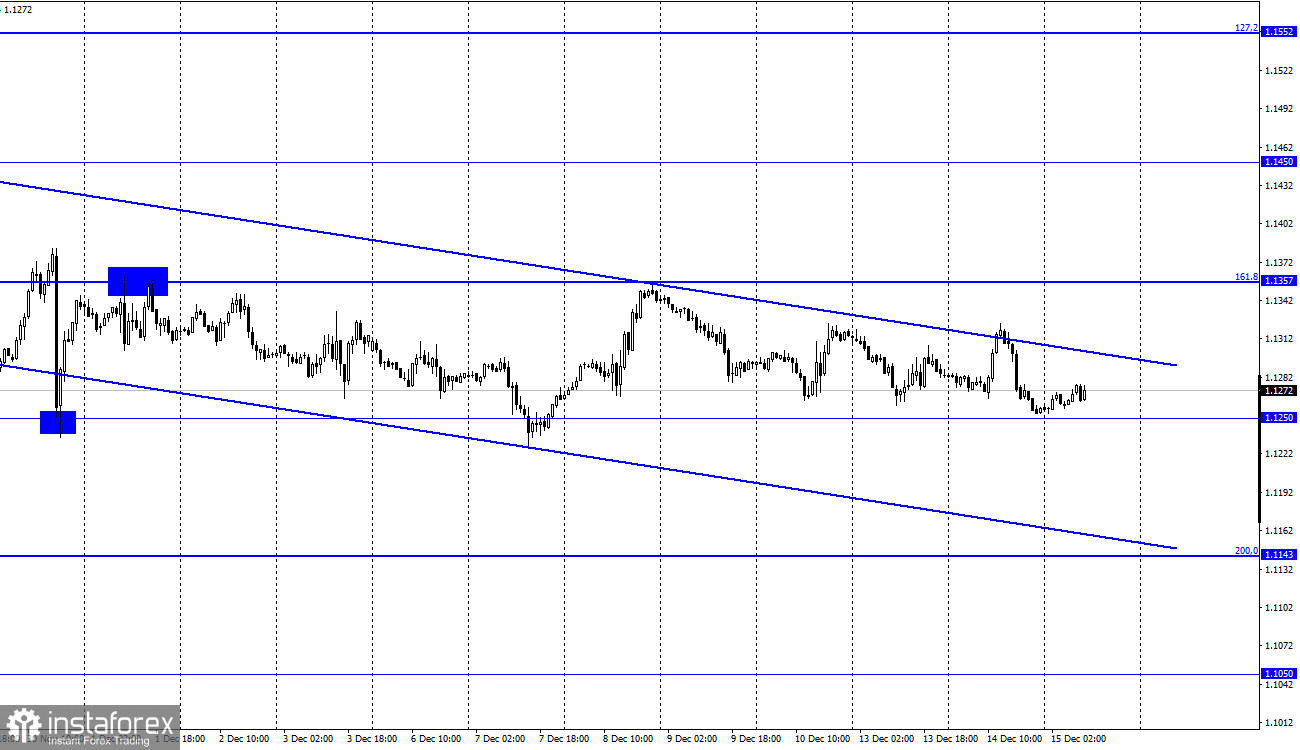

The EUR/USD pair made a new attempt to close above the downtrend corridor on Tuesday. It was unsuccessful. This was followed by a reversal in favour of the US currency and a fall to 1.1250. The pair is only 4 points away from this level. If the price stays below this level, we can expect a further drop towards the next retracement level of 200.0% (1.1143). However, the mood of traders may change sharply today. At the moment it remains bearish, as indicated by the downward trend corridor. However, in the evening, under pressure from an important information backdrop, it could change to bullish. So far there are no prerequisites. Everyone is expecting the Fed to reduce its stimulus programme even further. And this could be seen as a hawkish driver which should support the US dollar.

The EUR/USD pair made a new attempt to close above the downtrend corridor on Tuesday. It was unsuccessful. This was followed by a reversal in favour of the US currency and a fall to 1.1250. The pair is only 4 points away from this level. If the price stays below this level, we can expect a further drop towards the next retracement level of 200.0% (1.1143). However, the mood of traders may change sharply today. At the moment it remains bearish, as indicated by the downward trend corridor. However, in the evening, under pressure from an important information backdrop, it could change to bullish. So far there are no prerequisites. Everyone is expecting the Fed to reduce its stimulus programme even further. And this could be seen as a hawkish driver which should support the US dollar.

Therefore, the possibility that the EUR/USD pair will continue to fall is high. However, we should not forget that traders' reaction to the Fed meeting is not always logical. Also, it should also be remembered that in addition to the decision on the QE programme, the forecasts of key economic indicators for 2022-2023 will also be released. There will also be a dot plot that shows how many FOMC members support a key rate hike at different times. There will be a press conference with Jerome Powell, from whom everyone will be waiting for an explanation of the highest inflation in the US, as well as an announcement of plans to further roll back the QE programme and raise rates. Thus, there will be a lot of information tonight and Powell's dovish rhetoric could completely negate the hawkish effect of reducing QE by more than $15bn. Therefore, no matter how obvious the outcome of the FOMC meeting may be, we should not be entirely confident that the dollar will rise.

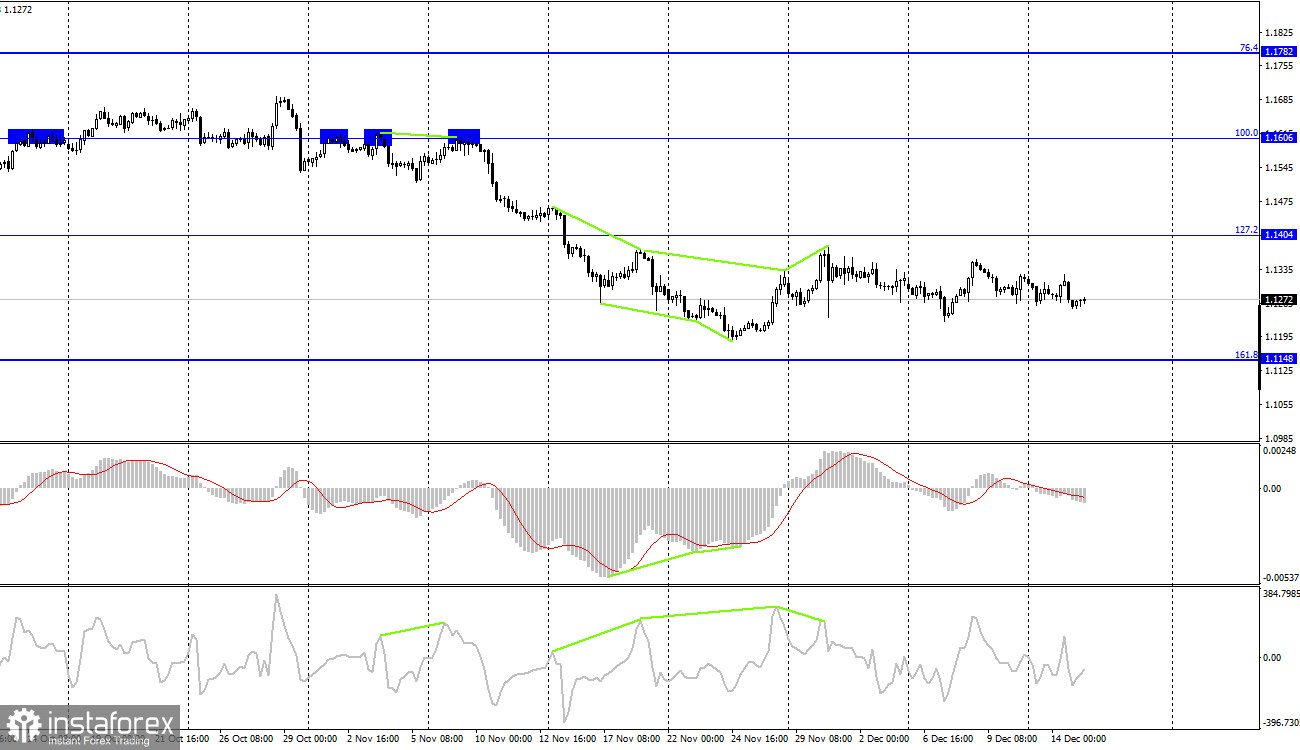

EUR/USD – 4H

According to the 4H chart, EUR/USD reversed downwards, moving towards the retracement level of 161.8% (1.1148). The pair is currently trading in the 1.1148-1.1404 range, without testing either level. The 1H chart offers more precise information on the pair's dynamics at the moment. There are no emerging divergences at this point.

News calendar for US and EU:

US - Retail sales data (13-30 UTC).

US - FOMC rate decision (19-00 UTC).

US - FOMC Economic Outlook (19-00 UTC).

US - FOMC statement (19-00 UTC).

US - FOMC press conference (19-30 UTC).

On December 15, there will be no major economic events in the EU. In the USA, in addition to the events listed above, a retail trade report will be released. The information background will be strong this afternoon.

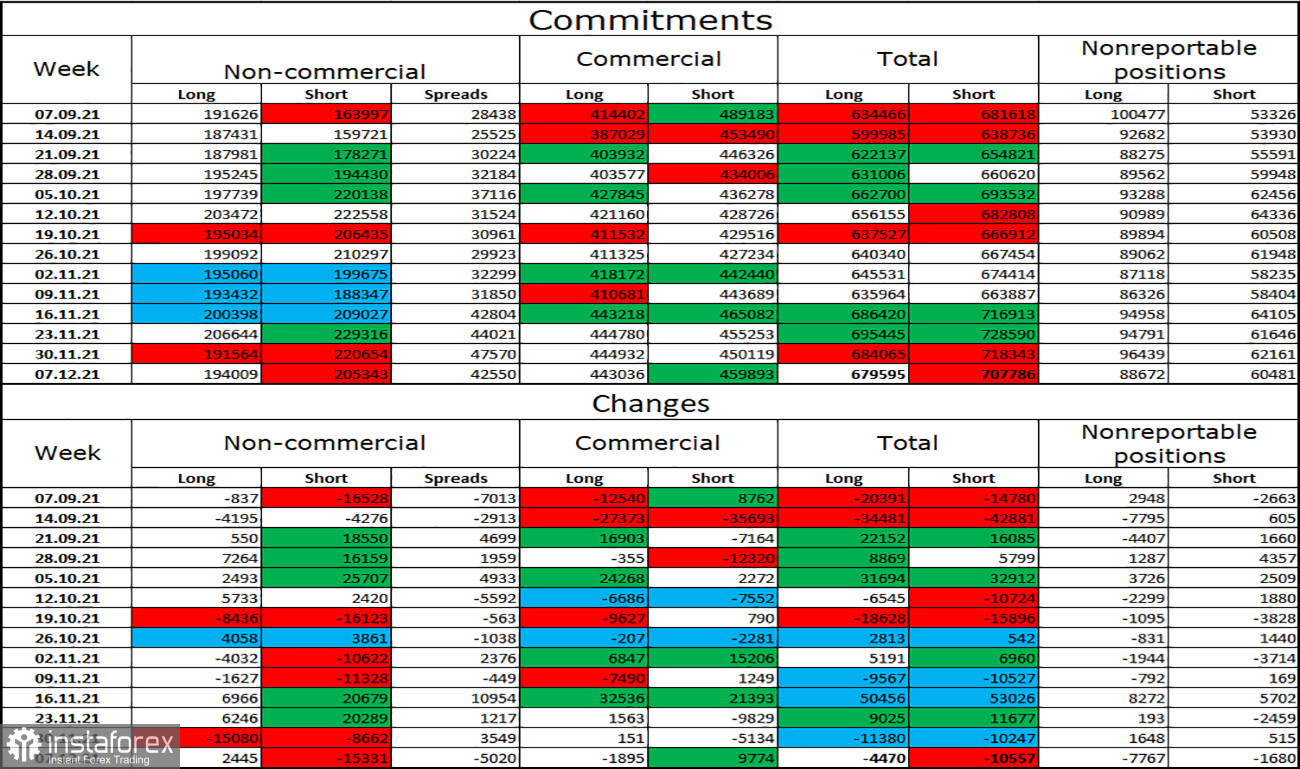

COT (Commitments of Traders) report:

The new COT report showed that the sentiment of the Non-commercial category traders became more bullish during the reporting week. Speculators increased Longs and also closed Short positions. In total, 2,445 long contracts on the euro currency were opened and 15,331 short contracts were closed. Thus, the total number of long contracts in the hands of speculators increased to 193,000, while the total number of short contracts decreased to 205,000. The bearish mood among the most important category of traders remains but has weakened during the reporting week. Since it is still bearish, the euro is likely to fall further.

EUR/USD outlook and tips for traders:

Traders were advised to close short positions near 1.1250. Opening new short positions could be possible if the pair closes below 1.1250 targetings 1.1143. Long positions could be opened if EUR/USD closes above the trend channel at the 1H chart targeting 1.1357 and 1.1450, or if it bounces off 1.1250 targetings 1.1357.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română