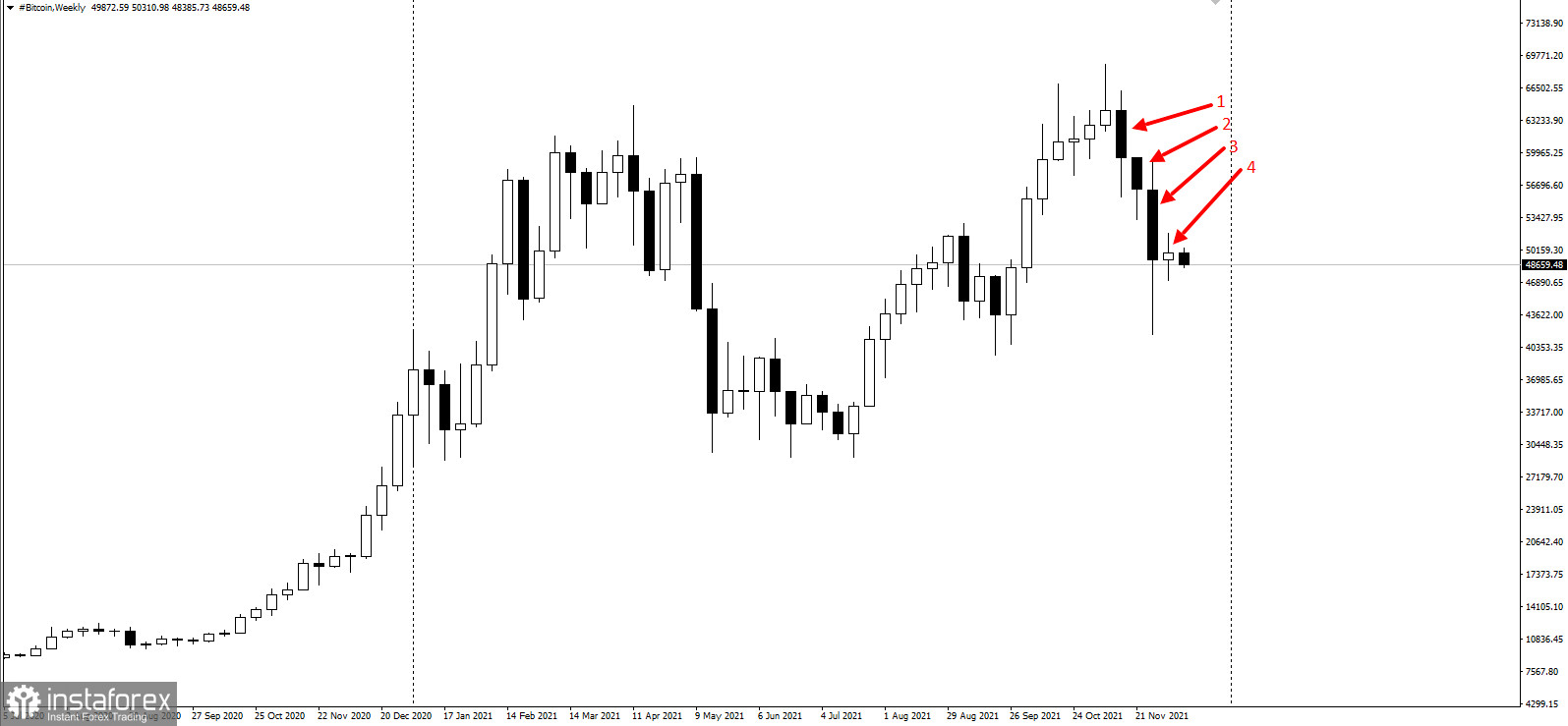

Bitcoin posted its fourth weekly decline over the weekend, following a short-term rebound triggered by a report showing that accelerating US inflation failed to allay negative sentiment that has recently gripped digital asset markets.

The largest cryptocurrency has long been touted as a hedge against inflation, in part because of its fixed supply.

On Friday, it rose 4.4% to $ 50,101, then fell by about 10% over the week. The coin is hovering around $ 50,000 after a sudden crash last weekend, when it plunged 20% on Saturday.

DeVere Group founder and CEO Nigel Green said: "This is an important threshold and the failure to secure it will likely spook some traders."

Although Bitcoin is down 30% since hitting $ 69,000 on November 10, it is still up about 65% this year.

Meanwhile, Ether, which is also hitting all-time highs last month, also saw a decline over the weekend.

Cryptocurrency proponents have long argued that Bitcoin and other digital assets can act as hedges against fluctuations in other areas of the financial market. As such, 21 million bitcoins will be put into circulation under the computer protocol governing issuance, but that figure is not expected to be reached in the next few decades.

"Bitcoin is still seen as an inflation hedge, especially for younger investors," said Matt Maley, chief market strategist for Miller Tabak + Co.

Many well-known investors and Wall Street analysts have supported the idea of using cryptocurrencies as a defense against rising prices, and veteran hedge fund manager Paul Tudor Jones even said in the past that he likes it as a store of wealth. Meanwhile, Michael Sailor of MicroStrategy said the easing of the Fed's inflationary policies helped convince him to invest in Bitcoin.

But others argue that Bitcoin hasn't been around long enough to solidify its inflation-proof image, not to mention it looks too much like a speculative asset and is prone to intermittent disruption.

Noelle Acheson of Genesis Trading stated: "If Bitcoin is 'digital gold' and gold is an inflation hedge, then it follows that Bitcoin is too, right? Unfortunately, there is no evidence to back this up, and even the relationship between inflation and gold has been tenuous over the years. Longer term, however, gold has more than held its value while fiat currencies have declined; Bitcoin could end up doing the same."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română