All components of the Australian employment data turned out to be better than expected, despite the negative impact of the "coronavirus factor." AUD/USD traders reacted to the publication accordingly, updating the three-week high and testing the 72nd figure. But once at 0.7225, buyers moderated their ardor and recorded a profit, after which the pair rolled back, "driven" by dollar bulls.

All this suggests that the aussie is still moving in the wake of the U.S. currency: the uncorrelation of the positions of the RBA and the Fed is playing on the side of the AUD/USD bears, while the macroeconomic successes of the Australian economy provide only temporary support for the aussie.

As soon as the pair updates local highs, it attracts sellers who promptly extinguish the upside prospects. Such trends will be observed until the greenback weakens throughout the market – a large-scale growth of AUD/USD is possible only due to a large-scale devaluation of the U.S. dollar. But, taking into account the results of the last meeting of the Federal Reserve, the greenback will at least stay afloat in the foreseeable future.

The November figures of the employment data reflected the recovery of the Australian labor market, leveling the concerns of Reserve Bank members that were voiced at the last meeting. Despite a protracted series of lockdowns, the country's economy withstood the blow and once again demonstrated stress resistance. The report released this week bears witness to this.

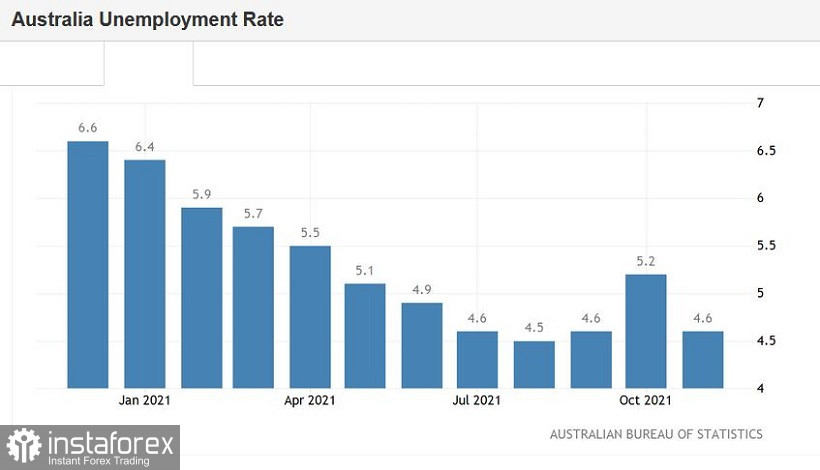

The unemployment rate in Australia fell sharply in November – from 5.2% to 4.6%, although, according to preliminary forecasts, it was supposed to reach 5.0%. This indicator returned to the lows of the current year after the October surge to 5.2%. The unemployment rate was below the five percent level in June-September, and before that - more than two years ago, at the beginning of 2019, that is, long before the events of last year.

In the run-up to the pandemic, this indicator has been fluctuating in the range of 5.0%-5.4% for many months. In other words, unemployment has returned to pre-crisis levels, and significantly ahead of schedule. Recall that the forecasts of the RBA announced at the February meeting of the Reserve Bank expected unemployment rate this year in the region of "6 percent," whereas, in their opinion, this indicator was supposed to return to the pre-crisis range of 5%-5.5% only in 2022.

As you can see, the indicator decreased, firstly, at a faster pace relative to the initial forecasts, and secondly, it broke through the lower limit of the specified range, updating the two-year lows.

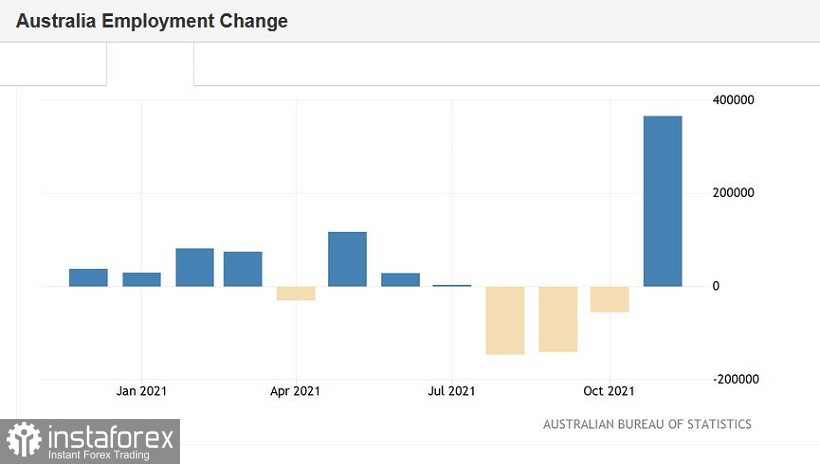

It is also necessary to note the positive dynamics of the increase in the number of employed in November. The overall indicator also turned out to be better than forecasts, reaching 366,000 (with a forecast of growth of 200,000). This is a record growth rate for the entire history of observations.

There is another "highlight" of this component. The structure of this indicator suggests that the overall growth was due to both partial and full employment (ratio 128,000/238,000). At the same time, it is known that full-time positions, as a rule, offer a higher level of wages and a higher level of social security compared to temporary part-time jobs. Therefore, the current dynamics in this regard is extremely positive.

In other words, the report on the labor market turned out to be strong in all indicators: it reflected not only a jump in employment growth, but also a sharp decrease in unemployment, and against the background of an increase in the share of the working-age population (the indicator rose to 66.1%, this is the best result since June).

Against the background of such positive data, the upside impulse of AUD/USD looked quite logical and reasonable. But despite such a strong report, the Australian could not stay within the 72nd figure. As soon as the U.S. dollar index woke up from suspended animation and crept up, aussie followed the greenback. Australian employment report immediately faded into the background.

This dynamics is explained by the continuing divergence of the position of the RBA and the Fed. Immediately after the release of data on the growth of the labor market in Australia, the head of the Reserve Bank, Philip Lowe, made his comments. On the one hand, he noted the success of the Australian economy, but on the other hand, he voiced quite "dovish" remarks.

Lowe categorically ruled out the option of raising the rate within the next year. According to him, the Central Bank will not tighten monetary policy until actual inflation "settles steadily in the target range of 2-3%." According to the forecasts of the RBA, this will happen approximately in 2023.

In other words, Lowe leveled the significance of the key data: firstly, he ruled out a rate hike within the next year, and secondly, he brought inflation to the fore, which demonstrates a fairly modest growth. While the Fed, let me remind you, not only announced the early curtailment of QE but also allowed the option of a triple rate hike (according to the Fed's point forecast).

Summarizing all of the above, it should be noted that such a relatively weak market reaction to such a "chic" macroeconomic release speaks volumes. First of all, that the aussie will move in the wake of the U.S. currency in the foreseeable future. Given the hawkish attitude of the Federal Reserve and the opposite attitude of the RBA, it can be assumed that the downside trend of AUD/USD has not yet exhausted itself. Therefore, corrective spikes in the pair can be used to open short positions.

At the moment, aussie is testing the support level of 0.7140 – this is the average line of the Bollinger Bands, coinciding with the Tenkan-sen line on the daily chart. It is advisable to go into sales after the bears overcome this price barrier and gain a foothold under it. The target of the downside movement is the 0.7040 mark – this is the lower line of the Bollinger Bands indicator on the same timeframe.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română