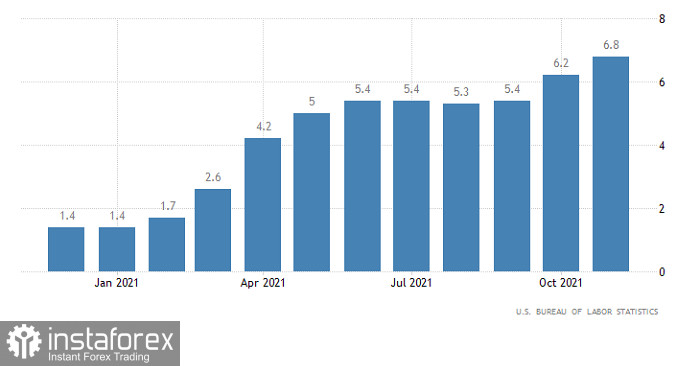

The market has been speculating on the possibility of unexpected interest rate hikes by the US Federal Reserve for almost a month. It has even drawn direct parallels with the year 1980 when the regulator raised the rate to 20.0% from 5.0%. Consequently, it caused turbulence in the market. After all, interest rate hikes could inevitably decrease speculative sentiment and lead to a crash in financial markets. Indeed, inflation has been at its highest levels since 1990. Therefore, spooked market participants were relieved to see that inflation came slightly lower than they had expected. So, the annual inflation rate in the US accelerated to 6.8%. the indicator was set to soar to 6.9% versus 6.2%, according to market expectations. It was enough so that the greenback started to fall. In other words, since inflation is growing slower, the Federal Reserve has no reason for immediate rate hikes, and it does not matter that the American regulator drew up a plan for tightening monetary policy long ago. Interest rates are expected to be raised as early as the spring of next year. Meanwhile, the market is convinced that the Federal Reserve will act unexpectedly and quickly. At the same time, inflation is now at its highest level unseen since 1982. No doubt, market participants are concerned. In other words, the US central bank has every reason for immediate action. Still, the market is run on emotions rather than facts. Therefore, since inflation has come better than expected, there seems to be no cause for concern. What matters more is what market participants believe in and not what is actually happening.

United States Inflation:

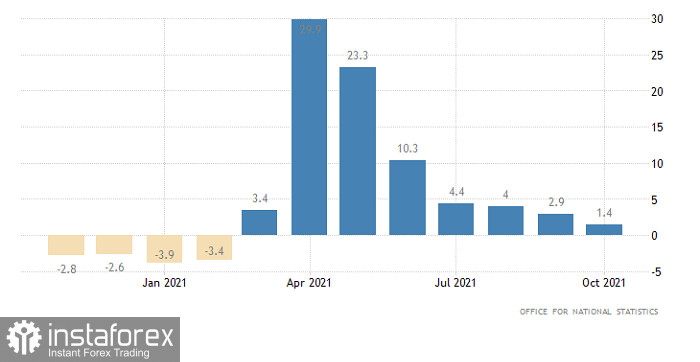

The market was focused solely on inflation on Friday and missed the fact that industrial production growth in the United Kingdom slowed down to 1.4% versus 2.9%, missing expectations of a 2.1% fall. All in all, the British economy is recovering not well enough.

United Kingdom Industrial Production:

Anyway, markets were able to breathe a sigh of relief only for a while, and we can now observe a pullback. It seems that market players are spooked by the 39-year-high inflation rate. As soon as they realize this fact, concerns about the possibility of a sharp increase in interest rates will mount again, and such a likelihood will continue boosting the greenback. Therefore, with the FOMC meeting looming, market participants are expected to get more nervous. All in all, the dollar is growing on expectations of interest rate hikes.

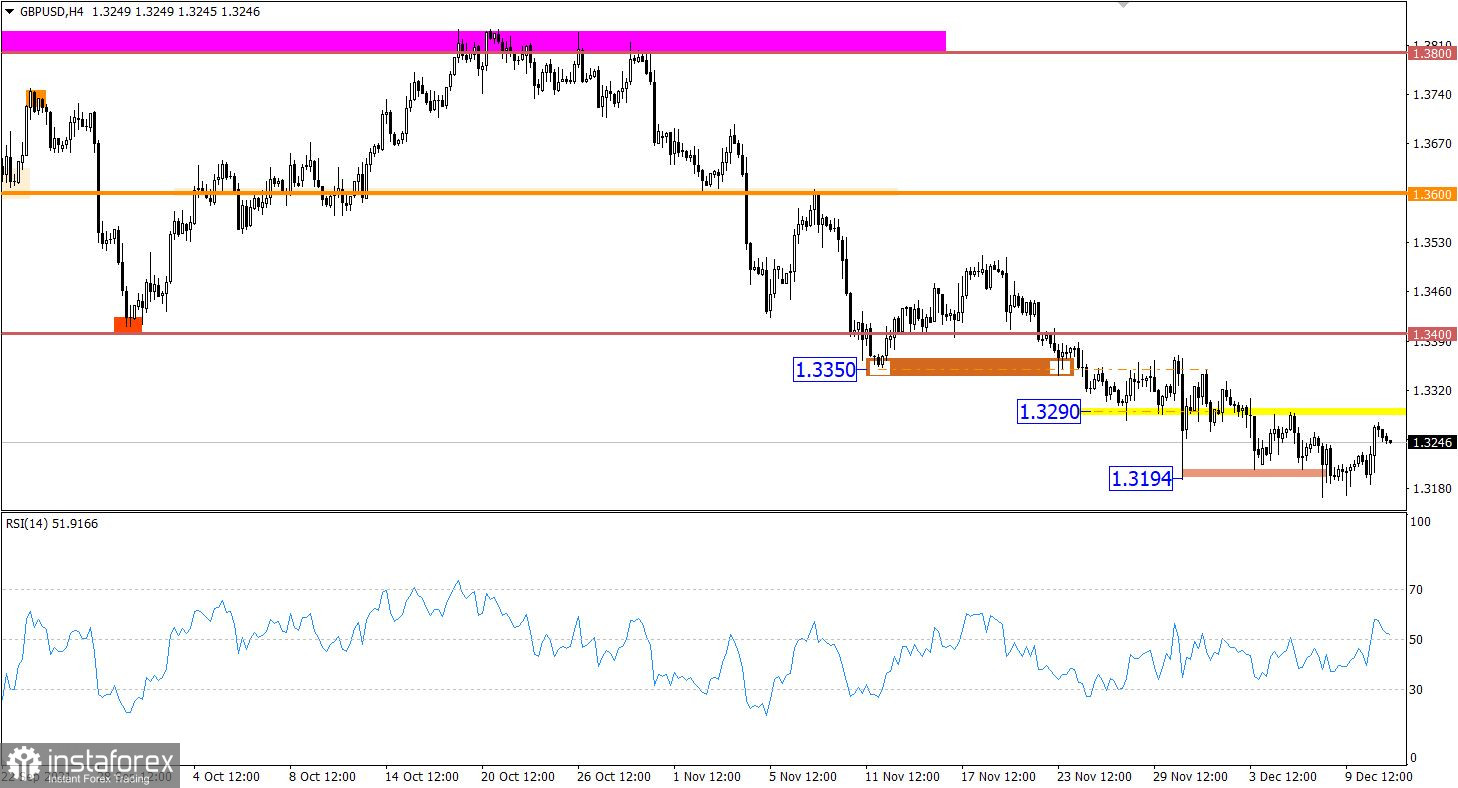

The GBP/USD pair has repeatedly tried to extend the upward movement. As a result, the quote entered the sideways channel of 1.3200/1.3290, which led to the accumulation process.

The Relative Strength Index (RSI) is moving along 50 on the 4-hour chart, signaling the balance of trading forces, which confirms the formation of the sideways channel.

On the hourly chart, there is a downtrend. Since early June, the pound sterling has lost over 1,000 pips.

Outlook

The sideways channel in the range of 1.3200/1.3290 is about to complete, which could mark the start of an uptrend as soon as the quote breaks one of the boundaries of the channel.

In terms of complex indicator analysis, there is a sell signal for intraday and mid-term trading due to a pullback from the upper boundary of the sideways channel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română