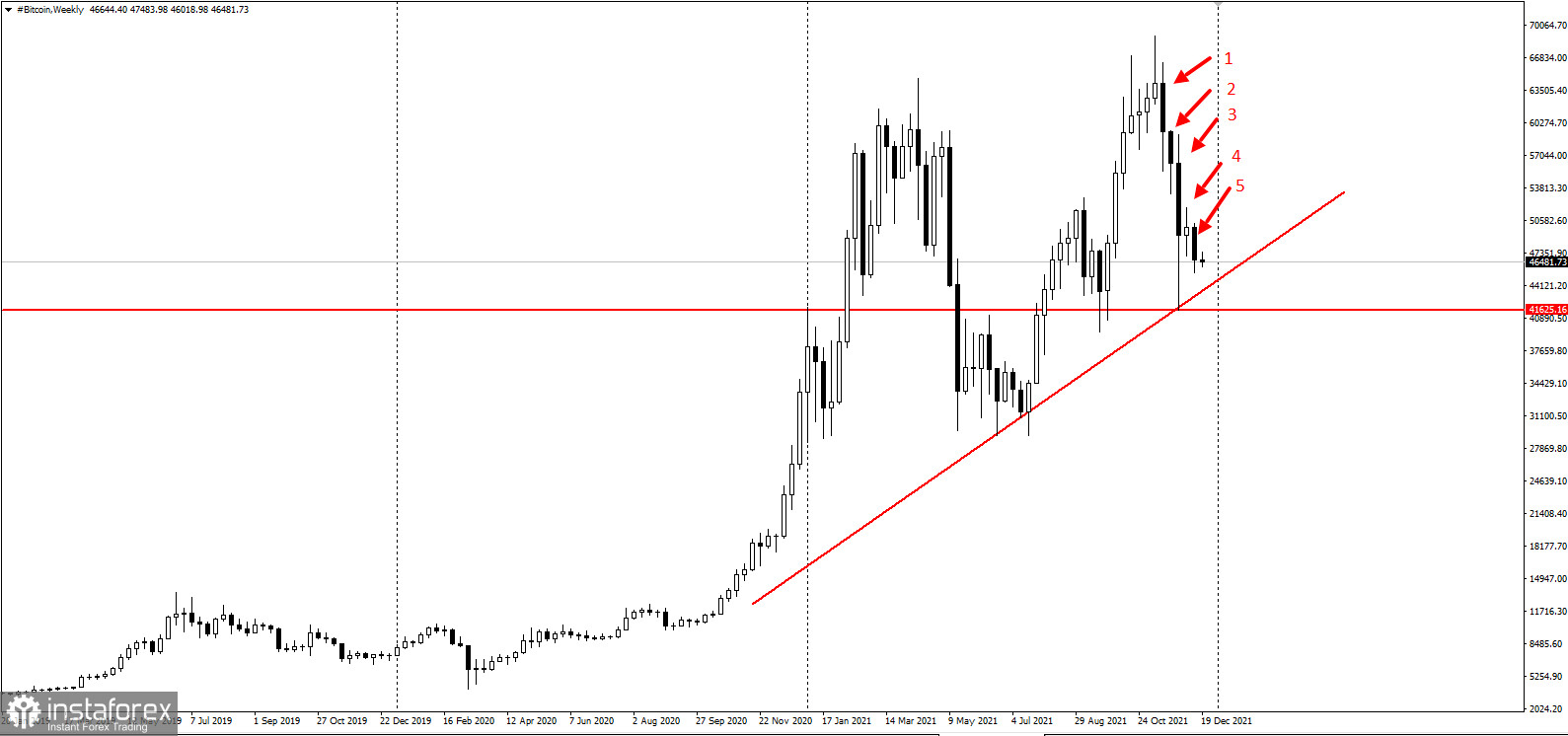

Bitcoin's digital token continued to drop on Friday, causing the largest cryptocurrency to dip for five weeks, joining other risky assets under pressure as central banks adopted a more aggressive tone on inflation.

It fell 4.3% to $ 46,501, down about 32% since hitting a record of nearly $ 69,000 on November 10. But all in all, it grew about 60% this year.

"Downward pressure that has historically existed towards the end of the year has continued to keep prices low," said David Grider, researcher from Grayscale.

Price will most likely continue to decline as central banks around the world prioritize fighting heightened inflation by tightening monetary conditions. They are also closely monitoring the impact of omicron, which leaves investors wondering if risky assets, such as cryptocurrencies and technology stocks, will undergo strong correction after rising from pandemic lows.

Cryptocurrency proponents have long argued that Bitcoin and other digital assets are a kind of asset class that can act as a hedge against inflation and fluctuations in other areas of the financial market. 21 million Bitcoins are planned to be released into circulation under the latest protocol, but this figure is not expected to be reached for several decades.

Scientists such as MIT's Christian Catalini and Antoinette Schoer, who have done extensive research on the sector, said the argument that Bitcoin is "digital gold" is overblown. "All the data to date refutes the hypothesis," Catalini said. He warned that it is too early to make such a judgment since many cryptocurrencies are less than ten years old.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română