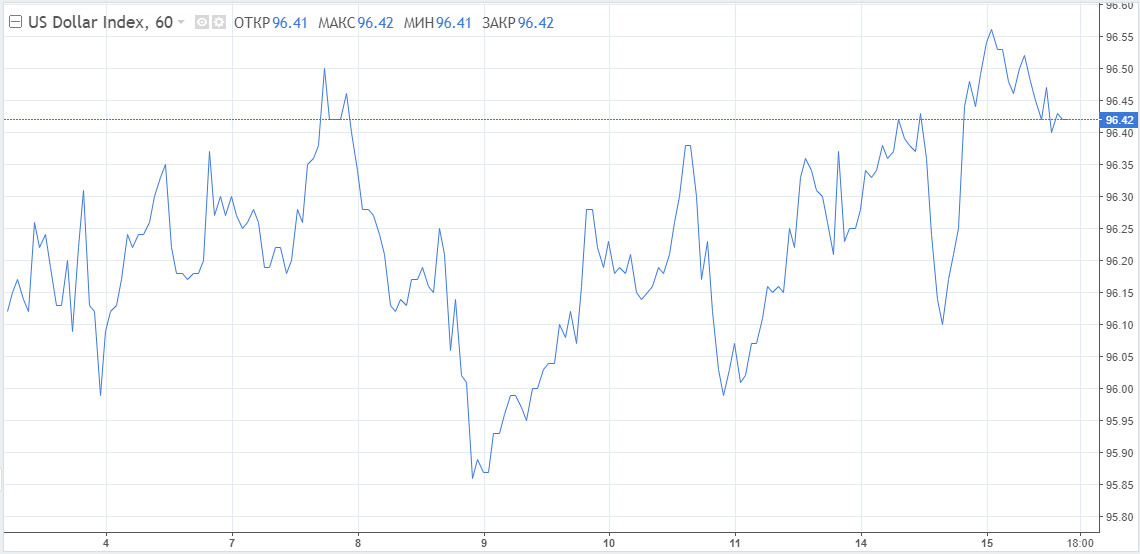

The US dollar approached weekly highs in the run-up to the Fed meeting, as traders are left wary of possible strong volatility in the market. Investors expect a hawkish policy shift from the Federal Reserve, and the accelerated QE tapering has already been priced in by the market. The Fed is forecasted to raise the interest rate in June and November 2022. However, some market players now even see a third increase, which could suggest that their expectations are too high. Any actions by the Fed not matching these expectations could push the US dollar down.

The Fed's dot plot has attracted great interest of market players at this point. It is widely considered to have put an end to the US dollar's downtrend in June, and could significantly influence the US currency in the near future.

According to an outlook by ING, two hikes in 2022 are likely to boost the US dollar.

Recent US inflation data turned out to be disappointing - the CPI in November increased higher than previously projected. The NY Fed Reserve Bank's consumer confidence survey indicated rising inflation expectations in the short term, reaching 6% in the 1-year period.

The US PPI went up by 9.6% in November, notably exceeding expectations. With fuel and food prices no longer being the sole drivers of inflation, the Fed could be forced to intervene. These measures would be detrimental for the stock market, but could prove to be a positive factor for USD.

The upcoming ECB meeting, which is expected to leave its monetary policy unchanged, is unlikely to push the dollar down. Many other central banks around the world, particularly in the developing countries, are set to tighten their monetary policy in December. The US dollar continues to go up, despite this global hawkish shift and the current economic phase.

The effects of the current situation could possibly be delayed. With the US markets being overheated, sooner or later it could lead to a capital outflow into foreign markets offering higher yields. However, it is unlikely to happen in the near future.

At this point, a continuing uptrend is the most likely course of action for the US dollar. After going up this week, the greenback could reverse downwards in 2022.

The outlook for EUR/USD remains the same. The pair's fall below 1.1200 would trigger stop orders and open the way for 1.1000. In this situation, traders could open long positions for the medium term, targeting 1.2000.

The support levels are located at 1.1230, 1.1210 and 1.1180. The resistance levels lie at 1.1305, 1,1350, 1,1375. Traders are advised to open short positions.

USDX is expected to continue its movement into the 98.00 area.

The pound sterling spiked by 0.30% against the US dollar today as traders brace for a hawkish move by the Fed.

UK CPI rose to a 10-year high in November, reaching 5.1% and exceeding market expectations. Previously, consumer prices rose by 4.2% in October. This could affect the Thursday's meeting of the Bank of England.

In the baseline scenario, the BoE would not change its policy in December and would hint at raising the interest rate in February. This could limit the downside movement of GBP.

The pair would find support at 1.3190, 1.3170 and 1.3130. The resistance levels are located at 1.3260, 1.3290 and 1.3325. Traders are recommended to open short positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română