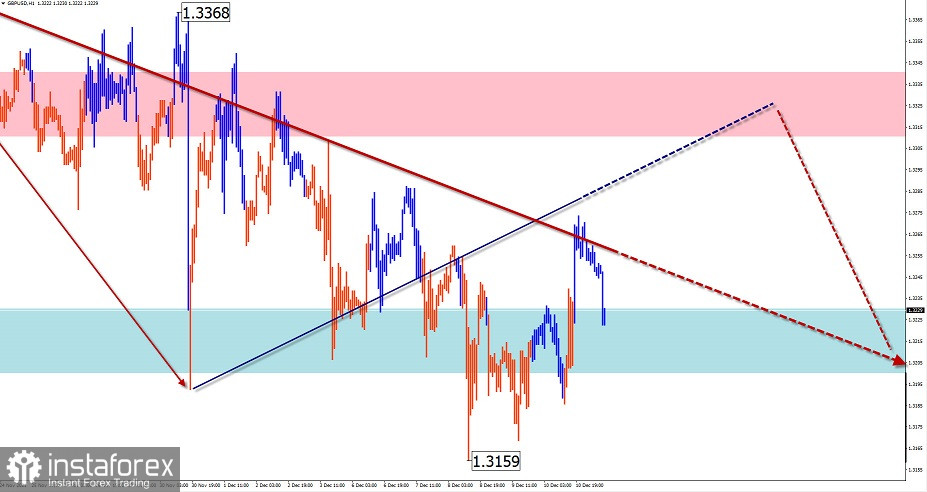

GBP/USD

Analysis:

Within the dominant bearish wave of the English pound sterling main pair, the formation of its final part (C) continues. Since November 30, a counter-corrective movement in the form of a shifting plane has been developing on the chart. Its final segment has not been formed.

Outlook:

A general upward vector of price movement is expected today. On the European session, the flat condition is not excluded, with the reduction to the support area. The price growth phase is more likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1.3310/1.3340

Support:

- 1.3230/1.3200

Recommendations:

Trading in the English pound market today is most appropriate within individual sessions. Until the occurrence of clear signals of a reversal in the resistance area sales are not recommended. Trading lot for buying is recommended to reduce.

AUD/USD

Analysis:

The general direction of the Australian dollar's short-term trend since February is set by a downward wave algorithm. Since December 3 an uptrend with reversal potential is forming. This could be the beginning of a new wave of counter direction.

Outlook:

A continuation of the general bullish movement vector is expected in the coming day. In the first half of the day, a sideways flat along the support zone is more possible. Then we can expect a rise in the rate. A break beyond the calculated resistance within the day is unlikely.

Potential reversal zones

Resistance:

- 0.7220/0.7250

Support:

- 0.7150/0.7120

Recommendations:

Trading in the Australian dollar market today can only be profitable as part of scalping, within individual sessions. There are no conditions for selling.

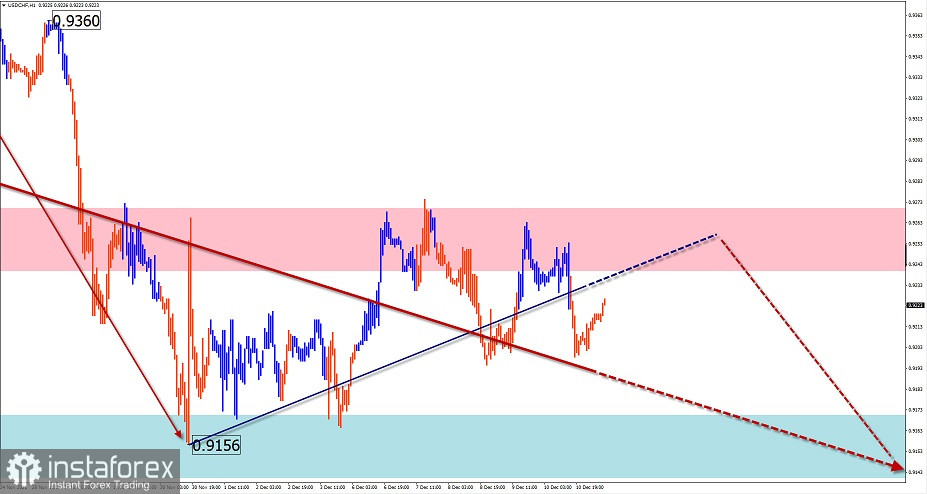

USD/CHF

Analysis:

The current sideways movement of the Swiss franc quotations in the main pair over the last six months fits into a downward plane algorithm. Since November 24, the final part (C) has started. An intermediate pullback has been forming in the last 2 weeks within its framework.

Outlook:

The general sideways movement is expected to continue today. In the first half of the day, some rate increase can be expected, not further than the calculated resistance. By the end of the day, against the background of increased volatility, a change of vector and subsequent downward price movement is possible.

Potential reversal zones

Resistance:

- 0.9240/0.9270

Support:

- 0.9170/0.9140

Recommendations:

There are no conditions for buying the franc today. Sell signals are to be monitored around calculated resistance.

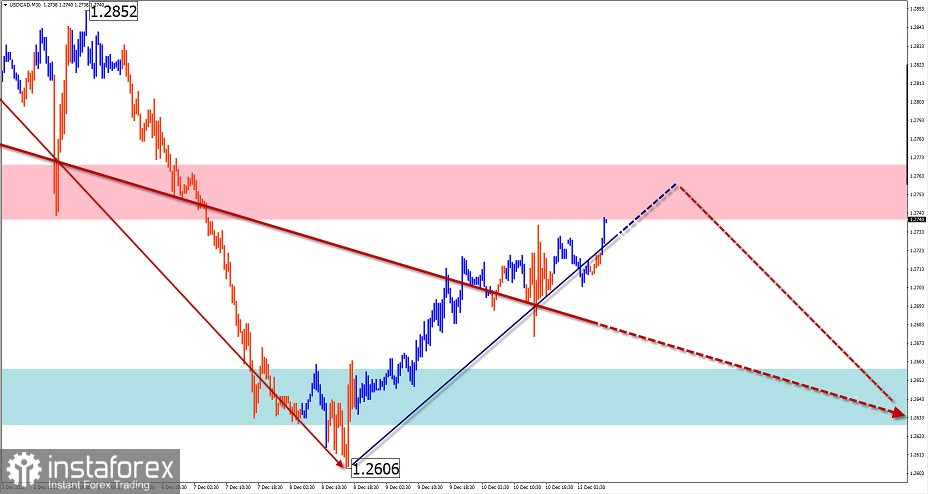

USD/CAD

Analysis:

The Canadian dollar has been steadily strengthening against the US currency since last March. The price has been predominantly in a sideways drift for the last six months. Since July a descending plane is developing on the chart, in which the final part is forming. In the last few days, the price has been bouncing upwards.

Outlook:

In the next 24 hours, the most expected scenario will be a sideways movement in the price corridor between the opposing zones. After a possible pressure on the resistance zone, we can expect a change of vector and a downward price move.

Potential reversal zones

Resistance:

- 1.2740/1.2770

Support:

- 1.2660/1.2630

Recommendations:

There are no conditions for buying in the Canadian dollar market today. It is recommended to monitor signals for sale in the area of calculated resistance. Taking into account the limited impending decline, it is better to reduce the trading lot.

Explanation: In simplified wave analysis (SVA), waves consist of 3 parts (A-B-C). The last unfinished wave is analysed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română