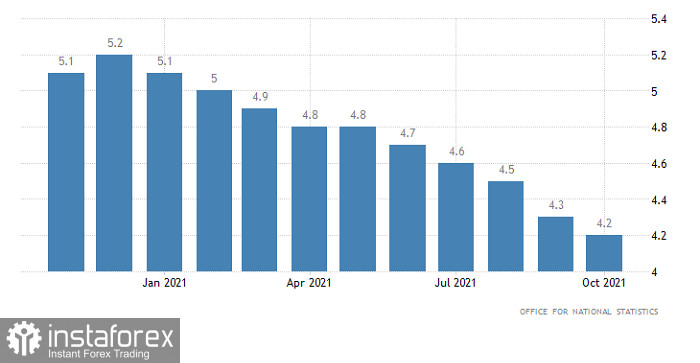

As expected, the UK unemployment rate dropped to 4.2% from 4.3%, whereas the growth pace in the average earnings index slackened less than anticipated. Thus, the indicator increased by 4.3% after a 5.0% climb in the previous period. Economists had expected the growth of 4.2%. The pound sterling began gaining in value just after the publication.

UK Unemployment Rate

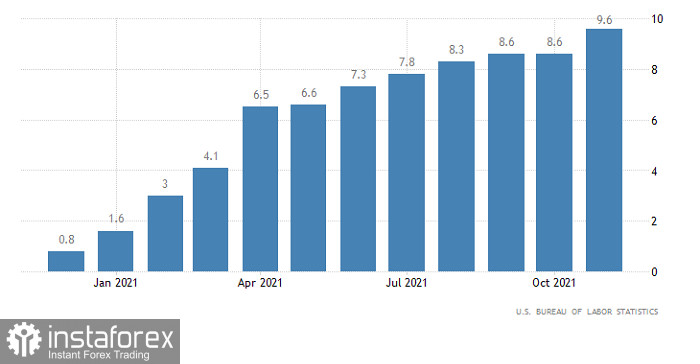

It seems that positive data on the average earning index supported the British pound during the publication of the US producer price figures. The PPI accelerated to 9.6% from 8.6%, whereas analysts had predicted a rise of 9.2%. Thus, producer prices are moving up faster than expected. This means that inflation may continue surging despite the fact that it has already reached its 39-year peak. That is why the US Fed has enough reasons to tighten its monetary policy faster than planned. In fact, this should have boosted the greenback, but the pound sterling just inched down, remaining above the levels logged before the publication of the labor market reports.

UK Producer Price Index

Today, the UK will disclose its inflation figures. According to the forecast, inflation may accelerate to 5.0% from 4.2%. It is quite possible that the ongoing rise in inflation will force the Bank of England to raise the benchmark rate faster than planned. The regulator will announce its decision only tomorrow during the meeting. Nevertheless, the prospect is likely to support the British pound.

UK Inflation Rate

Although the FOMC meeting is the main event of the day, its result will be disclosed closer to the end of the day. That is why market participants will price in the information tomorrow, at the Asian session. Until then, traders will rely on the retail sales data. According to the forecast, the indicator may show a smaller advance of 15.9% compared to a jump of 16.3% in the previous period. It means that consumer activity, which is the main driver of the US economy, is falling. This data may lead to a further decline in the US dollar.

US Retail Sales

However, it will hardly last long. Once the US Fed announces its rate decision, the greenback is likely to resume gaining in value. Notably, the currency may show a significant jump. Of course, the regulator is unlikely to hike to the key interest rate today. However, taking into account the unprecedented inflation growth and extremely low unemployment rate, the regulator may revise the pace of the key rate hike for the next two years. The pace is likely to be considerably higher.

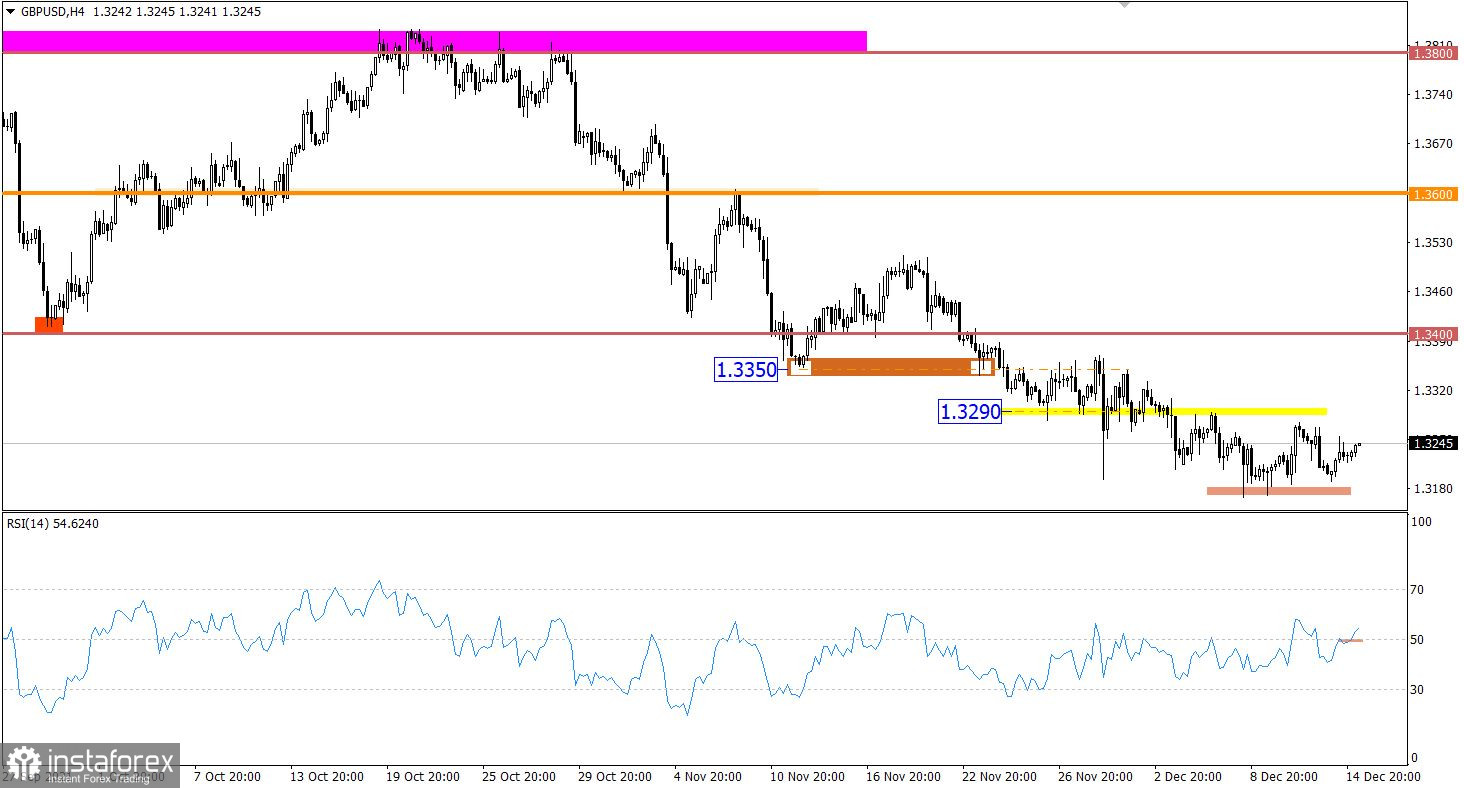

This could be a strong reason for the US dollar appreciation. Notably, the greenback has significantly advanced recently. Only the Fed's decision to take a wait-and-see approach may change the scenario. If the previous plan of monetary policy tightening remains unchanged, the US dollar will be under significant pressure and is likely to slump. Although the speculative activity is very high, the pound/dollar pair is still trading within the range of 1.3200/1.3290, touching one limit after another. This points to the accumulation process that may lead to an acceleration in the market.

On the four-hour chart, the RSI technical indicator is hovering near line 50, thus proving the flat movement.

On the daily chart, we see an insignificant stagnation in the structure of the downtrend.

Outlook

Once the price fixes below 1.3165 on the four-hour chart, traders will receive a sell opportunity. This may result in a jump in the volume of short positions and a further drop in the pair. Until then, the pair is expected to trade flat between the levels of 1.3200 and 1.3290.

The comprehensive indicator analysis provides buy signals on the short-term and intraday periods amid the price rebound from the lower limit of the range. In the medium term, technical indicators provide sell signals due to a stable downtrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română