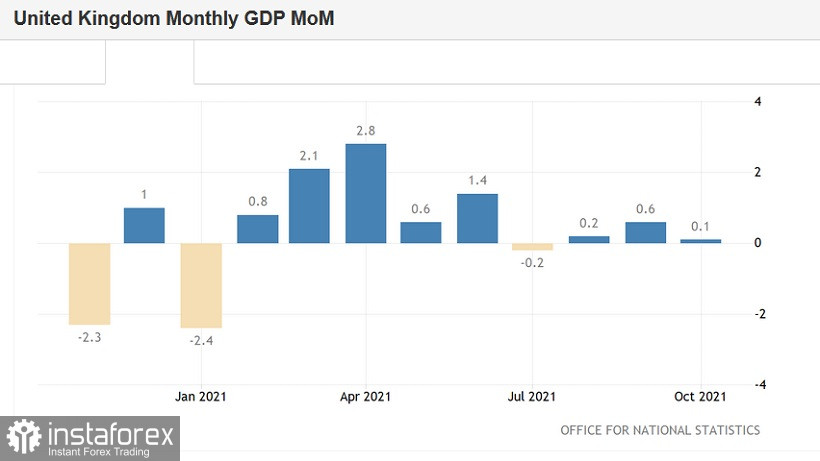

Last Friday, the GBP/USD pair declined to the area of 1.13, reacting to weak data on the growth of the UK economy. The release came out in the "red zone", making it doubtful that the Bank of England will decide to tighten the rhetoric at the December meeting, the results of which will be announced this Thursday. On the other hand, other key macroeconomic reports will be published this week, which may offset Friday's negativity to some extent. After all, the published data on British GDP growth are somewhat late (for October), whereas we will learn more recent figures this week.

For example, the November inflation report will be released on Wednesday. In other words, the pound is not in a rush to go to the low (1.3160) yet, although it is pressured not only with contradictory statistics but also with Brexit, the aftermath of which continues to pull the GBP/USD pair down.

In general, the pound is forced to react to a kind of "Bermuda Triangle" of fundamental factors: Omicron, statistics, and Brexit. For the last four weeks, almost all fundamental factors have played against the British currency: if the pair was trading at the border of 34 and 35 figures in mid-November, then last week, it updated the price low of the year, falling to the level of 1.3160. Only hawkish remarks from the representatives of the Bank of England keep the pound "afloat". But if key macroeconomic reports come out in the "red zone" this week, the rhetoric of the British regulator may significantly soften. This fact will send the pound into a knockdown, that is, under the support level of 1.3000.

According to preliminary data, the UK's overall consumer price index will be released at the level of 0.5% (on monthly terms), while the growth rate was 1.1% in October. As for annual terms, the overall CPI should rise to 4.8% (in October – 4.5%). The main consumer price index (excluding volatile energy and food prices) is projected to show positive dynamics, rising to 3.7%. The retail price index should slow down significantly on a monthly basis (to 0.3% against the background of October growth to 1.1%), but at the same time accelerate year-on-year (6.7% in November, 6.0% in October).

Meanwhile, the labor market data is scheduled to be released on Tuesday. The unemployment rate is expected to decline to 4.2%. The number of applications for unemployment benefits (-32 thousand) and the average earnings will decrease both taking into account the bonuses and without this component.

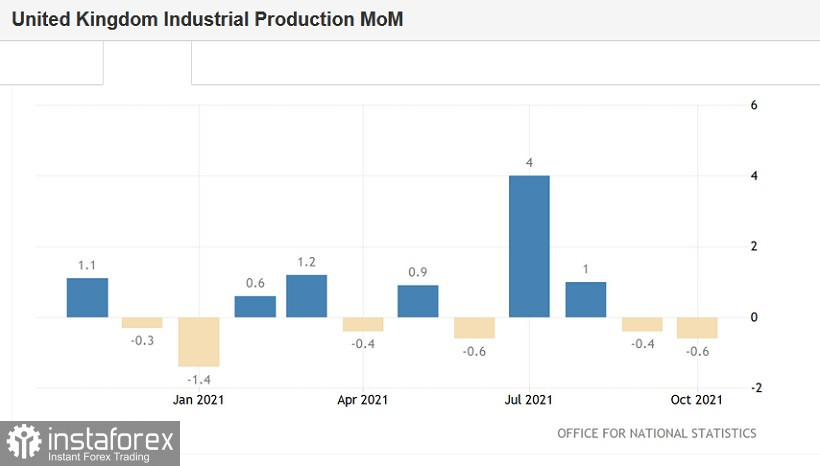

If the above-mentioned macroeconomic reports, which will be published before the December meeting of the Bank of England, are in the "red zone", the pound will be under significant pressure. At the moment, several experts still have hope for an interest rate increase in February next year. However, if inflation and the labor market disappoint, these hopes will collapse. It can be recalled that the data published on Friday reflected a slowdown in the British economy. The country's GDP increased by only 0.1% in October (with a growth forecast of up to 0.4%). The volume of industrial production fell by 0.6%. The indicator of production of the processing industry came out at zero (in monthly terms), slowing down to 1.3% year-on-year. For comparison, it is worth noting that this indicator was at the level of 2.8% in September.

In other words, the key reports of the current week will either increase pressure on the pound or keep it "afloat" until the announcement of the results of the December meeting of the British regulator.

Other fundamental factors also put pressure on the pound. In particular, the so-called "fish issue" (the conflict between Great Britain and France on the issue of fishing in the English Channel) has not yet been resolved. On Friday, London decided to issue new licenses to European fishermen to fish in British waters (thanks to which the pound won back some of the losses on Friday), but France announced that it intends to use "available legal means" to force Britain to satisfy all applications. This week, Paris will ask the European Commission to launch legal proceedings against the UK if London remains at its position on the fishing dispute. And judging by the rhetoric of the British representatives, Downing Street will not change its position. Therefore, the political conflict, which may end with the introduction of trade sanctions by the EU, will continue.

In addition, we must not forget the "coronavirus factor". Against the background of the spread of the Omicron strain, Prime Minister Boris Johnson introduced stricter quarantine restrictions in England. The government has required people to work from home, wear masks in public places and use Covid passes. Scotland, Wales and Northern Ireland had established their own quarantine restrictions even before Johnson's decision. This fact also exerts background pressure on the pound.

In this case, short positions on the GBP/USD pair will continue to be a priority in the medium term. It is advisable to use corrective bursts as an excuse to enter sales. The main target of the downward movement is the level of 1.3160 – this is the price low of the year, coinciding with the lower line of the Bollinger Bands indicator on the D1 timeframe.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română