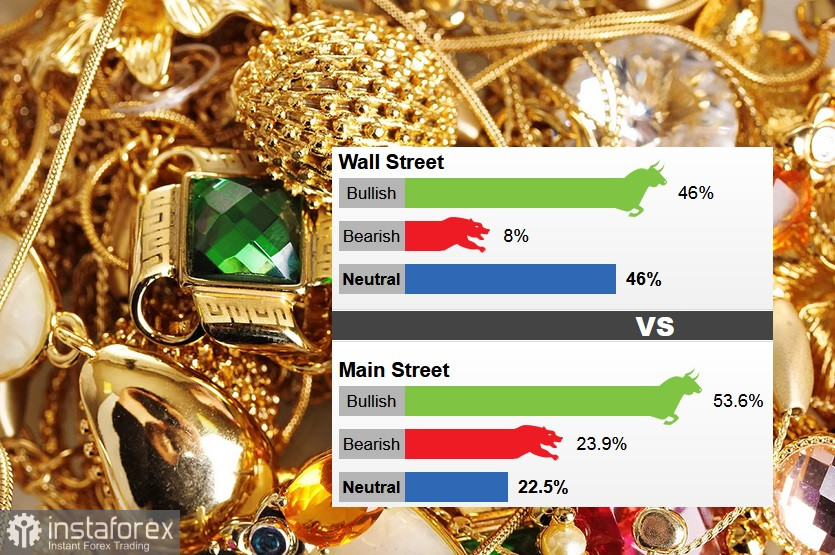

According to a Wall Street survey, 13 analysts shared their opinion regarding the rise in gold prices and a neutral position, which was 46% each, and only 8% voted for a price reduction.

The Main Street side was more optimistic. Of the 1,039 participating retail investors, 53.6% were optimistic, 23.9% were bearish, and 22.5% were neutral.

The main event to watch out for will be the Fed's announcement on Wednesday.

Last week, investors were focused on the latest US inflation figures, which were the determining factor ahead of the FOMC meeting.

November data showed that US consumer prices rose at the fastest pace in nearly 40 years, rising 6.8%. However, the monthly change was less than in October and increased by 0.8%, which gives the markets hope that price pressure may reach a maximum.

According to Adrian Day Asset Management President Adrian Day, investors will definitely turn to gold as protection as inflation has reached its highest level since 1982. This inflation is real and serious, and it will be more stable than the original version. Moreover, he said that the Fed, the European Central Bank, and other major central banks are seriously lagging behind in dealing with a phenomenon that does not exist.

It is not surprising that inflation remains the most noticeable trend in 2022.

Looking ahead, many economists believe that inflationary pressures will peak in the first half of 2022 and then decline in the second half of the year; however, consumers can expect inflation to significantly exceed historical norms. According to economic forecasts, inflation will be from 4% to 6% next year.

According to economists, 2022 will be an important transition year as the Fed strives to tighten its monetary policy. Due to the growing threat of inflation, the US central bank will raise interest rates in June.

What does all this mean for gold? There is still uncertainty in the global economy.

Before the gold bulls start swooning at the idea of four rate hikes next year, it's important to look at the big picture. Most analysts consider current market expectations to be too aggressive.

According to many analysts, real interest rates will remain at a low or negative level next year due to inflation. It is predicted that renewed interest is expected in the precious metal, which was scarce in demand in 2021, as investors try to protect their wealth and purchasing power.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română