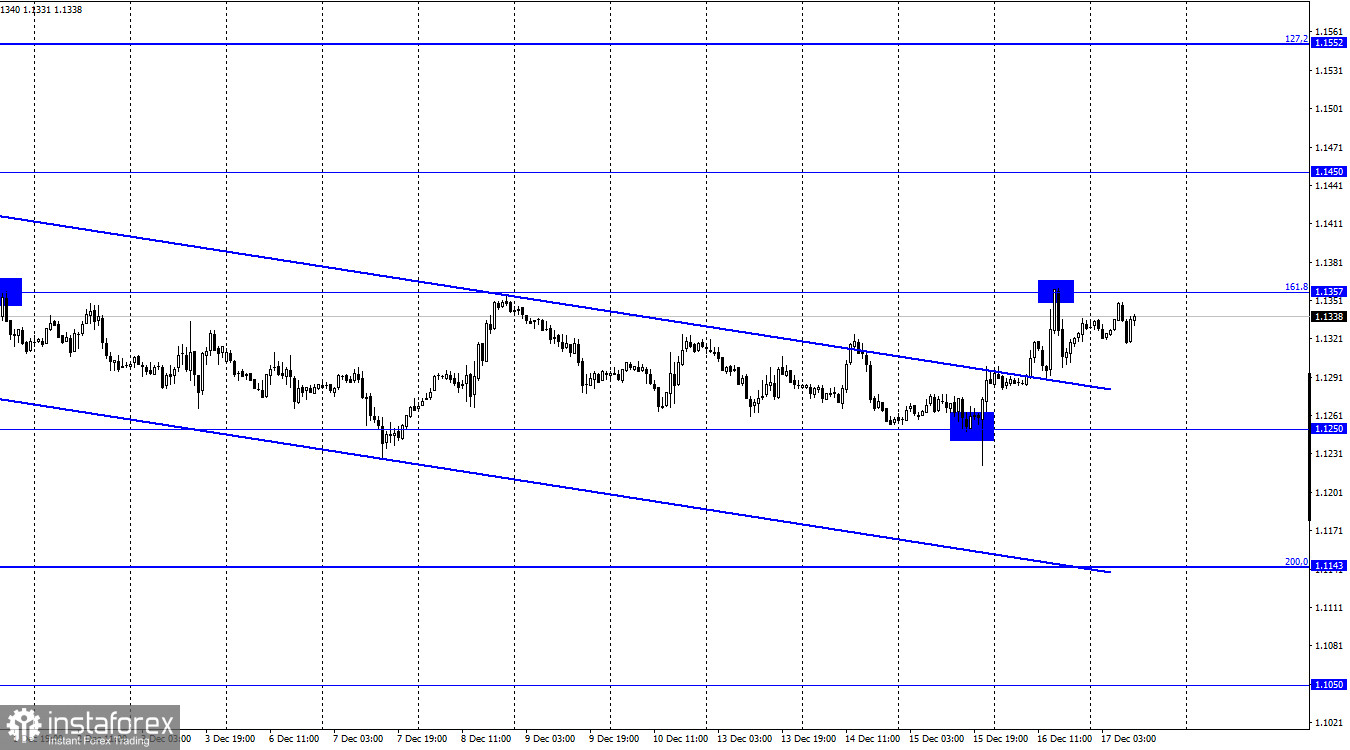

EUR/USD – 1H.

The EUR/USD pair continued its growth on Thursday, performed a rebound and broke away from the level of 161.8% (1.1357). Thus, there was a reversal in favour of the US currency and a slight decline, which has now been completed and the pair is rising again towards 1.1357. A new pullback from this level will again be in favour of the US dollar. A consolidation above the retracement level of 161.8% will increase the chances of the continuation of the growth towards 1.1450. The information backdrop yesterday was just as strong as on Wednesday. There were plenty of economic reports, but traders' main focus was on the ECB meeting and its outcome. The ECB announced it would continue to reduce asset purchases under the PEPP programme. It also left interest rates unchanged and announced the end of the PEPP programme in March 2022. ECB officials said that the APP programme would be expanded from €20bn a month to €40bn in April.

Thus, the outcome of the meeting is rather contradictory. However, it is similar to the outcome of the Fed meeting. Both central banks are about to end monetary stimulus. The only difference is that the Fed is prepared to raise rates next year and even several times, whereas in the EU this is still out of the question. The Fed thus outperformed the ECB. The Euro currency, on the other hand, has risen after these two meetings, at a time when the US dollar should have risen. I already referred to this strange feature yesterday, and it looks like the chart factor and the break-up of 1.1250 are to blame. Bearish traders might have already changed their mind to sell the pair, so even a hawkish Fed attitude did not change that. Consequently, both Fed meetings did not affect the traders and the pair as they should have. Therefore, further movements of the pair are unlikely to depend on the outcome of the ECB and Fed meetings. It should be noted that the Euro currency is only up 100 points. This cannot be called a strong reaction. Other economic reports on Wednesday were also quite interesting. In particular, business activity in the EU services sector fell to 53.3 points.

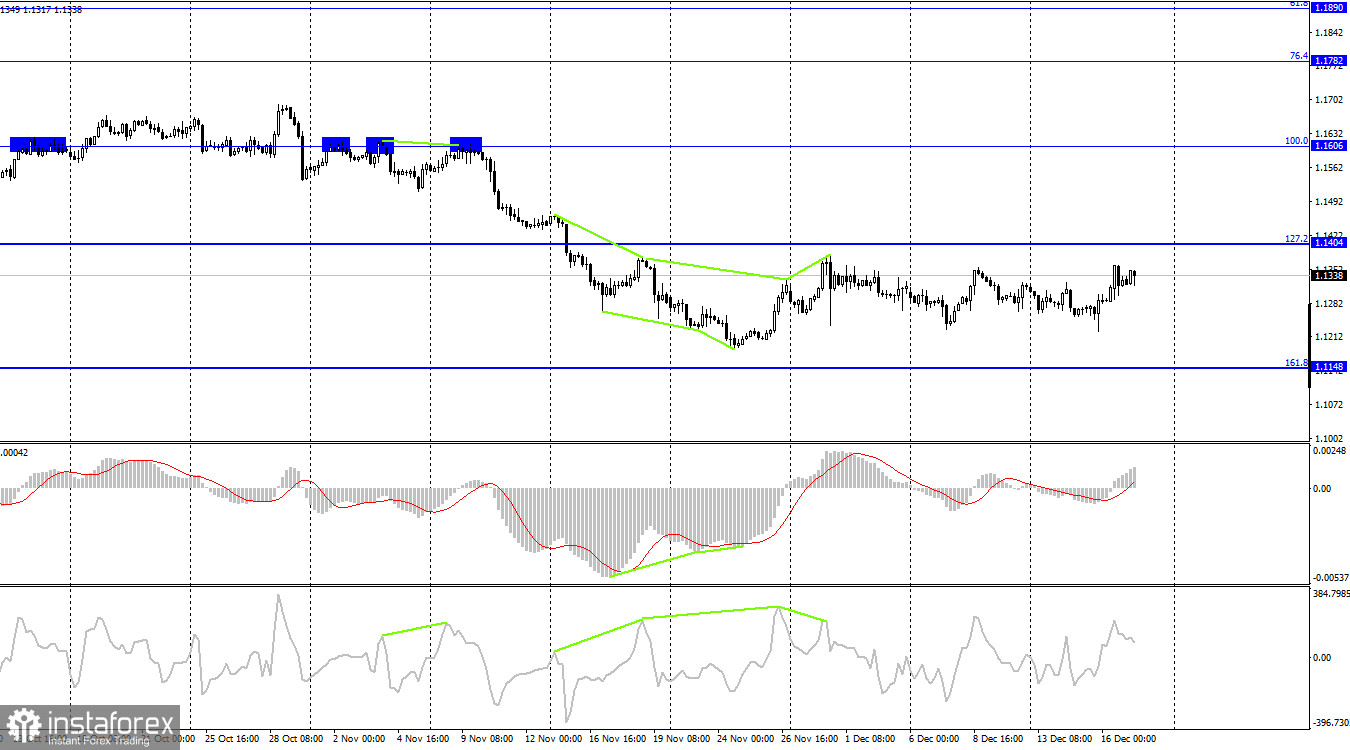

EUR/USD – 4H

According to the 4H chart, EUR/USD reversed downwards, moving towards the retracement level of 161.8% (1.1148). The pair is currently trading in the 1.1148-1.1404 range, without testing either level. The 1H chart offers more precise information on the pair's dynamics at the moment. There are no emerging divergences at this point.

News calendar for US and EU:

EU - Consumer Price Index (10-00 UTC).

There will be no important economic events in the EU and US on December 17. The only interesting report will be EU inflation for November. However, the final data is unlikely to be significantly different from the first one. The information backdrop will be very weak today.

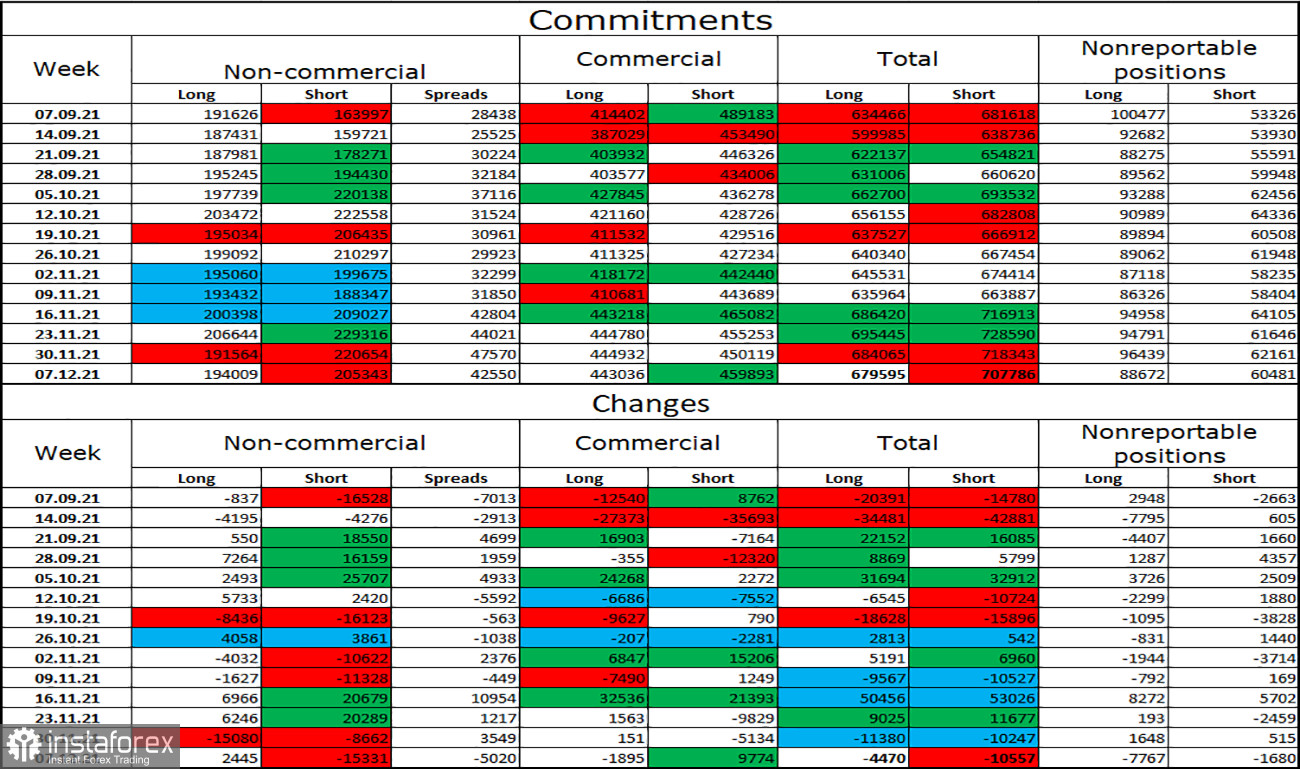

COT (Commitments of Traders) report:

The new COT report showed that the sentiment of the Non-commercial category traders became more bullish during the reporting week. Speculators increased Longs and also closed Short positions. In total, 2,445 long contracts on the euro currency were opened and 15,331 short contracts were closed. Thus, the total number of long contracts in the hands of speculators increased to 193,000, while the total number of short contracts decreased to 205,000. The bearish mood among the most important category of traders remains but has weakened during the reporting week. Since it is still bearish, the euro is likely to fall further.

EUR/USD outlook and tips for traders:

Traders were advised to close short positions near 1.1250. Opening new short positions could be possible if the pair closes below 1.1250 targetings 1.1143. I recommend buying the Euro at a rebound from 1.1250 with a target of 1.1357. New purchases are recommended when closing above 1.1357 with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română