The price of gold crashed today ignoring strong downside obstacles and now it seems determined to approach and reach new lows. It was trading at 1,631 at the time of writing. The price action failed to activate a larger rebound as the Dollar Index rallied.

XAU/USD dropped by 1.45% from today's high of 1,654 to the 1,630 daily low. The yellow metal dropped also after the UK CPI reported a 10.1% growth versus the 10.0% expected, while Core CPI surged by 6.5% compared to the 6.4% expected. In addition, the Canadian CPI rose by 0.1% compared to the 0.1% drop expected.

Higher inflation could force the central banks to continue hiking rates, that's why XAU/USD resumes its downside movement.

XAU/USD Trading In The Red!

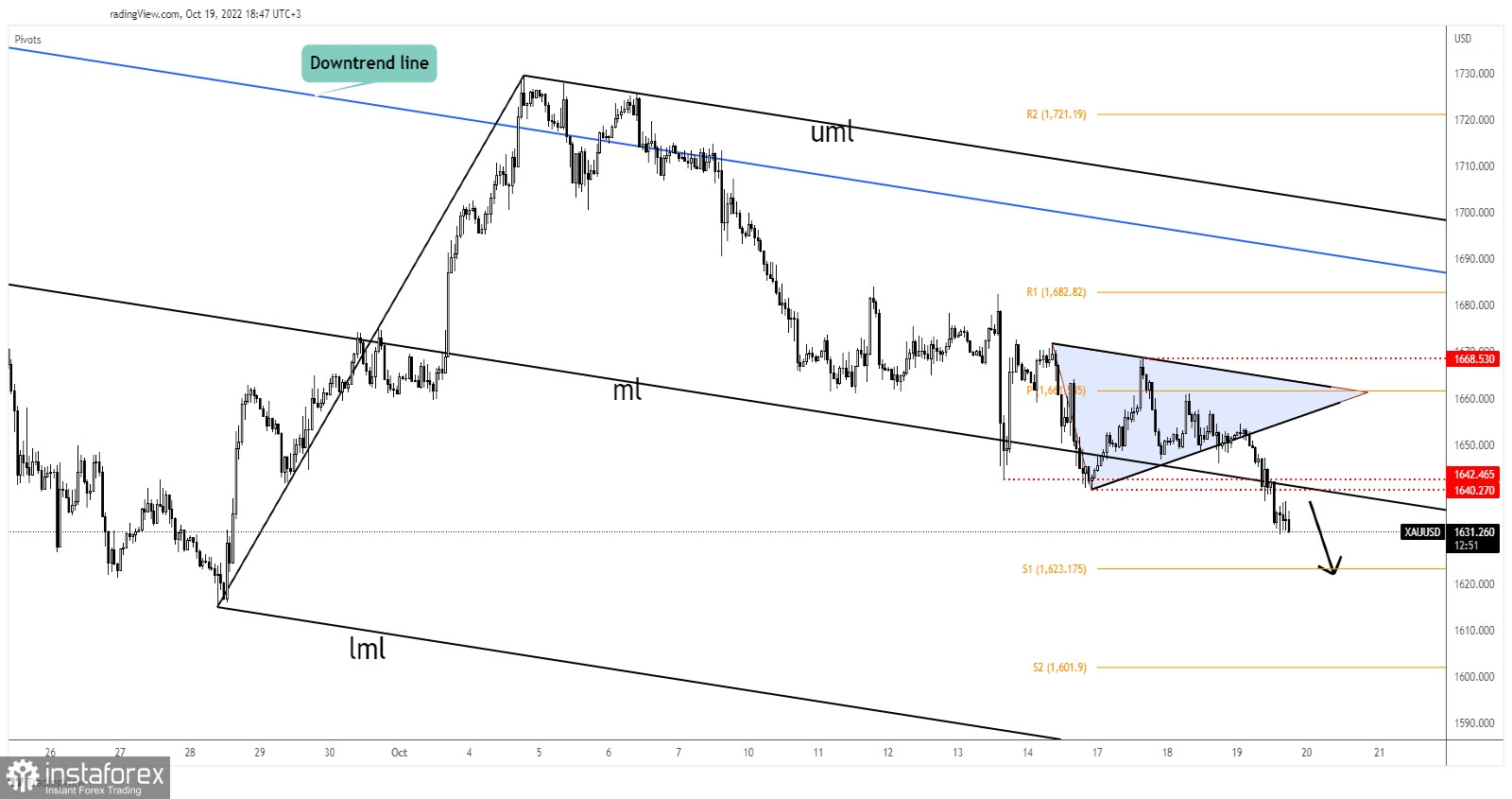

As you can see on the H1 chart, the rate registered a downside breakout from the symmetrical triangle signaling downside pressure. Also, it has ignored the 1,642 and 1,640 former lows and the median line (ml) which represents downside obstacles.

You knew from my previous analyses that XAU/USD could extend its downside movement if it makes a valid breakdown below the median line (ml). Now, this scenario took shape.

XAU/USD Forecast!

The breakdown below 1,640 and below the median line (ml) was seen as a short opportunity. The first downside target is represented by the S1 (1,623). Taking out this level may announce a larger drop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română