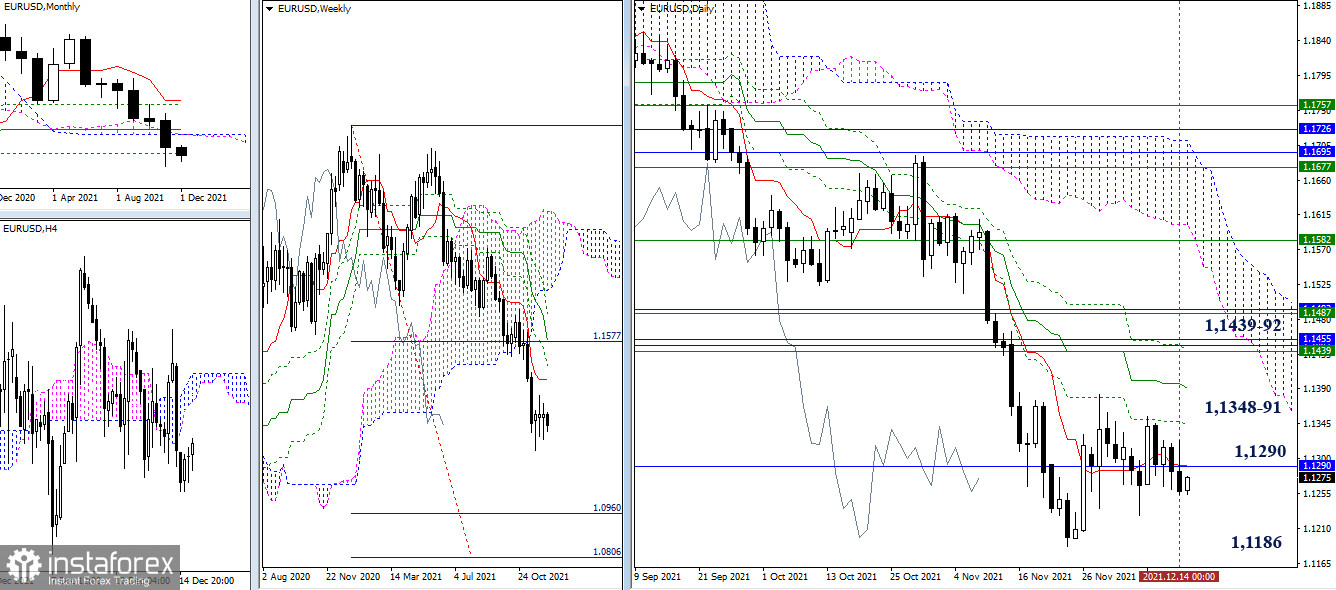

EUR/USD

The euro continues to consolidate and trade in the attraction and influence zone of the monthly level of 1.1290 (Fibo Kijun). The guidelines that make it possible to change the situation remain the same. The bears need to leave the consolidation zone and update the minimum extremum (1.1186) in order for new prospects to appear and after updating it, it should consolidate below.

At the moment, the bulls are facing intermediate resistances of the daily Ichimoku cross, which are at 1.1348 and 1.1391 today. The breakdown of which will open up opportunities for testing the main resistance zone 1.1439-92, where several strong levels of the weekly and monthly half have accumulated at once. Therefore, breaking through this resistance zone will be very important for the emergence of new upward prospects.

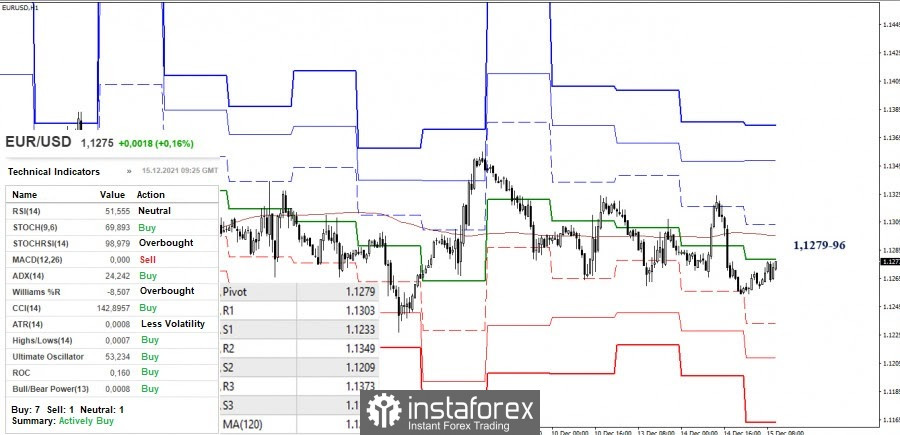

The uncertainty in the higher timeframes is expressed by instability in the smaller ones. Now, a certain preponderance of forces is observed on the bearish side, as they have consolidated below the key levels, which defend bearish interests at 1.1279-96 (central pivot level + weekly long-term trend). The classic pivot levels (1.1233 - 1.1209 - 1.1163) remain the downward pivot points. However, a consolidation above 1.1279-96 will once again change the balance of power in the smaller timeframes and resistances may be useful for the development of bullish moods 1.1303 - 1.1349 - 1.1373 (classic pivot levels).

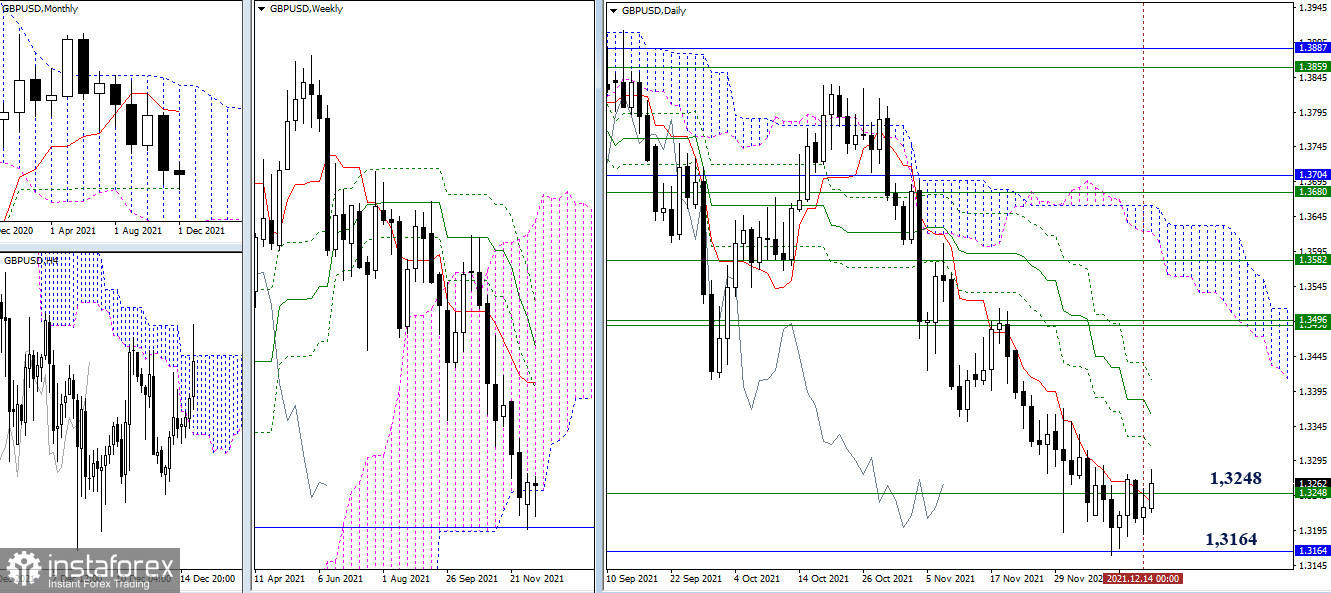

GBP/USD

The pound is trying to tune in to implement the bullish potential of last week, which was previously indicated from the encountered and tested supports of the monthly Fibo Kijun (1.3164) and the lower limit of the weekly cloud (1.3248). The continuation of growth will lead the bulls to test the resistance of the daily cross (1.3314 - 1.3362 - 1.3410). In the current situation, it is the elimination of the daily dead cross that can be the beginning of strengthening and restoring bullish positions and moods.

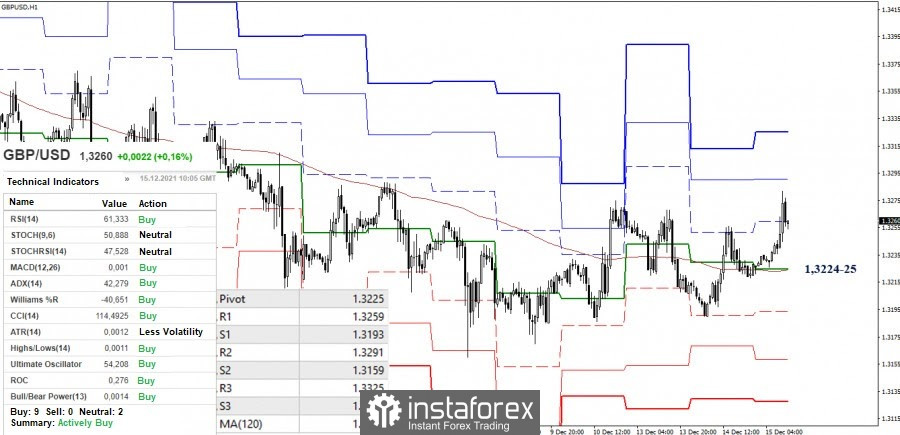

Due to the key levels, the bulls took advantage of the smaller timeframes. They are currently trying to break through the first resistance of the classic pivot levels (1.3259). R2 (1.3291) and R3 (1.3325) are further along the ascent path today. A return to the key levels that are joining forces today at the turn of 1.3224-25 (the central pivot level + a weekly long-term trend) will deprive players of an advantage and return the situation to a new uncertainty on the H1 chart.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română