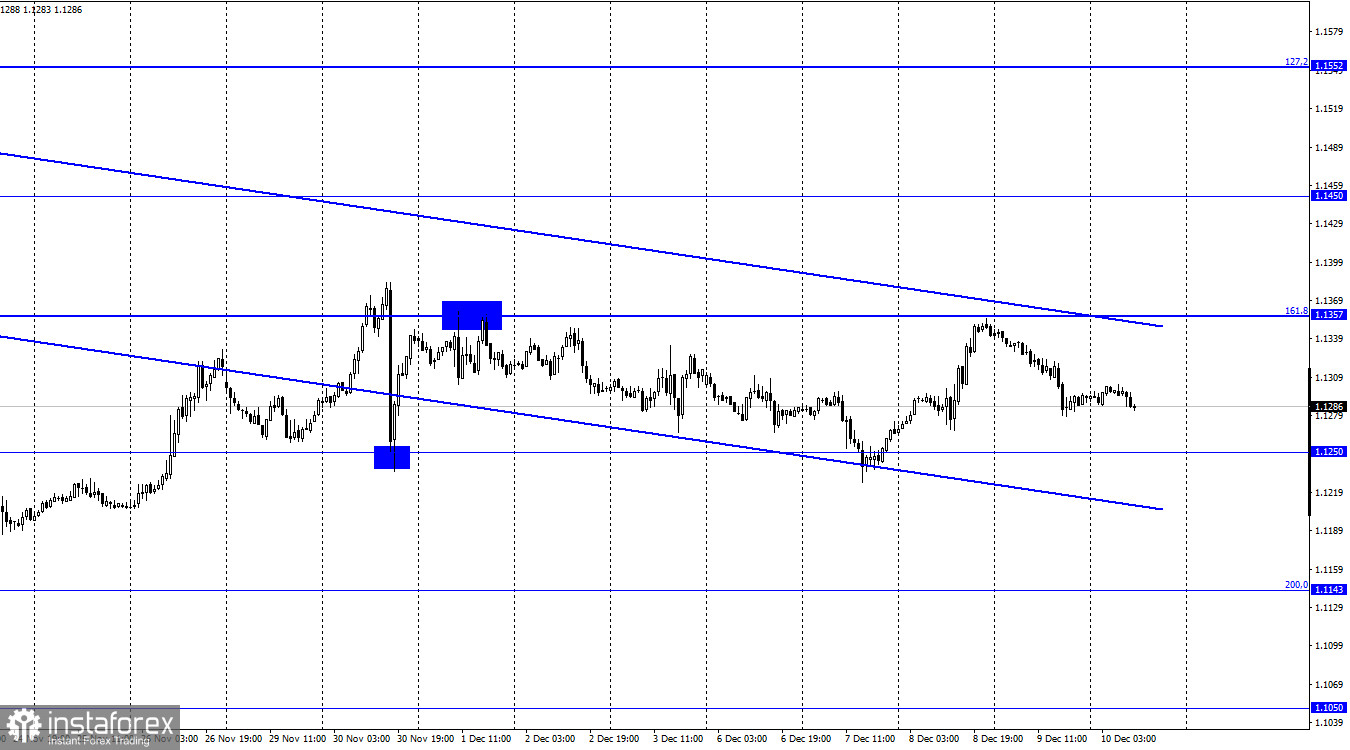

EUR/USD – 1H.

Hi, dear traders!

On Thursday, EUR/USD reversed downwards, falling towards 1.1250. The pair remains within the downward channel, indicating a bearish trend. Despite the best efforts of bulls, EUR/USD has repeatedly failed to close above the upper channel line and couldn't even match the high of November 30. The possibility of an upside movement for the pair is extremely low. Closing above the upper channel line would propel the pair upwards, but today's US inflation data is likely to push it down instead. EUR/USD somehow managed to gain 80 pips on Wednesday despite the absence of news and statistic data, but today the situation could change for the worse.

The US inflation report could heavily influence the sentiment of investors - currently inflation is the number one issue for the markets. Depending on the inflation rate, the Federal Reserve's meeting next week would decide whether QE tapering would continue as planned at $15 billion per month or if it should be accelerated at $20-30 billion per month. Previously, inflation in the US increased to 6.2% year-over-year, now it is expected to reach 6.7% or more. The US dollar could extend its upside on the news amid trader reaction to upcoming Fed actions, while the euro has no news that could give it support.

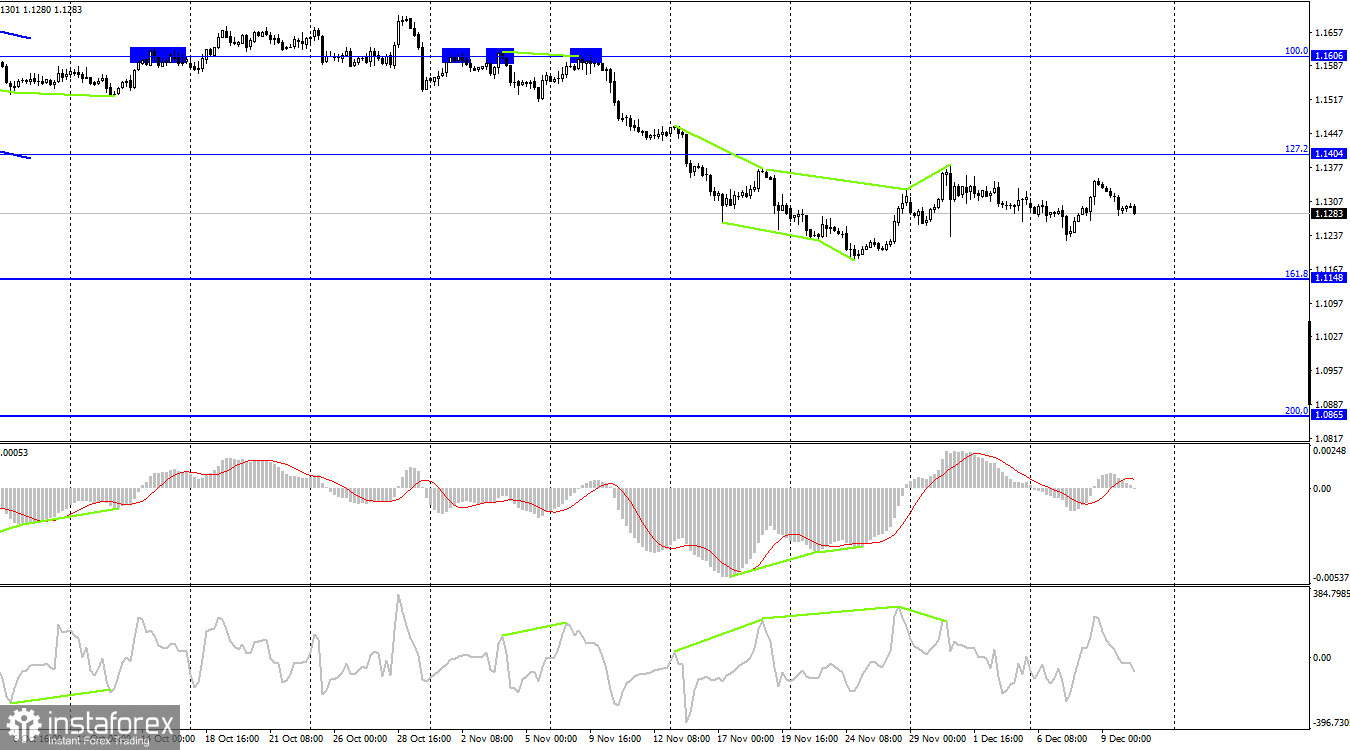

EUR/USD – 4H

According to the 4H chart, EUR/USD reversed downwards and began to fall towards the retracement level of 161.8% (1.1148). The pair is trading in the 1.1148-1.1404 range. Currently, the 1H chart offers more precise information on the pair's dynamics. No indicator is showing any signs of emerging divergences.

US and EU economic calendar:

EU - speech by ECB president Christine Lagarde (09-05 UTC)

US - CPI data (13-30 UTC)

US - University of Michigan's consumer sentiment report (15-00 UTC)

Christine Lagarde's speech failed to affect the markets, but the US inflation data is very likely to influence investors.

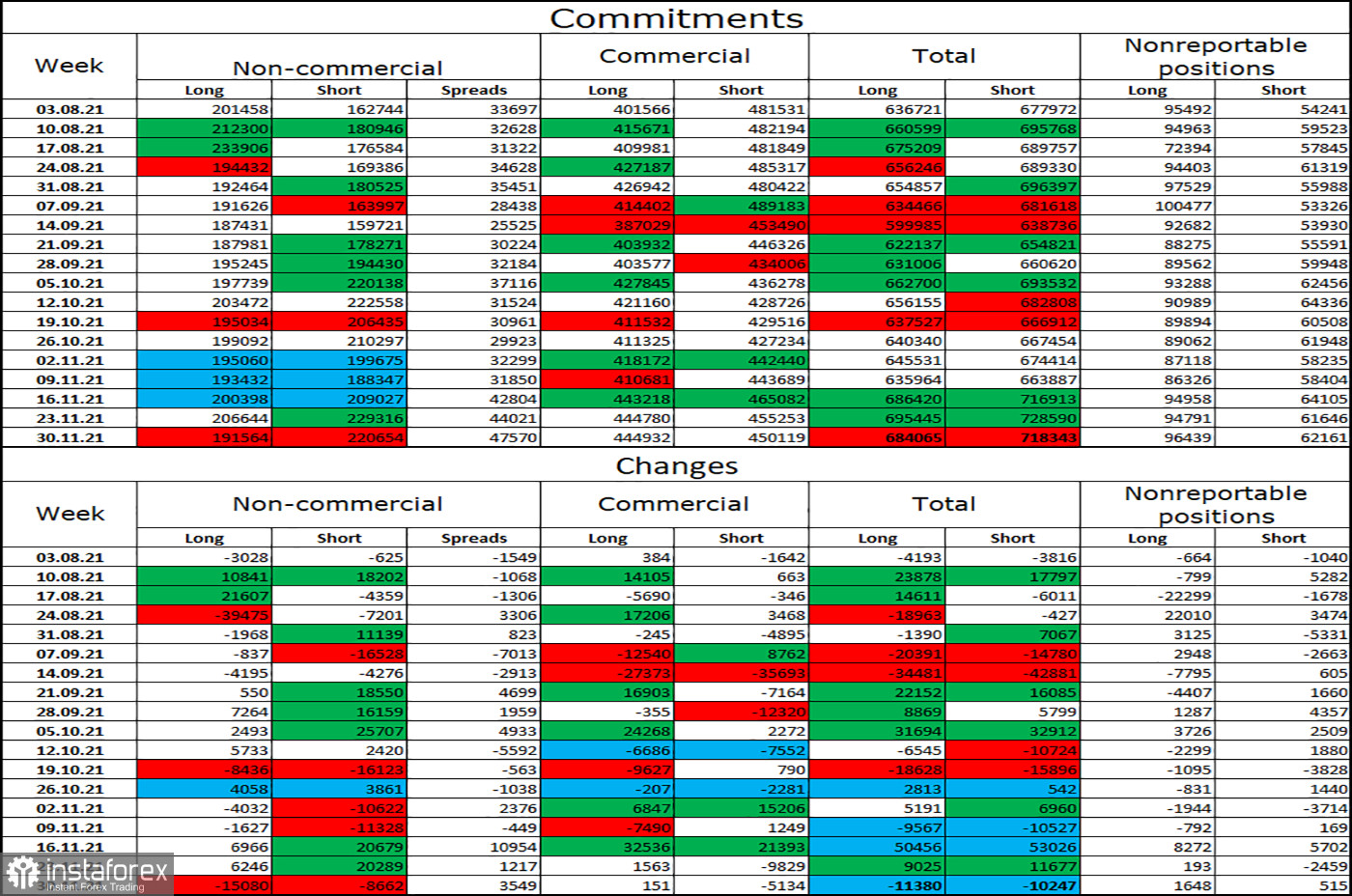

COT (Commitments of traders) report:

The new COT report indicates an increasingly bearish sentiment among Non-commercial traders. Last week, market players closed 15,080 Long positions and 8,662 short positions. The amount of open Long and Short positions decreased to 191,000 and 220,000 respectively. Given the current downtrend that only intensified last week, EUR/USD is likely to resume its downward movement. There are no indications of a possible rally at this point.

Outlook for EUR/USD:

Earlier, traders were recommended to open short positions if the pair bounced off 1.1357 at the 1H chart targeting 1.1250. Currently, these short positions can be kept open. Traders are recommended to open long positions if the pair closes above the downward channel at the 1H chart targeting 1.1450, or if it rebounds off 1.1250 targeting 1.1357.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, and large private investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain profit, but to maintain current activities or import-export operations.

The category of non-reportable positions includes small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română