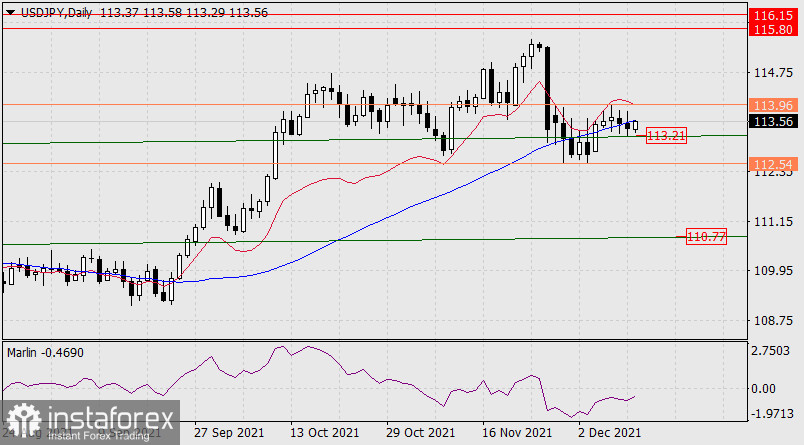

After Friday's slight decline, the USD/JPY pair is again trying to develop growth, fighting with the resistance of the MACD line at the moment. The price will need to pass the signal line of 113.96 after it crosses this indicator line. If it does then the 115.80-116.15 target will open.

A similar scenario for the pair and in the opposite direction: after the price moves under the support of 113.21, the price will need to overcome the bearish signal level of 112.54, and then the 110.77 target will open. Thus, the price can freely wander in the 112.54-113.96 range for a long time. But there will be a Federal Reserve meeting on Wednesday that will easily push the price out of this convenient range. The US central bank is expected to strengthen its hawkish tone and the dollar will strengthen against all major global assets. The main scenario, therefore, is bullish - the pair will rise to the target range of 115.80-116.15.

This morning the price went above the balance and MACD indicator lines on the four-hour chart, while Marlin is still in the negative zone. We follow the development of events.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română