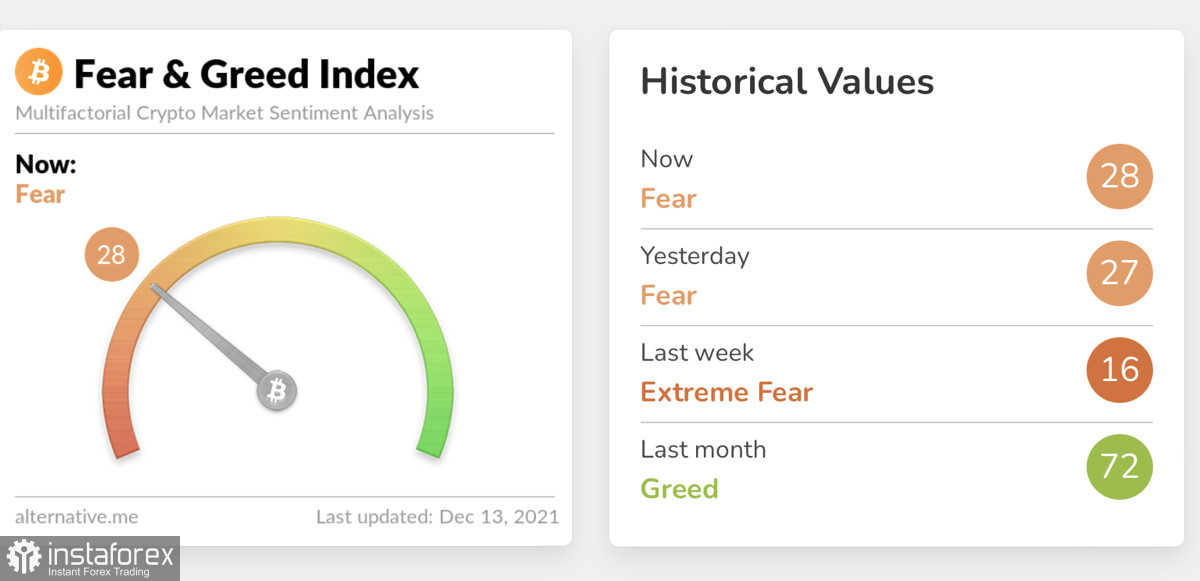

Over the past week, the situation around the first cryptocurrency has returned to normal, the fear and greed index has begun to grow, and Bitcoin has confidently entrenched itself above $48k. Despite this, the coin still cannot start an upward movement to new highs. And judging by a number of fundamental factors, the cryptocurrency no longer has time to resume its upward movement.

Current situation

As of 15:00 UTC on December 13, the asset made a bearish breakdown of the $48k level and, concurrently, the 0.236 Fibonacci level. Bitcoin is trading in the $47k region and is close to an important support zone in the $46k region. If this level is broken, the path will open for the asset to retest the $42k- $45k range. Most likely, the reason for such a sharp decline was the negative news or theses expressed by the Fed chairman. In any case, in addition to the spark that catalyzed the fall, there are a number of fundamental factors that put pressure on the BTC/USD quotes.

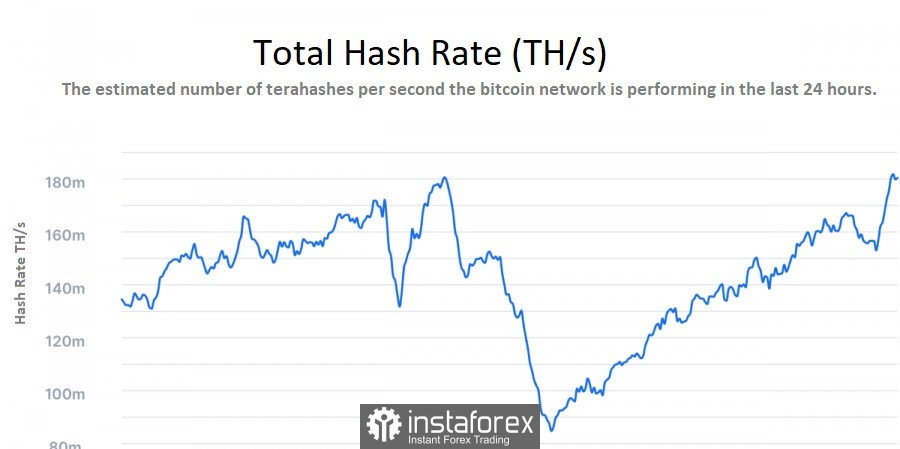

Hashrate growth and value fall

In early December, the bitcoin hash rate came close to the absolute maximum set in early April. Due to this, competition among mining companies is growing, and the value of the cryptocurrency is falling. In addition, the decrease in bitcoin liquidity is associated with the release of 90% of the total emission, which is an important factor in pressure on the price and decrease in the total value of the cryptocurrency. Over the past month and a half, the difficulty of mining (the fight for a reward) has grown by more than 6%, due to the fact that miners' income will fall in the near future.

Investors withdraw bitcoins from exchanges

Over the past two weeks, the U.S. stock market has been experiencing euphoria and an increase in the quotes of the major indices. As a result, investors use the cryptocurrency market as a backup foothold for storing liquidity reserves. During the take-off of stock indices, Glassnode analysts recorded a negative inflow of the coin to the exchanges, which serves as proof that players are transferring funds to growing stock indices. It also negatively affects the price of bitcoin by increasing pressure on the price of sellers who control the situation on the crypto market.

Forecasts

On the four-hour chart, bitcoin completed its downward movement and buyers began to buy back positions. However, I suppose that by the end of the next four-hour candlestick, the quotes will not be able to overcome the boundary in the $48k- $48.8k area, where the resistance zone and the 0.236 Fibo level pass. Technical indicators also signal the end of a short-term downward trend but do not demonstrate the prerequisites for a confident buyout of positions by the bulls.

The MACD is forming a bearish crossover and continues to move below zero, while the Stochastic and Relative Strength Index indicates a weak momentum, supported by an entry into the key support area. I assume that the BTC price will continue its downward movement towards the final range of $42k- $45k after a short consolidation in the $46k-$48k region.

Despite the local negativity, bitcoin still remains within the bull market, the classic movement of which was interrupted by the complex structure of the fourth wave. Despite this, the main audience of the cryptocurrency remains confident in the further movement of the price to new highs. This is evidenced by the growing on-chain activity, the confident positions of long-term holders, and the absence of panic when local lows are reached. Most likely, the re-achievement of $42k will become the final point of the local downward trend, after which Bitcoin will resume its movement to new highs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română