The quotes from most world markets shifted to the red zone at the opening of the week. This time, the new COVID-19 strain Omicron acted like the Grinch who stole Christmas. The Netherlands was the first country in Europe to announce the introduction of a new strict lockdown before January 14, and a number of other countries are also tightening restrictions.

These measures will restrict trade at the end of the year, which may lead to a deterioration in macroeconomic indicators, hence the decline in markets. The S&P500 index fell by 1% on Friday, which led to a decline in Asian markets at the opening and will put pressure on European markets. Global yields are also going down. The yield of 10-year US bonds fell to a minimum of 1.37%, and even the hawkish comments of the Fed did not help.

Fed Governor Christopher Waller said the whole point of accelerating the pace of the exit from QE was to finish it by March and be ready to raise rates at the meeting, as inflation is obscenely high. Another Fed representative, William, said that the Fed has a chance to tighten policy without causing a recession.

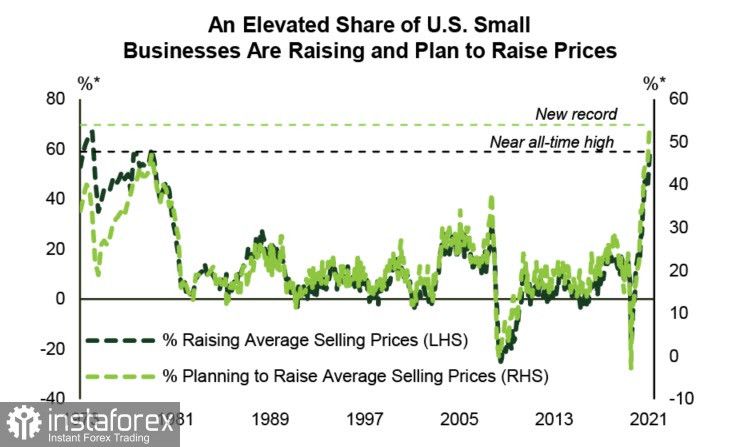

The Fed's fuss about inflation has objective grounds. Producer prices went up sharply, rising to 9.6% year-on-year in November from 8.8% in the previous month. The acceleration indicates widespread price pressures throughout the supply chain. Small businesses are also increasing the pressure. A survey by the National Federation of Independent Enterprises showed that 59% of enterprises increased average selling prices in November, and another 54% plan to increase them in the coming months. The first indicator is close to the historical maximum of the 1970s, and the second one is a new record.

It is clear that if the markets are getting ready for a tightening of policy, then the demand for risk will begin to decline due to the decrease in the availability of cheap liquidity. According to the CFTC report, oil is under pressure for the fourth week in a row, calculating a bearish advantage in overall positioning, which indirectly indicates an increasing pressure on commodity assets.

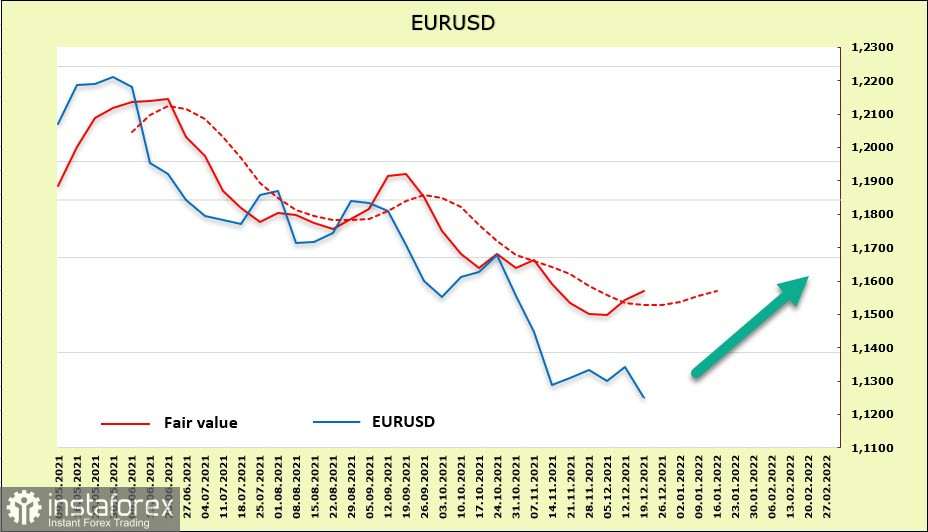

EUR/USD

The growth of inflation in the eurozone is still much less noticeable. The latest Eurostat data showed that the index remained at the same level of 2.6% in November, which, together with the measures taken by the ECB on Thursday, excludes any unexpected steps to curb price growth.

As follows from CFTC's weekly report, changes in the euro were technical. A slight decrease in open interest led to an alignment of the volumes of contracts in long and short, in general, there is no dynamics. The decline in UST yields at Monday's opening led to an increase in the settlement price, which gives reason to expect a correction. The expectations of an increase in demand for protective assets are also in favor of a possible correction.

The euro continues to trade in a bearish channel, and the US dollar remains the long-term favorite in this pair. At the same time, an attempt to make an upward correction to the upper limit of the 1.1450/70 channel will be observed in the coming days. There are low chances of leaving higher, so there are reasons to use growth attempts for sales.

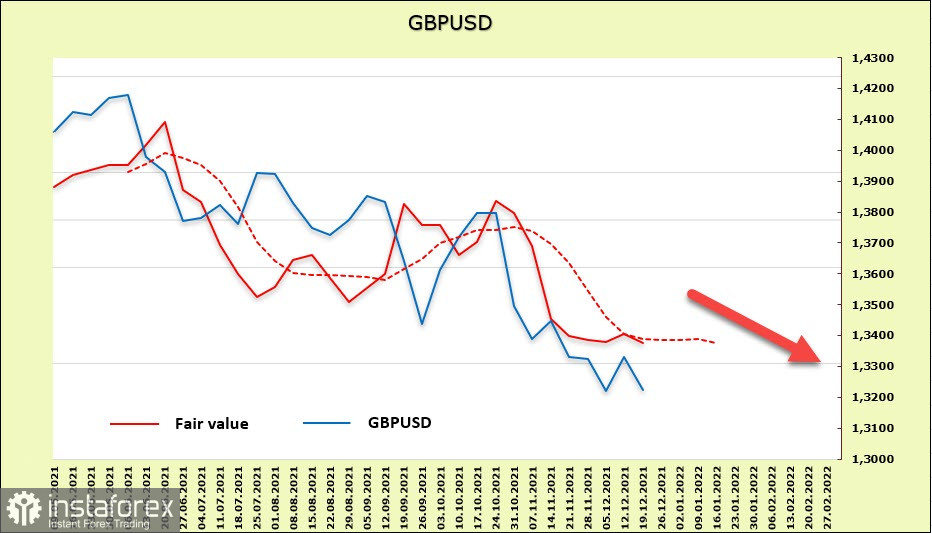

GBP/USD

The pound's net short position rose again. Speculators are withdrawing from long contracts, fearing the development of the energy crisis in Europe and the onset of the Omicron strain, which may lead to an expansion of restrictive measures. Johnson's government is considering reimposing lockdown measures for a period of two weeks. If this happens, the pound will come under pressure. Perhaps, this is even the main reason that the target price for the pound has stayed below the long-term average, and therefore, the priority should be considered the downward one.

The pound rushed down again after a weak attempt to make a correction. The chances of a breakdown of the key support level of 1.3160 increased, so further the long-term target of 1.2830 will become relevant. Also, the pound failed to correct even to the middle of the channel, which indirectly indicates the strength of the bearish impulse. In this case, there is no reason to hope for a bullish reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română