Most of the global markets closed the previous week in the negative zone amid growing concerns about the spread of the Omicron strain in the world, while investors continued to assess the consequences for the asset value of the results of the meetings of the world Central Bank led by the Fed.

The currency markets remain nervous, worried that the coronavirus pandemic will continue for a significant period of time. It is believed that this could last at least another six months, and a maximum of one year. In these conditions, investors clearly show a high degree of caution and partially close their positions, which leads to a drop in demand for risky assets and, accordingly, stock indices decline, while commodity and commodity asset prices fall.

The financial market reacts to all this by dropping the rates of commodity and raw materials assets against the US dollar, strengthening the yen and franc, which are growing as safe-haven currencies. Here, the demand for government bonds of economically strong countries increased again. So the yield of the benchmark of the US 10-year Treasuries began to decline again after its attempt to recover last week. Today, electronic trading is down by 2.90% to 1.361%.

What should be expected in this short week due to the start of the Christmas holidays?

We believe that everything can only change if major market players, who enter the markets overwhelmingly through American trading platforms, decide that the "Omicron" topic can be pushed aside for now and that it is worth buying fairly cheap shares of companies, thereby inspiring a local Christmas rally, which is called the Santa Claus rally in America. This scenario is very likely. If we follow how the markets acted at the end of last year, the situation was similar. It was overcome, although with efforts and a moderate rally. It is likely that the same thing should be expected this week.

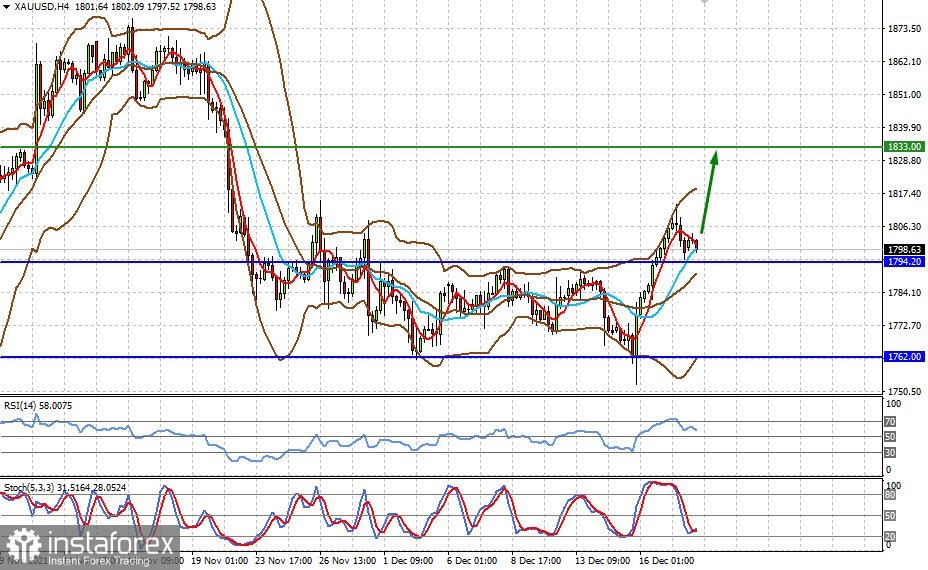

The currency market is completely dependent on the general situation in the financial markets. Any fears force investors to reduce positions in risky assets and buy safe-haven currencies, which leads to a strengthening of the yen and franc. This was until recently, but the situation has slightly changed since mid-December. The "Omicron" news began to dominate the media and it became a strong signal for buying gold as a protective asset. If the market does not calm down, it will be possible to expect the continuation of demand for gold after a slight correction.

Taking into account the market picture, we believe that a Christmas rally is still possible, and hence a weakening of the US dollar against major currencies. Against this background, gold's price may correct, and the price of crude oil will try to recover again to the local highs of mid-October.

Forecast of the day:

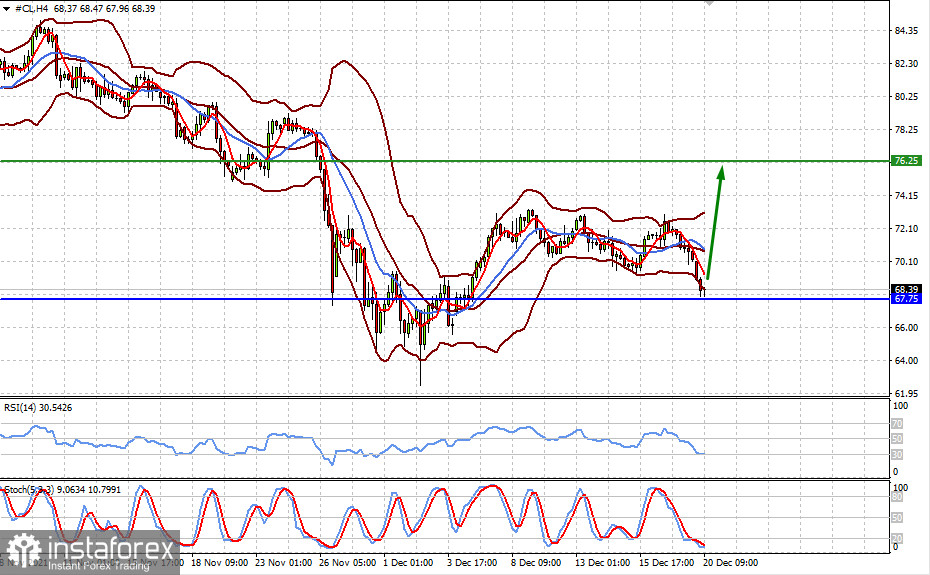

The price of WTI crude oil stopped above the level of 67.75. If it holds, and the mood in the market improves, a local price recovery to the level of 76.25 can be expected.

The spot gold price made a slight downward correction after reaching the level of 1813.94 and settles above the level of 1794.20. If it holds, an updated growth in demand for gold and a price increase by 1833.00 can be expected.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română