The main outcome of the Fed's last monetary policy meeting this year was the clarification of the regulator's position on the number of interest rate hikes next year, as well as in the next two years.

Investors, waiting for the central bank's decision on monetary policy, were already prepared for the fact that the previously announced increase in the volume of asset repurchase reduction under the quantitative easing program from $ 15 billion to $ 30 billion would be accepted, which has already been taken into account in the prices of stocks and other financial instruments, fully concentrated on the process of raising interest rates. Everyone understood that they would be raised next year. It was unclear in what quantity and at what pace.

It is now clear that the Fed is planning three rate hikes in 2022, and two each in 2023 and 2024. And it would seem that everything fell into place, but this is not quite true. Speaking at a press conference following the meeting, J. Powell made it clear that there is no clear plan to raise rates on time, and as they say, the regulator will look into it. In general, as we thought earlier, he left open the dates when rates could actually rise, and this is not accidental, since the bank, despite the fact that they abandoned the wording "temporarily high inflation", seems to still hope that it will stabilize.

Another important point is linking the first rate increase with the end of the quantitative easing program. It can be argued that the Fed will not raise rates until the asset repurchase program ends, so it is highly likely that the first rate hike will actually take place in the spring of next year, which means that the markets still have time for possible local growth. It seems that this is why there is a moderate recovery in demand for risky assets at Asian trading, and futures for European and American stock indices are traded in the "green" zone.

Should we expect a Christmas rally in the markets?

We believe that the markets have received guidance for the near future since it seems that the Fed will not do anything about rates for at least another 4 months. It is also possible to assume that today's monetary policy decisions of the ECB, the SNB, the Bank of England, and tomorrow the Central Bank of Japan will most likely show that the current monetary policy rates remain unchanged. This will lead to an increase in demand for risky assets and to a rally in the stock markets. The US dollar will possibly be under pressure on a positive background.

Forecast:

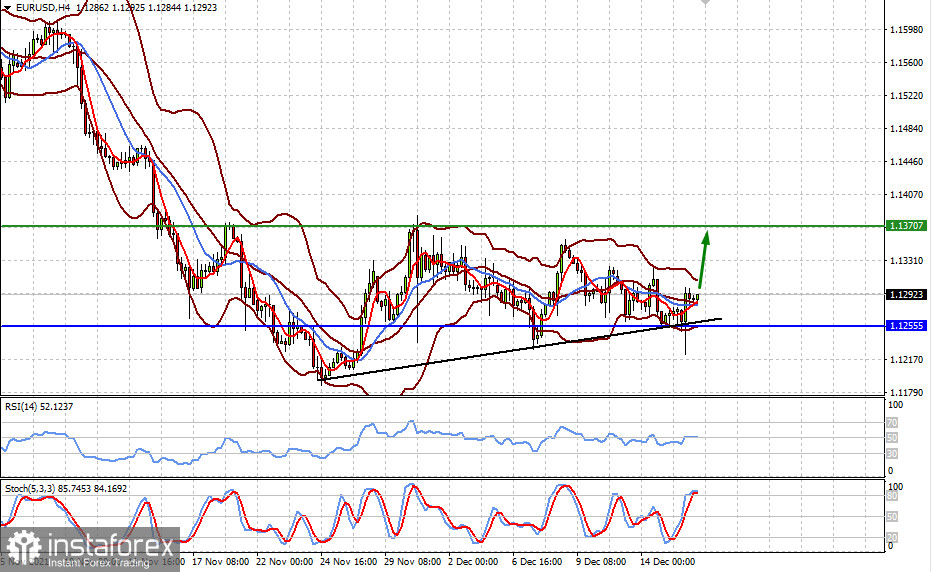

The EUR/USD pair may continue its local growth to the level of 1.1370 after the ECB meeting.

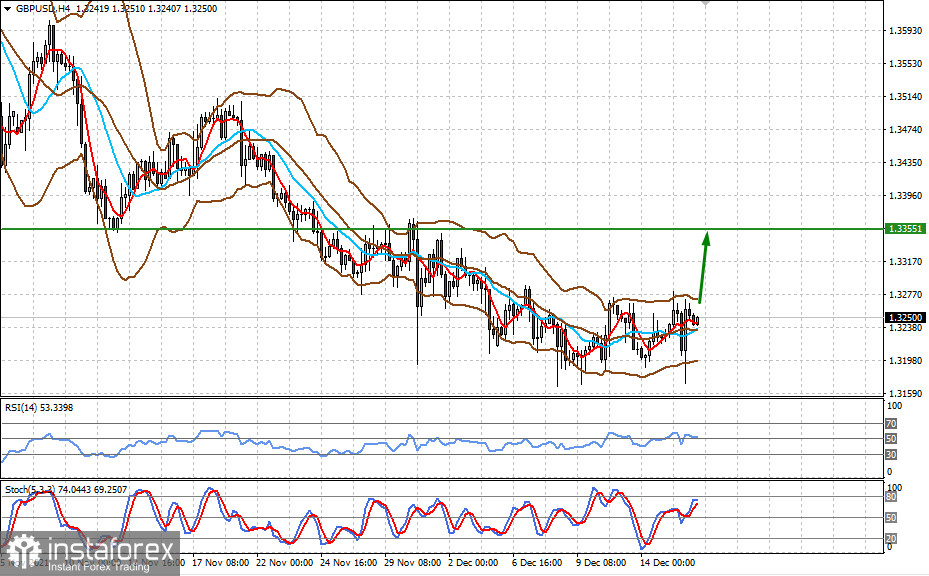

The GBP/USD pair may also rush to the level of 1.3355 as a result of the Bank of England meeting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română