Analysis of positions and tips on trading the euro

Yesterday, there were perfect conditions for selling the euro. The price tested 1.1275 at the very beginning of the day. At that time, the MACD indicator had just started to move down from the zero line. It was a confirmation of the correct entry point into the short positions. However, the pair dropped only by 10 pips and made a reversal. The pair tested 1.1291 at a time when the MACD indicator rose significantly from the zero level. For this reason, I ignored the entry point to long positions. Many traders opened short positions only in the afternoon after a rebound from 1.1320. The decline was about 50 pips from the entry point.

The euro area industrial production report for October disappointed traders. At first, the euro slightly decreased but shortly after, it jumped. It occurs oftentimes before the publication of important economic reports. The US dollar index climbed in the afternoon following the US producer price index data. The reading grew considerably, beating expectations. At the same time, the Fed has more reasons to tighten monetary policy to cap inflation.

Today, the economic calendar contains crucial macroeconomic statistics. Italy and France will unveil their inflation reports. The euro may gain momentum if the figures turn out to be positive. However, traders will focus today largely on Jerome Powell's testimony. If the toe of his speech is hawkish and he confirms monetary policy tightening, demand for the US dollar will weaken. This will lead to the strengthening of the EUR/USD pair in the afternoon. If the regulator takes a more aggressive stance than expected, the pair may collapse again. Additionally, today, the US will publish the retail trade report. However, this report is unlikely to affect markets.

Entry points to open long positions

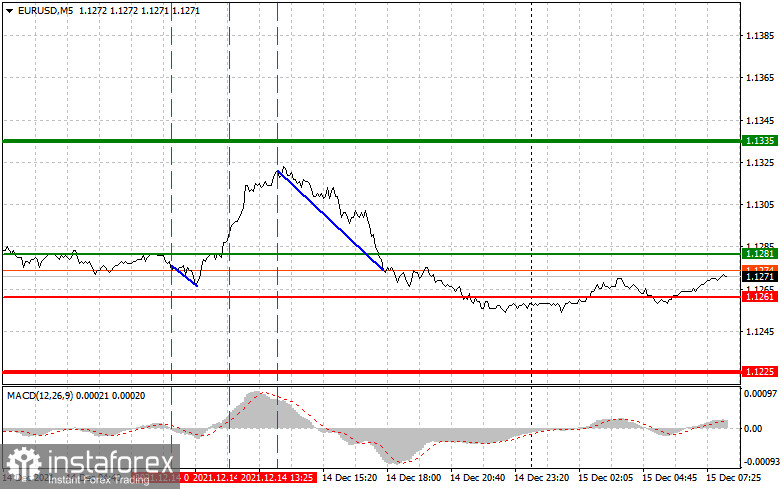

Scenario No.1: today, it is recommended to open long positions on the euro when the price reaches 1.1281 (the green line on the chart) with the target level of 1.1335. When the price approaches 1.1335, I recommend locking in profits. Open short positions on the euro, counting on a downward movement of 10-15 pips from the level. The euro may also grow only in the case of strong inflation data in Italy and France. However, investors are anticipating the result of the FOMC meeting. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to rise from it.

Scenario No.2: it is also possible to buy the euro today if the price reaches 1.1261. At this moment the MACD indicator should be in the oversold area. It may limit the downward movement of the pair and lead to an upward reversal. The pair is expected to touch 1.1281 and 1.1335.

Entry points to open short positions

Scenario No. 1: one can open short positions sell if the pair approaches the level of 1.1261 (the red line on the chart) with the target level of 1.1225. I recommend locking in profits near that level and opening long positions on the euro, counting on an upward movement of 10-15 pips from the level. If the inflation reports turn to be negative, the ECB is sure to maintain its asset purchase program. It is bearish for the euro. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price reaches 1.1281. At this moment, the MACD indicator should be in the overbought area. It will limit the upward movement of the pair and lead to a downwards reversal. The pair is expected to drop to 1.1261 and 1.1225.

Description of the chart:

The thin green line shows the entry point to open long positions.

The thick green line is the estimated price where you can place a Take profit order or lock in profits by yourself as the price is unlikely to rise above this level.

The thin red line shows the entry point to open short positions.

The thick red line is the estimated price where you can place a Take profit order or lock in profits by yourself as the price is unlikely to drop below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make decisions very carefully when entering the market. Before the release of important fundamental reports, it is best to stay out of the market as the market is quite volatile. If you decide to trade during the news release, then always place Stop Loss orders to minimize losses. Without placing Stop Loss orders, you can blow the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română