The ECB hawks are not satisfied with Christine Lagarde's decision. They actually have their reasons. The reduction of stimulus measures was announced, however their execution is rather bureaucratic. Consequently, the policy is further stimulating.

The ECB announced the next reduction of the volume of asset purchases within the framework of the PEPP program. It is planned to complete purchases completely in March, as it was originally planned. To mitigate this effect, purchases under the APP program are temporarily increased to 40 billion euros in the second quarter and 30 billion euros in the third quarter of 2022. From October, the regulator will again achieve the rate of 20 billion euros.

Apart from increasing purchases under the APP program, Lagarde reserved the right for the ECB to resume purchases under the PEPP.

The rate hike will occur only after the stimulus measures are completed, as they are scheduled for the next year, the market should not expect the regulator to take tough action. At the press conference Lagarde repeatedly stated that there would be no rate hike next year.

It is noteworthy whether market players will believe her or will expect an earlier monetary policy tightening, as it was with the Fed. Jerome Powell was also confident in his dovish beliefs. However, he abandoned them expeditiously. The stimulus cuts have been accelerated, and a triple rate hike is expected next year.

ECB outlooks

One of the key outcomes of the ECB meeting was the updated economic outlooks. GDP growth was downgraded to 4.2% y/y for the next year due to the impact of the COVID-19 pandemic. Growth forecast increased to 2.9% y/y in 2023, economy may expand only by 1.6% y/y in 2024.

The inflation forecast has been dramatically changed. Growth is expected to be 3.2% y/y instead of 1.7% y/y. While the ECB is aware that inflation will accelerate significantly, a rate hike is strongly rejected.

The ECB still believes that this inflation rate is caused by high energy prices and supply chain disruptions. The price acceleration will be temporary, peaking in 2022, and in 2023-2024, inflation will return to 1.8% y/y, which is below the 2% inflation target, according to the regulator's calculations. Notably, this scenario, based on the bank's monetary strategy, does not imply a rate hike.

It is noteworthy how long the ECB and Lagarde will hold this view while other global regulators tighten policy. The Bank of England has already started to raise interest rates, being the first among major central banks.

The first emotions have faded, and the currency markets will carefully assess the meetings of the three banks - the US, the EU and England.

The dollar entered red zone as the euro and the pound reacted positively to the meeting outcome. As for the pound, the issue is clear, the rate was increased, while no one expected it.

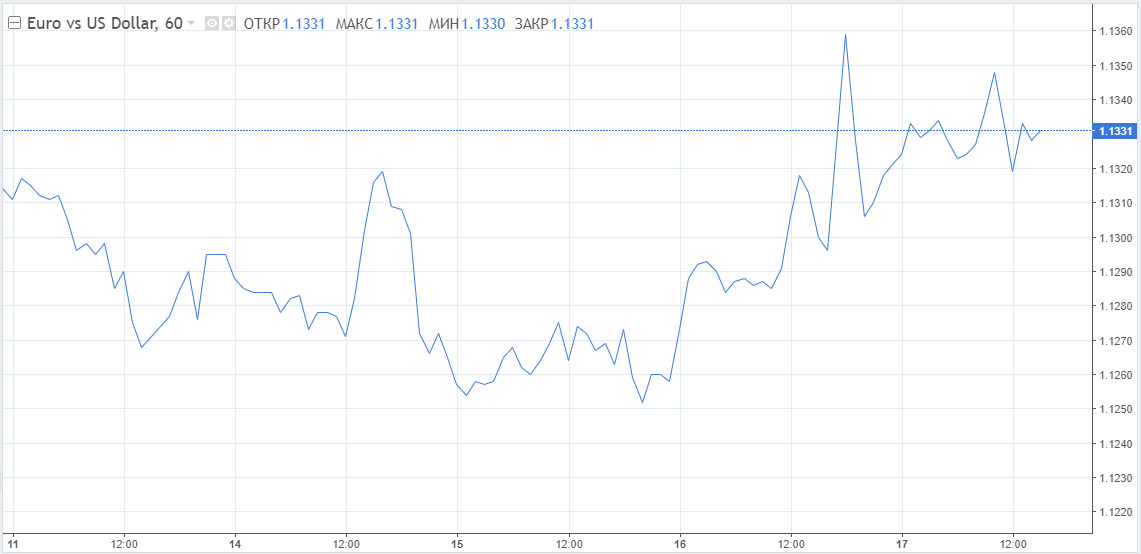

The euro is constantly declining. The day before, EUR/USD hit a record high for more than 2 weeks and stopped at 1.1360. No chances to move further and on Friday the euro is consolidating near 1.1330.

The technical picture shows that the EUR/USD is still following a bearish scenario. After strengthening the downward movement the rate will go towards 1.1265, targeting at 1.1150.

However, an upward movement is possible. An upgrade and rise above Thursday's high towards 1.1375 make buyers weaker and push the euro up. Buyers' success in overcoming the resistance at 1.1400 would favour the euro, however, it is hard to believe so far. There is no reason, neither technical or fundamental, unless major players want to trade by their own rules.

Support is indicated at 1.1285, 1.1245 and 1.1205. Resistance is at 1.1365, 1.1400, 1.1445.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română